Expert Forum on MSME insurance

Expert Forum on MSME insurance

19 May, 2022 •The role of different partners to offer products that matter for enterprises

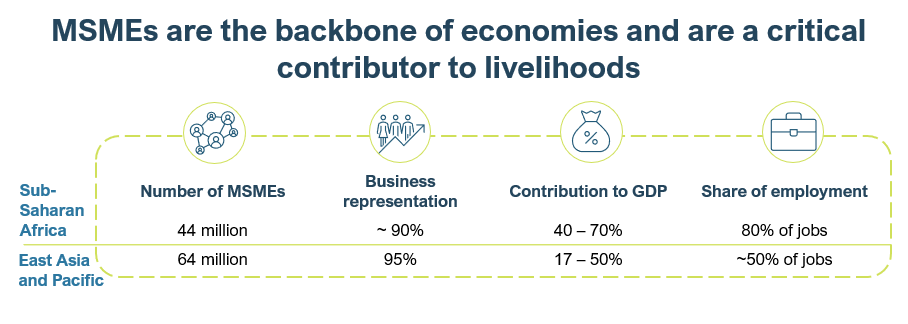

We all know that MSMEs are central drivers of economic activity and individual livelihoods across the developing world.

And MSMEs are not very resilient – face a lot of risks and fail a lot. It is estimated that less than 50% of

MSMEs in developing economies survive beyond the first 5 years. In Uganda, for example, as many as two-thirds of MSMEs fail within their first year. Insurance can’t address all these risks, but it should have a role to play.

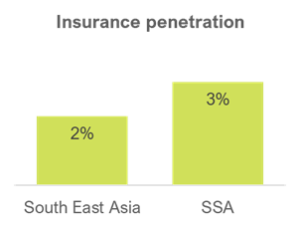

Yet, estimates of insurance uptake by MSMEs remains low. These figures not only highlight the potential for insurance to better contribute to positive societal outcomes, but they also emphasize the commercial opportunity insurance can be to providers that are able to reach this largely untapped market.

So why don’t we see more successful MSME insurance models around the world?

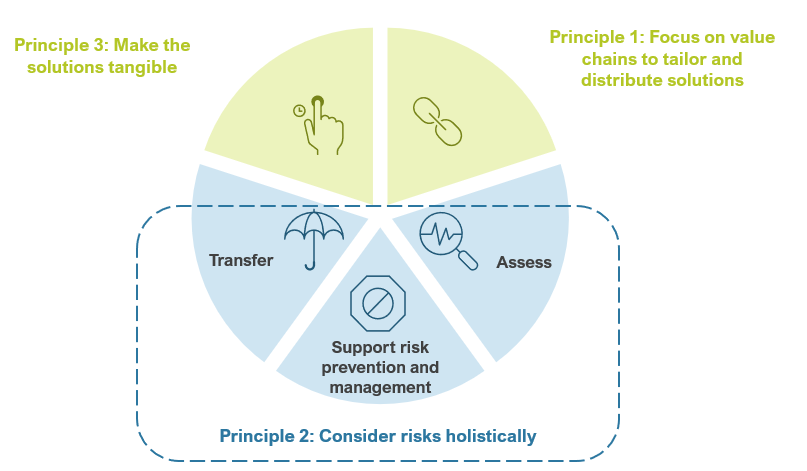

Over the last two years, the MiN’s MSME Best Practice Group have been grappling with this question. We’ve identified three key principles for insurers looking to rethink their approach to reaching MSMEs.

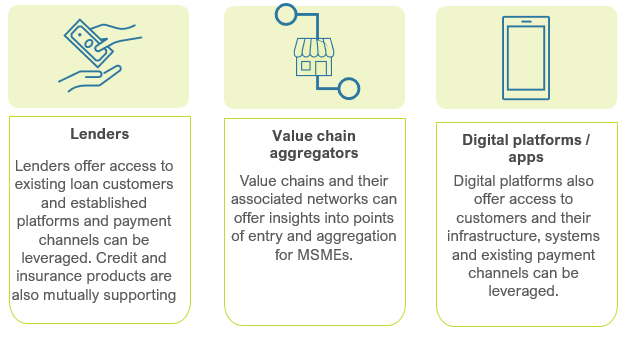

Few, if any, traditional insurers are able to effectively deliver on all three principles alone. Instead, partnerships, often with unusual and non-traditional organizations, are a critical factor of success. The focus of the Best Practice Group (BPG) in 2021 has therefore been to identify and speak to some of these potential partners(Beehero, iBuild and Smartloads all contributed to BPG discussions). Three of the most viable types of partners to reach MSMEs emerged:

Register here to join us on 24 May 2022 to further discuss the unique perspectives and opportunities for each of these types of partners. During this event, the Microinsurance Network, in partnership with the GIZ, Cenfri and the ILO’s Insurance Impact Facility, will launch three short focus notes, each discussing the opportunities and considerations for partnerships between each of these types of institutions and insurance providers to better serve MSMEs with holistic resilience solutions.