Could this be microinsurance’s uber moment?

Could this be microinsurance’s uber moment?

15 November, 2016 •Over the last decade, microinsurance has grown from covering fewer than 100 million risks to covering more than 500 million. But are we overstating what this growth means for insurance market development?

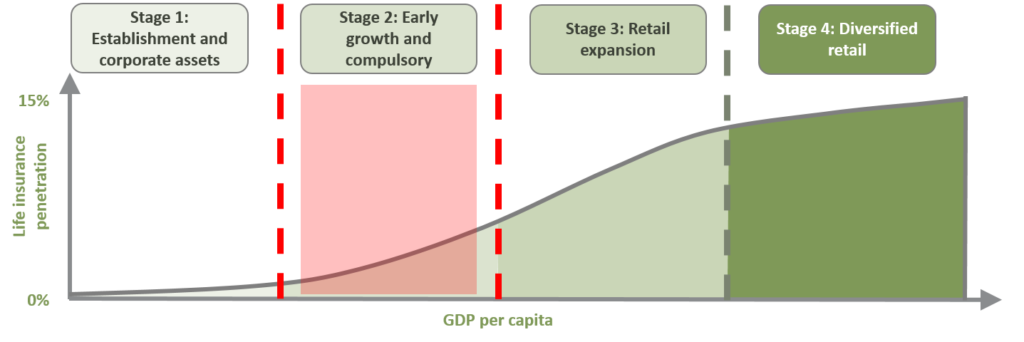

The diagram below illustrates how an insurance market typically develops in a country: from initially just underwriting large corporate risks, such as insuring large-scale assets in the extractive industries; to expanding its early retail reach via compulsory insurance, employee groups and other group-based models; to gradually growing an individual and voluntary client base; before, eventually, covering a diversity of risks for the bulk of individuals.

See here for a more detailed explanation of these stages.

Most of the growth that we have seen in microinsurance has happened in Stage 2: Early growth and compulsory (shaded in red). In this stage, there is rapid growth in the numbers of individuals covered by insurance – hence the 500 million success story.

But a closer look at the nature of this uptake shows that, despite almost two decades of development efforts, very little of this is voluntary. Retail insurance is often compulsory (think credit life insurance or third party vehicle insurance) and large chunks of clients are added “in one go” by non-insurance client aggregators such as mobile network operators (MNOs) that roll out insurance to their subscribers. In some countries, governments, sometimes with donor-backing, have also auto-enrolled large numbers of people in insurance to drive public interest goals.

Much of this cover is driven by the needs of the intermediary. For example, enhancing MNO client loyalty or protecting the portfolio of credit providers. This is yet to really address the risk needs of the client and low claims ratios suggest that these products still offer limited value to consumers, who are often unaware of the cover they have. The limited benefits mean that, despite the growth in numbers covered, these models have not contributed substantially to growth in gross insurance premiums. They are viable, yes, but they struggle to make it into the top five business opportunities that capacity-constrained insurers can pursue at any point in time when compared to other, more lucrative opportunities.

Thus our cross-country research shows that many developing insurance markets are stuck in this stage. Crossing to Stage 3, where you see a broad-based, voluntary retail market emerging, is proving to be really challenging. Why is this the case?

In most cases, income levels, and by consequence premiums, create an absolute barrier as they are too low to recoup the costs of investing in infrastructure required to get to Stage 3. Hence many efforts at reaching scale remain government or donor-driven and the bulk of consumers continue to rely on informal alternatives or other types of financial services to cover risks that the insurance industry typically considers not to be insurable.

What has all of this to do with Uber, and why do I think this could be microinsurance’s ‘Uber’ moment? Because something needs to change. The fundamentals of insurance don’t work for this market unless heavily supported by public interest. Adults don’t find it convenient to use insurance to manage risk and don’t trust insurers. Even mobile microinsurance has not changed this.

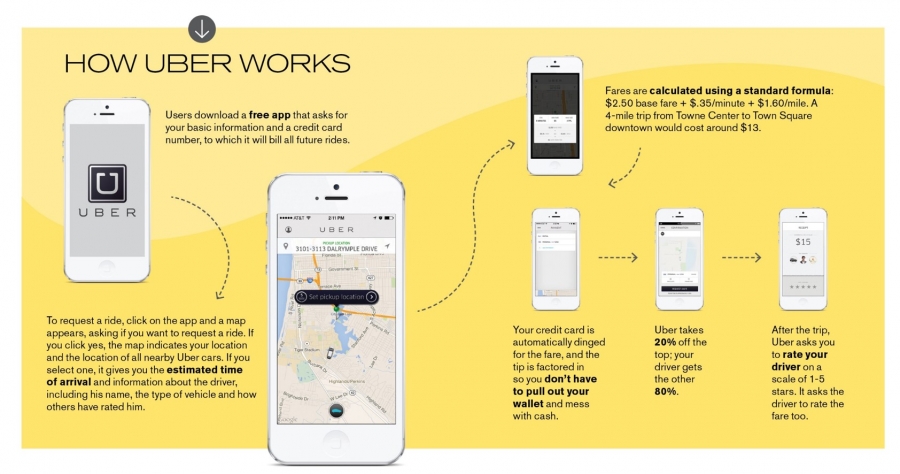

So we need models that change these dynamics, not simply provide a new delivery solution. And that is where we can learn from what the likes of Uber did for the transport industry. It did not simply offer a payment solution for using traditional taxis. It offered a transport solution that shifted power to consumers and fundamentally changed the transport market and even the nature of vehicle ownership. In so doing it challenged (and is still challenging) regulatory approaches, which are still largely based on the traditional market.

This week I am hosting the final plenary session at the 12th International Microinsurance Conference to explore the “reinvention” of microinsurance through technology with a panel that can really help us push the discussion:

- Tang Loaec, CEO of P2P Protect, will present on their P2P model, TongJuBao, in China. The emerging person-to-person (P2P) insurance models are starting to leverage technology to reinvent insurance from the ground up, through a mutual model of bringing users together around common risks and allowing them to define the rules of engagement: what they want to cover, how much they want to cover, whether to pay claims and what to do with risk surpluses. P2P Protect takes this one step further by also covering new fields of risks typically not considered insurable by mainstream insurers, but commonly experienced in China. For example, family unity where it covers the time required to take off from work to travel home to rural areas to look after your sick parent.

- Kelvin Massingham, regional director of HelloDoctor, will present on SemaDoc in Kenya. It assists consumers to manage their health risks by bundling medical advice, a hospital cash plan, credit facility and a health savings account, all delivered through the mobile phone and taken up on a voluntary, individual basis. The bundling of insurance with risk prevention (through telephone diagnosis) and other risk management strategies such as savings and credit broadens the approach beyond pure risk cover, to ask what combination of strategies works best for the consumer. A much needed step in insurance.

- Luc Noubissi, senior insurance specialist for CIMA and chair of the Digital Technology in Inclusive Insurance Drafting Group for the IAIS, will present on CIMA’s current approach to digital insurance, as well as the need for regulatory guidance to address the crucial role that technology can play in changing the dynamics of the insurance industry that keep us stuck in Stage 2.

We need this to be microinsurance’s ‘Uber moment’. But we also have to be sober about whether the new models will be more than an evolution of the existing MNO model. So what will it be? I look forward to finding out this week, and I hope you do too.