Having that awkward conversation: Using mobile research to get more honest answers from people

Having that awkward conversation: Using mobile research to get more honest answers from people

15 August, 2017 •I bought myself a fitness band recently and I’ve found it quite useful in encouraging me to get off the couch. But, if I’m completely honest, I know I overstate how useful it actually is. When people ask me about it, they usually want to know how many steps I manage on a typical day. I say between 10,000 and 12,000 – which is a lie. I do frequently reach 10,000 steps, but there are many days when I don’t; and reaching 12,000 is an unusually good day. I feel a little guilty telling this lie, but I tell it because I want to put forward the best possible image of myself.

I’ve shared my secret here to demonstrate how this desire to project one’s best image of oneself – a social desirability bias – influences the way in which people talk about themselves to others. This has implications when we think about what we ask in, and how people answer, surveys.

I became interested in social desirability bias a few years ago when I first started using mobile surveys. My background was primarily in in-person interviewing, and mobile surveys were my first real experience with self-completion surveys.

Mobile surveys as an innovation are often cited as a solution to some long-standing operational challenges faced by researchers in the developing world. While developed markets have been able to reduce costs and timelines through online research, a lack of infrastructure and access has largely meant that in developing markets researchers have had to stick to logistically heavy, interviewer-administered, face-to-face and telephonic data collection. But now, with the proliferation of mobile phones, people can be reached for short self-completion surveys for a fraction of the cost and time.

Mobile is revolutionising survey research despite its challenges – for example getting to the right survey sample – as there are additional benefits that go beyond simple cost and time considerations. In the financial inclusion sphere, arguably the most exciting of these is the removal of a social desirability bias that is introduced by the presence of the interviewer who administers the face-to-face or telephonic interview.

When using mobile data collection, we see a change in response patterns to certain questions. For example; people respond differently to rating scales of satisfaction. In figure 1 below you can see how, on a matched test of face-to-face and mobile samples, mean scores of satisfaction tended to be lower for the mobile sample. Further, the pattern of actual scale point answers indicated an interesting difference. In the face-to-face survey, most of the people provided an answer of 8 out of 10 or higher on a 10-point scale, while the mobile self-completion shows a spike at 5 out of 10 and a more even distribution across points 5 to 10. This clearly demonstrates that people feel more comfortable saying that something is just “average” when there isn’t an actual person standing in front of them.

Satisfaction scales are not, however, that relevant to financial inclusion research where brand equity is less important than what people are doing and how they live their daily lives. There are, however, many far more sensitive questions that will benefit from the removal of a social desirability bias.

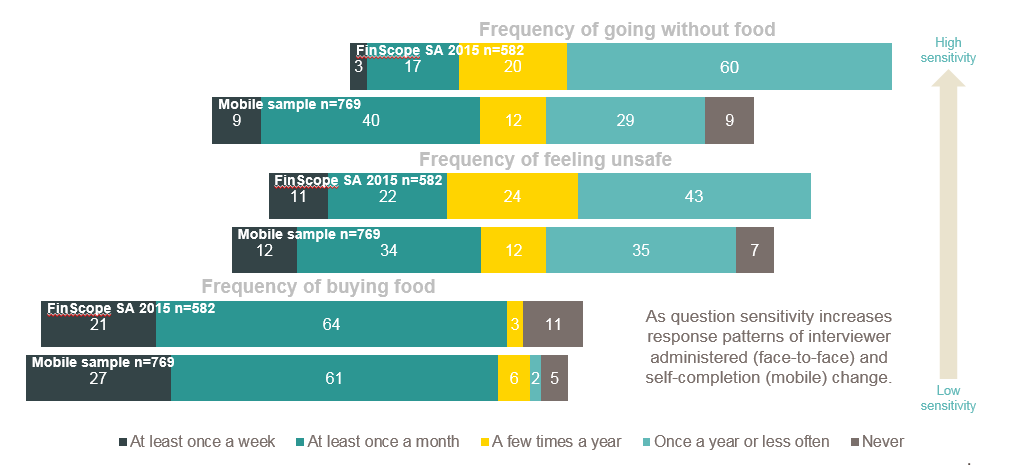

Figure 2 below shows some of the results of a test run by Kantar TNS in 2015. The questions shown in the figure are some of the Afro Barometer questions typically included in the FinScope South Africa survey. The differing patterns of responses across these three variables highlight how questions with greater sensitivity produce different results for in-person interviewing and mobile self-completion.

When survey participants aren’t sitting in front of an interviewer – someone they feel might pity or judge them based on their answers – I think they are more likely to give honest answers about what they’re spending on, what they’re borrowing for or their state of lived poverty.

Financial inclusion research still needs to include traditional methods like in-person interviews, but the mobile self-complete survey is an exciting prospect when it comes to having awkward conversations. In fact, it enables us to start diving deeper into people’s financial lives.

Shirley is a researcher within the data team at the insight2impact (i2i) data facility.

insight2impact (i2ifacility) was funded by Bill and Melinda Gates Foundation in partnership with Mastercard Foundation. The programme was established and driven by Cenfri and Finmark Trust.