Digital app services in sub-Saharan Africa sees promising start

Digital app services in sub-Saharan Africa sees promising start

7 October, 2020 •Expanded smartphone access in Africa underpins evolving consumer behaviour.

Smartphone uptake in Africa is growing rapidly. GSMA reported that smartphone adoption in sub-Saharan Africa reached 45% in 2018 – nearly half a billion people – and is projected to reach 66% by 2025. To put that further into perspective, 623 million African consumers with smartphone devices will be able to use mobile technologies to transact in the digital economy by 2025 as consumers, workers and/or entrepreneurs. Alongside this rise in smartphone ownership, we expect further changes in the digital behaviour of the African population, with exciting consequences for economic inclusion.

Cenfri analysed Caribou Data’s panel data for three leading platform ecosystems – Kenya, Nigeria and South Africa – to identify trends in digital app usage. Caribou Data collects data on smartphone usage at a phone system level from adults in several countries.

Using data on the 500 most used apps in each of the three countries, we organised apps into four broad categories:

- Transactional apps: These connect distinct groups for exchange of goods and services observed on the app (e.g. Poll Pay, Jumia and Fiverr).

- Financial apps: These are applications that enable users to manage their finances (iPesa, Timiza and AfrikaLoan).

- Social media apps: These connect distinct user groups to share information, ideas, personal messages and other content (e.g. WhatsApp, Facebook and Twitter).

- Other: This category includes apps from broad categories that are widely and frequently used, such as entertainment (e.g. Photo Editor, MP3 Player and Candy Crush Saga).

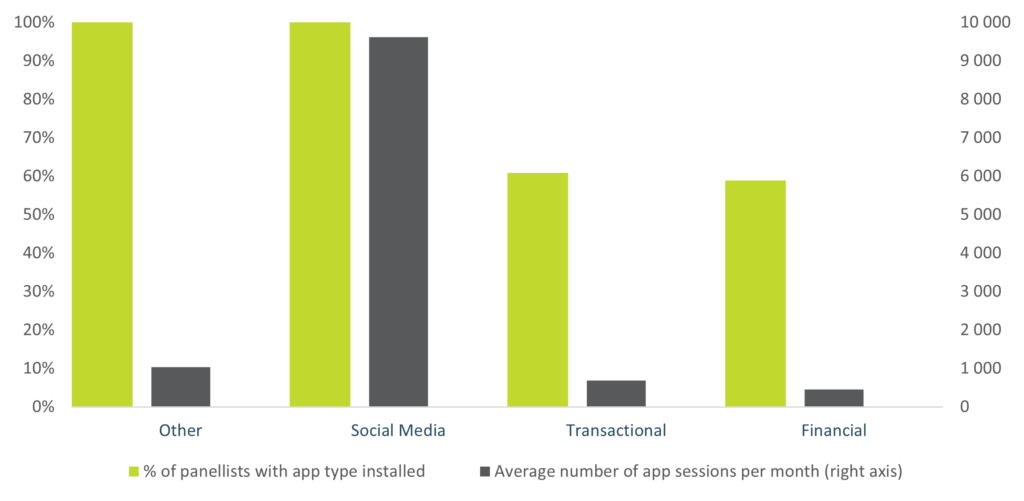

Economic exchanges are more digitised in key African markets than we expected. The data revealed some important lessons on the state of smartphone app usage across the platform ecosystems of Kenya, Nigeria and South Africa. Financial and transactional platform apps have gained respectable market share, having been installed by 60% of panellists on average. The average number of sessions per month for transactional platforms is 113, and 75 for financial platforms. This amounts to just under an hour spent on transactional platforms and just over half an hour spent on financial platforms on average per user per month, for a total of 1.5 hours across these two categories. While these numbers indicate that most users do not spend large amounts of their time on apps from these categories, the usage figures are significant and indicate that these apps do deliver value.

Although the data shows an increase in the usage of smartphones for financial and transactional online behaviour, social media remains ahead of all the other app types: 100% of panellists had at least one social media app installed on their phone, and nearly half of all the app sessions over the period of analysis were social media related. This insight raises a key question: Will financial services successfully piggyback on social media in the near future? Will the Asia experience be repeated, with African equivalents of WeChat and Alipay playing a key role in extending digital payment services on the continent? For example, Facebook marketplace and WhatsApp business could allow for social media apps to be viewed and used as transactional apps once they have financial functionalities embedded.

As in Asia, the demographic characteristics of social media users cover the full spectrum in Africa, which means these apps reach individuals who most likely have little to no other contact with formal financial institutions via their phones. Unlike Asia, African markets are much smaller, and countries have unique regulations and market conditions, which would increase the burden on social media apps, should they add financial services functionality to their offerings. It is also unclear whether consumer protection and data privacy will present significant hurdles to financial product offerings via these channels.

Beware of insidious digital exclusion. Even though there has been impressive growth in some respects, and the ubiquity of social media apps engenders excitement around future digital financial inclusion, the Caribou data also reveals differences across countries along traditionally divisive lines. For example, there remain stark differences in the way that some groups use applications on their mobile phones. Our analysis of the data finds that women, rural segments and older adults are commonly trailing behind in app usage. Across all major app categories, besides social media which is used by everyone in the sample, fewer of these population segments install apps or use them actively. More interestingly, in terms of both the number of sessions and the duration of sessions, these segments spend significantly less time on their mobile applications. We think there is continued risk of women, rural segments and older adults insidiously being excluded as African economies digitise more rapidly on the back of the COVID-19 pandemic. It is therefore important that the gender gap in uptake and use of digital financial products be monitored to determine whether it is increasing or decreasing over time and whether or not it compares favourably to the gender gap in the uptake of traditional financial services. Future development programmes should also look to introduce specific interventions that could bolster access to the benefits of the digital economy, for these vulnerable segments of the population.

What does the rise of smartphone apps mean for USSD? Is USSD being challenged by apps, and will this affect the applications for which USSD is suited? USSD has been used to build many successful mobile-based businesses in Africa and was instrumental to the success of mobile money. Given the data shown above, there appears to be no hesitation among African users to migrate to digital social media apps and even to transactional and financial apps, which could also offer improved payment functionality with additional value-added financial services embedded. Even among M-Pesa users, who traditionally have operated almost exclusively on USSD, uptake and usage of the M-Pesa smartphone app has been growing quickly. M-Pesa currently has approximately 42 million users in total, and the M-Pesa Tanzania app has been installed more than 500,000 times from Google Play since it became available. The mySafaricom app, which can be used to conduct M-Pesa transactions in Kenya, has more than 5 million installs from Google Play.

However, the introduction of smartphone-based applications as a replacement for USSD increases the cost and technical burden on companies significantly, which may act to restrain the supply side. There are also industries and areas that will remain resistant to growth in smartphones and applications, such as those in rural areas; and there remain barriers to smartphone uptake and usage, including the high cost of data and smartphones for the consumer and the cost of expanding network coverage into rural areas for the provider. Furthermore, even as traditional USSD strongholds such as mobile money are being increasingly challenged by apps, more than 90% of mobile money transactions were still sent through on USSD channels in 2018, and a large suite of new and innovative products have been built on USSD*.

It remains to be seen whether the advent of smartphone-based apps will also signal the USSD sunset era for Africa.

* A large suite of new and innovative products have been built on USSD. For example, in the agricultural sector, Trotro Tractor – a digital platform operating in Ghana – offers a model in which farmers can connect to owners of farming equipment for rentals through basic SMS functionality, thereby lowering the access hurdle for its network of users. In the transport sector, USSD menus and SMS-based notifications for driver partners who mainly use basic feature phones are provided by e-hailing platform YegoMoto in Rwanda, in addition to providing a smartphone application for more digitally savvy and connected drivers. MNOs also typically have large agent networks that can be employed and strategically leveraged by digital platforms to better reach consumer segments in remote and rural areas, blending digital and analogue channels for expanded reach. Leveraged effectively, partnerships with MNOs could provide digital platforms with the assets and capabilities required to scale their operations to a mass of hard-to-reach network users.