When digital payment goes viral: lessons from COVID-19’s impact on mobile money in Rwanda

When digital payment goes viral: lessons from COVID-19’s impact on mobile money in Rwanda

19 May, 2020 •Since the onset of the COVID-19 pandemic, many African governments have implemented policy changes and lockdowns to prevent the further spread of the virus to vulnerable populations. In countries with high levels of mobile money penetration, governments have been able to leverage digital payments to avoid cash, which can act as a carrier of the disease.

Though the economic crisis is already having a devastating impact on businesses and individuals in Africa, this imperative to digitise is one of the key opportunities that are emerging from the pandemic.

The early experiences of Rwanda show the kind of impact these digitisation efforts can have. On March 19, the National Bank of Rwanda (BNR) instituted a set of rapid economic policy changes to support both businesses and individuals during the lockdown, and to further the national digitisation agenda. These decisive measures will be in place for three months, and they include:

- Zero charges on all transfers between bank accounts and mobile wallets

- Zero charges on all mobile money transfers

- Zero merchant fees on payments for all contactless point-of-sale (via mobile) transactions

- An increase in the limit for individual transfers using mobile money wallets, from RWF 500,000 to RWF 1,500,000

As insight2impact had just completed a mobile money transaction data analysis with the Rwandan Utilities Regulation Authority (RURA), which regulates telecoms in Rwanda), the regulator reached out to see if we could rapidly analyse the mobile money transaction data during the lockdown period, to track the response to these policies and identify trends and insights for policymakers.

This project is an ongoing race against time to set up an indicator database and dashboard, virtually, to enable rapid analysis and review by policymakers before the three-month period is up. Despite the many challenges of working virtually, the speed with which the RURA responded to this opportunity by identifying the indicators and key data to track (with the ongoing support of the BNR) made it possible to get the first set of analysis out within a month.

Huge growth in person-to-person transfers

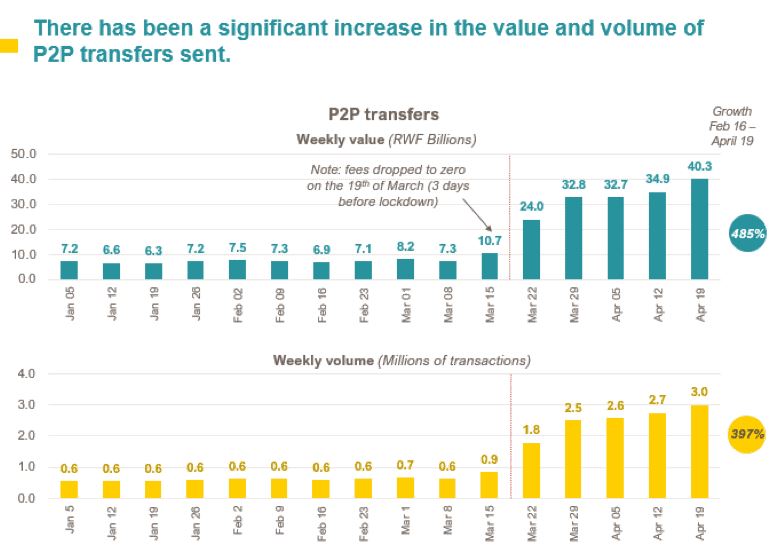

Since the lockdown was implemented, the growth in person-to-person (P2P) transfers, in both value and volume, has been phenomenal. After a rapid increase in the first week of lockdown, this high level has remained as the “new normal,” with slower but continued growth up to the end of April (see figure). For comparison purposes, in the first week of January, the total value of funds sent via a P2P transfer was RWF 7.2 billion (US $7.6 million). In the last week of April, the value sent reached RWF 40 billion (over US $42 million) – an increase of over 450%.

With zero fees and limited mobility to physically move cash, greater numbers of people are switching to mobile money transfers. Utilising national ID numbers, we were able to identify the number of unique subscribers sending a P2P transfer, which doubled from 600,000 in the week before lockdown to 1.2 million in the week after lockdown. In the final week of April, 1.8 million individuals sent a P2P transfer.

However, we don’t fully understand the use cases for P2P transfers yet. From our previous analysis of mobile money in Rwanda, one hypothesis is that many P2P transfers are informal payments for goods and services, not internal “remittances” from cities to family members in rural areas. For example, our 2019 mobile money research showed that in a given month, almost 60% of P2P transfers from Kigali remained in Kigali. Further research is needed to understand customers’ digital financial behaviour.

Covid-19’s impact on female mobile money usage and merchant payments

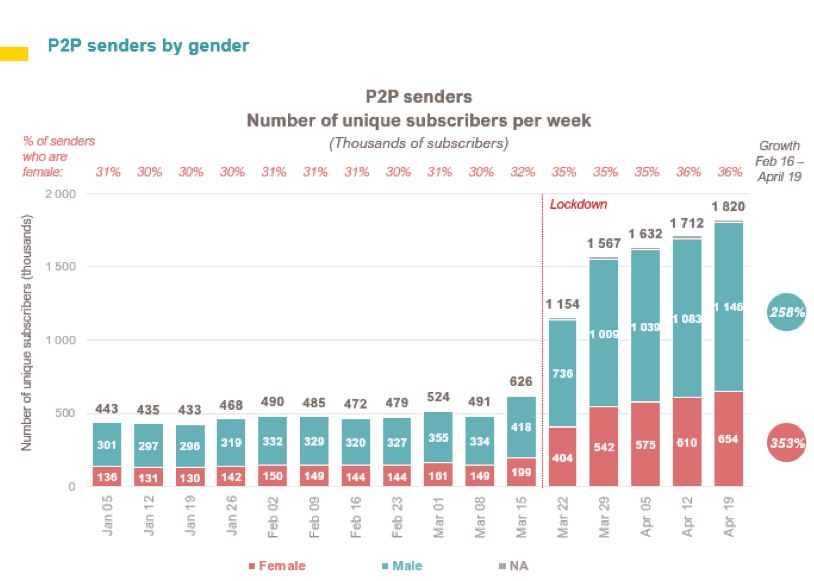

Using registration information for mobile money subscribers, we can also see the change in behaviours by gender. While most people sending a P2P transfer during the lockdown period are male, the number of female senders has grown more quickly. Prior to the lockdown around 31% of senders were female, but by the fifth week of lockdown this had increased to 36% of senders (see figure).

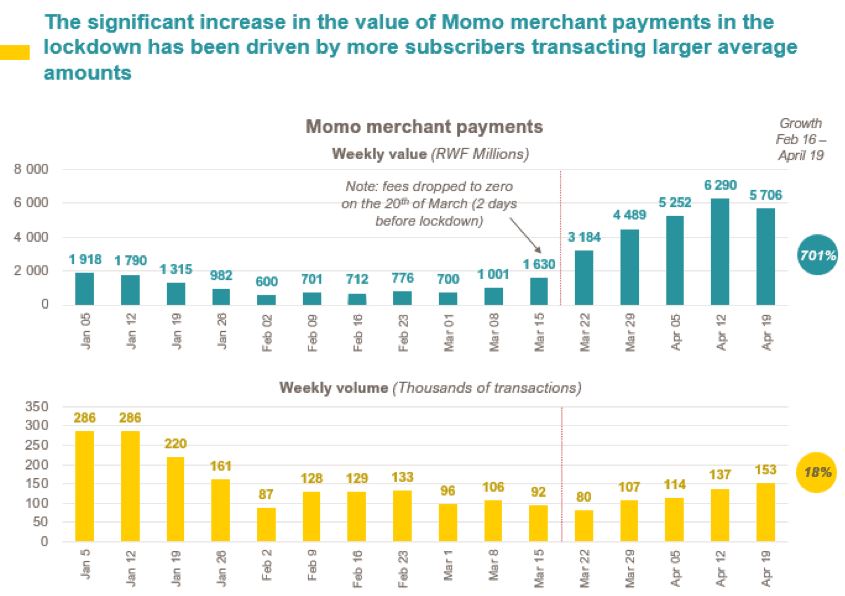

Digital merchant payments via mobile have been strongly promoted in Rwanda, and they had experienced strong growth before COVID-19. For example, MomoPay, MTN’s mobile payments solution, saw a rapid uptake by both merchants and consumers through 2019. The potential for continued expansion to new merchants has been interrupted by the lockdown, but mobile merchant spending has gone up – even though limits on mobility and the ability to shop have altered customer behaviours. People are buying less frequently, but when they do, they are spending higher values (see figure). From mid-February to mid-April, the weekly value of funds being spent digitally at merchant outlets has increased 700%.

Key lessons from Rwanda

The current crisis provides an opportunity for governments to advance the digitisation of their economies. Below are a few lessons on how they can achieve this, based on our Rwanda policy tracking so far. More data will be needed to see if these changes will stick.

- Make it as cheap as cash to go digital: By slashing or eliminating fees on money transfers during the lockdown period, digital payments can compete with cash. Although the sustainability of this approach remains to be seen given the sacrifice in fee revenue required from mobile money operators, it provides an on-ramp for the use of digital financial services by those who would otherwise have used cash. The current data shows cash-outs from mobile wallets have also decreased sharply since the lockdown started, and are now less than half of their January values – meaning more subscribers are using digital value. However, we will have to wait for post-COVID-19 data to determine if these behaviours are permanent.

- Track the impact: Using transaction data to track key indicators in a dashboard will give policymakers almost real-time data on whether a policy change is working as expected. The next steps will be to use transaction data to track the real economy impact of these policies, and this impact’s geographic distribution.

- Use the evidence to adjust policies: Applying data analytics to segment data on the usage of digital financial services by gender, age group, location or other demographic factors provides timely evidence on how different segments of the population are responding, and who is being excluded. Aggregated numbers cannot do this. The public sector will need to increase its investment in data science to ensure that the digital revolution is evidence-based and leveraged for the public good.

As this project evolves and our dashboards are finalised for policymakers to use, we hope to continue sharing the learning on this process. We hope this will encourage other governments to consider the application of advanced data analytics to financial transaction data, to track the impact of the COVID-19 crisis and the responses to policy changes among different customer populations.

This ongoing insight2impact project has been made possible by the rapid action and strong collaboration of RURA and BNR, and expert analytic and data science input from 71point4.

This article was first published on Next Billion as part of the Openi2i series an initiative of Cenfri and Finmark Trust.