Delivering on the promise of digitising payments in Zambia

Delivering on the promise of digitising payments in Zambia

30 June, 2017 •Digital financial inclusion holds great promise. Last year, a McKinsey report found that digital finance could add up to $3.7 trillion to the GDP of emerging economies within a decade. A recent blog from the World Bank explains that the biggest impact from financial inclusion comes from digital payments and savings accounts. Studies on digitising cash payments in Brazil, South Africa and Mexico all find significant efficiency gains from digitising payments for governments and their service providers.

Globally, enthusiasm about digital financial inclusion is on the rise, and Zambia is no exception. The “digitisation of payments” refers to the process of switching from making and/or receiving payment using non-digital instruments, such as cash and cheques, to making and/or receiving payment using a digital instrument such as bank card, mobile money, and other forms of electronic money transfers. The Zambian Government has included targets for the digitisation of government-to-persons (G2P) payments, such as government salaries and refunds, and persons to government (P2G) payments, such as school fees, health service cost sharing from the public, and tax payments, in its draft National Financial Inclusion Strategy.

While the benefits of digitising payments are evident, our research in Zambia and other countries in the SADC region suggests that a blanket approach to digitising payments may have unintended, adverse effects. For example, in Malawi, we found that due to lack of cash-out infrastructure, travel and opportunity costs incurred by digital-payment recipients amounted to more than seven times the amount of their direct account fees, and accounted for 15% of their average monthly income. Many adults opted out, forcing one donor programme to discontinue the use of digital channels to disburse its grant payments. We found similar evidence and outcomes in Mozambique, the DRC and Zambia.

G2P payments are only one type of digital payments. To recognise the full benefits of digitisation, we need a broader understanding of how to migrate other types of payments from cash to digital. For example, in South Africa using cash-in and cash-out infrastructure is cheaper for most adults than is the case in Malawi. When the South Africa Social Security Agency (SASSA) migrated its grants from cash to digital in 2012, adults didn’t incur the same high costs to access their income. However, beyond receiving their grant income, few are using digital channels to meet their payments needs, thus not fully realising the value of digitisation. A survey of 97 SASSA grant recipients living in major urban centres with prevalent digital payments infrastructure found that over 90% withdrew their grants entirely in cash as soon as they received them.

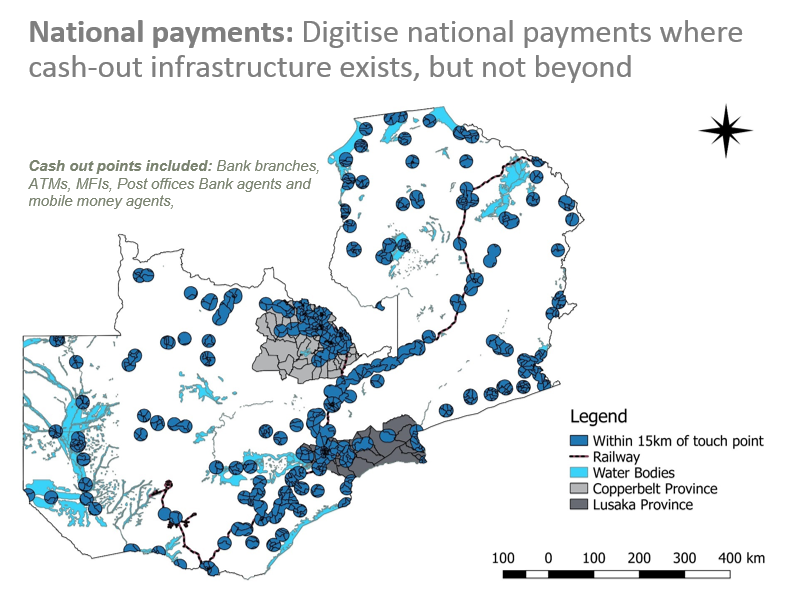

The Zambian Government can draw on the lesson from these examples in its approach to digitising G2P payments. To ensure that payment recipients do not incur substantial costs, it should consider digitising such payments only to recipients in areas that already have the appropriate infrastructure. The FSD Zambia GIS data shown in the figure below presents the geographic area in Zambia within a 15km radius of a cash-out point in 2016. The table shows the proportion of Zambians that reside in this geographic area per province.

To encourage the extension of cash-out points beyond the existing areas, careful consideration should be given on how regulatory tools can contribute to growth. Regulations need to create the right incentives for providers to expand the cash-in and cash-out infrastructure. In addition, rules need to enhance the incentives for retail purchases from shops and business-to-business payments. With the right incentives and support, the necessary infrastructure can be extended, allowing the Government to expand the digitisation of payments to these areas.

As a counter-example, in Mozambique regulations required digital services providers to charge zero cash withdrawal fees, which was intended to benefit the consumer, but instead created the opposite result. The rules caused providers to stop investing in infrastructure outside of Maputo. This increased the effective cost for consumers, who had to travel longer distances to access the infrastructure.

In the Lusaka and Copperbelt provinces of Zambia, appropriate cash-out infrastructure is already in place. These areas require a broader approach, to ensure that consumers have the incentive to switch from cash to digital mechanisms for their other payments.

One area in which digital payments have already made inroads in Zambia is remittances. According to FinScope (2015), only 17% of Zambian remitters still use cash, while other payment types (such as bill and merchant payments) remain almost entirely in cash.

The reasons why digital financial services for remittances have grown faster than other types of payments should be considered in increasing digital financial market development. Most customers use digital payments for remittances since such payments offer greater value than the cash alternative. Compared to cash, digital remittances are cheaper, more convenient and more reliable. The value is also transferred immediately, which is particularly important when responding to an emergency. For merchants, however, using cash for day-to-day payments offers better value than digital alternatives. Similarly, consumers still prefer cash for in-person payments to merchants, because it is cheaper, more convenient, requires no trust in an institution or system, and is immediate.

Making digital options more valuable and attractive to consumers is the fundamental requirement for broad payments digitisation. Currently, cash is still a far better mechanism for most Zambians. To design products and platforms that create more reasons for adults to switch to digital channels in Zambia, we need to better understand what consumers value and how different payment types respond to various needs. Adequate infrastructure, such as digital payments acceptance points, is also a prerequisite.

There may be more immediate gains from digital payments through reduced leakages and reduced cost of transporting cash for government, businesses and donors. But for digitisation to fully deliver on its promise, there is a need for a longer-term and nuanced approach that considers that value to the consumer and delivers it.