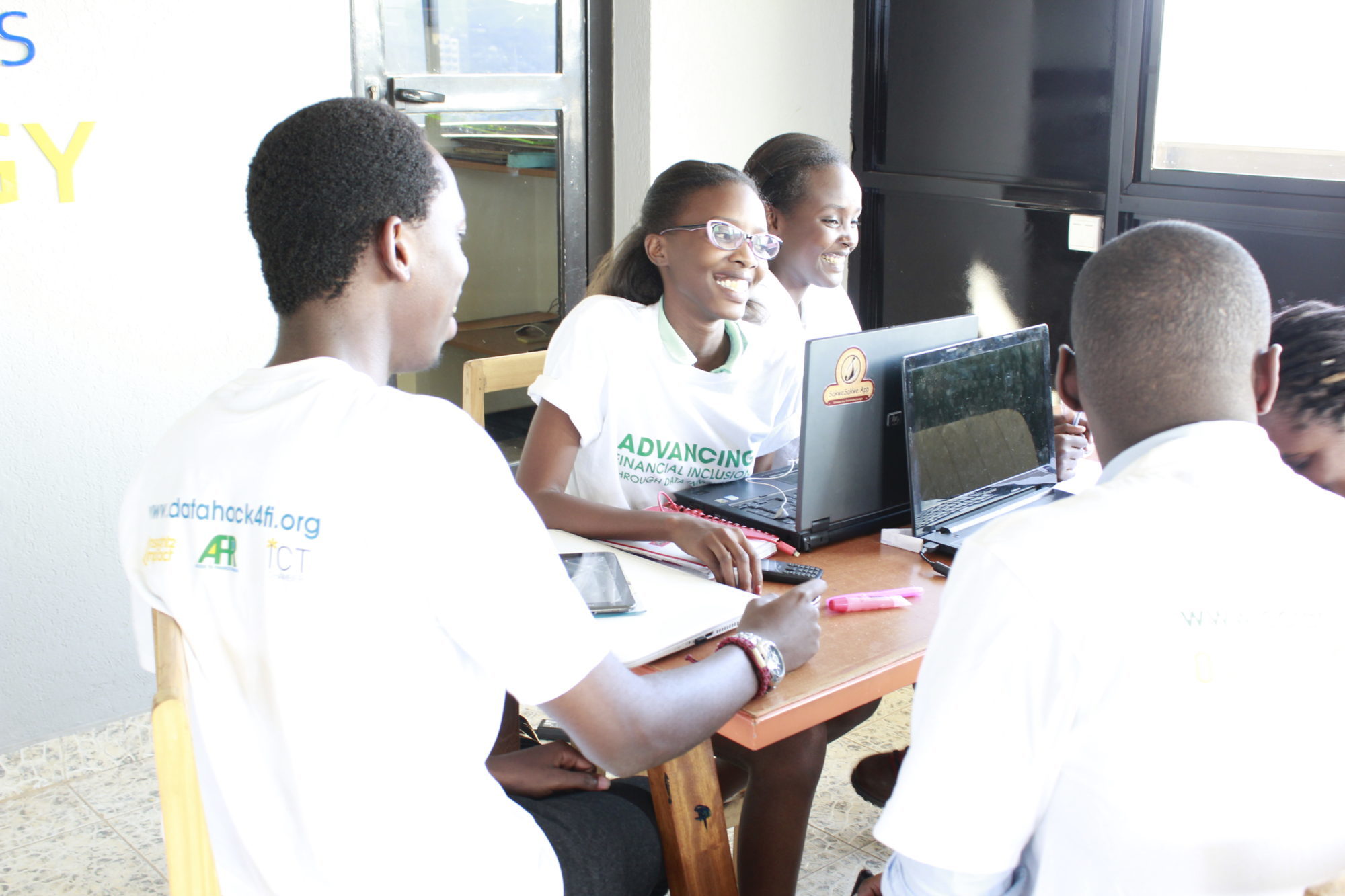

DataHack4FI innovation competition

DataHack4FI is an innovation competition bringing together data enthusiasts and financial service providers (FSPs) to promote the use of data-driven decision-making in financial inclusion. insight2impact (i2ifacility) was funded by Bill & Melinda Gates Foundation in partnership with Mastercard Foundation. The programme was established and driven by Cenfri and Finmark Trust.