Digitising destinations: a tourist’s journey starts online

Digitising destinations: a tourist’s journey starts online

20 February, 2024 •COVID-19 turned some of us into virtual voyagers. We spent hours scrolling through posts of people hiking to waterfalls, adventurers crossing canopy walks, and families soaking up the sun on blue flag beaches. After one too many posts captioned “take me back”, we promised that if we ever get out of lockdown, we’d turn our digital wanderlust into real life travels.

Even before COVID, the ease and convenience of using digital tools such as websites and apps to find holiday destinations and experiences had become the preferred method for booking and paying for many of us. In fact, an average traveller views approximately 38 websites before booking a trip, and 82% of all travellers are booking their travel or tourist activities through a website or mobile app (TravelPort 2022, and Condor, 2023).

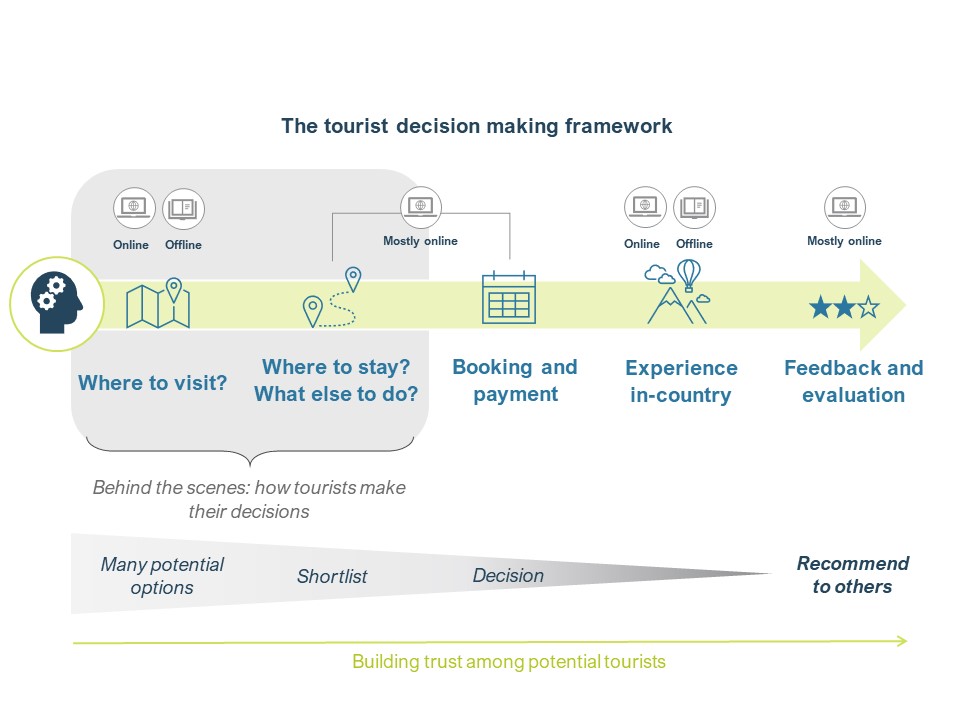

For tourism sectors and operators, this means that digital tools have gone from being merely a ‘nice-to-have’ to an absolute necessity. As visualised below, a strong online presence, coupled with key tools like digital payment and online booking platforms, is key in almost every step in the tourist decision-making process.

We recently conducted a digital diagnostic of the tourism sector in Ghana, in partnership with the Mastercard Foundation, CDC Consult and the African Tourism Research Network, to understand what these dynamics mean for the future of tourism in Ghana.

From diving into this, we found that digital technology is necessary for public and private sector operators in any tourism sector to influence the tourist decision making process. Together, these tools have the power to:

- Attract and win-over a global audience. A well-designed website and/or social media presence with consistent branding and transparent and authentic information is essential for any tourism sector/operator to (i) be considered by the modern traveller in their decision-making process, (ii) attract a global audience, and (iii) outcompete other destinations and activities that have made it onto a tourists’ shortlist.

- Enhance the tourist experience. A simple user-friendly interface for secure payment and booking processes can be the difference between selecting a destination or discarding it. These tools play a key role in creating a professional platform for any tourist site or operator to enhance the tourist experience – making it seamlessly easy to select, book and pay.

- Build credibility and trust. The tools discussed above are also the foundation for building a strong reputation. For example, a digital presence can be used to encourage direct customer feedback and engagement through comments and ratings. These can build credibility and transparency while also building a database of constructive feedback which can later be used to further enhance the tourist experience.

You only get one chance to make a first impression. This adage has never been truer in tourism. A strong virtual presence, which spotlights a country or operator’s physical assets and services, supported by easy means to verify, book, and pay, is essential just to be considered by tourists.

While this seems like a relatively intuitive and simple reality to adjust to, not all tourism sectors and operators across the globe have fully embraced digital transformation. Ghana, for example, has unique cultural and heritage offerings including its rich history, heritage sites and cultural festivals. Combined with effective campaigns such as the Year of Return, particularly targeting the diaspora, Ghana does well in getting travellers to consider it as a potential destination.

However, missed opportunities have resulted in potential traveller interests not translating into actual tourism. Some insights from our work below illustrate this reality and show some of the missed opportunities associated with not adapting fully to the digital world:

Digital marketing in Ghana’s private sector

- What the data tells us: The adoption of digital tools to enhance the tourist experience remains underutilised. Across the tourism sector, the accommodation sector has the highest number of institutions with a digital presence. Of the institutions in the accommodation sector, a total of 53% (3,854 institutions) are hotels. Only 50% of these hotels have claimed their Google Business Profile (GBP), and a mere 29% of them have their own websites. This trend is consistent across operators in the tourism sector. An average of 47% of institutions have claimed their GBP and an average of 25% have a website – meaning that tourists see less than 50% of Ghanaian tourism operators when choosing where to go and what to do in Ghana. [Source: Authors own analysis from SEMRush analytics, October 2023]

- What this means in practice: Tourism operators are missing out on opportunities to be considered, shortlisted, and selected by tourists. They are also neglecting a commercial opportunity to increase revenue. A GBP is an easy and free tool for all businesses. Not claiming this profile means that half of the hotels in Ghana are not seeing their reviews on this platform and losing an opportunity to promote business and access insights. Not having any form of digital presence also means that businesses are losing out on a substantial chunk of business and revenue. Firm-level data collected by the Word Bank (2020), highlights that, on average, Ghanaian tourism businesses that have a digital presence earn five times higher revenue than businesses that do not.

Digital marketing in Ghana’s public sector

- What the data tells us: The Ghanaian tourism sector’s digital footprint is not effectively channelling tourists through the decision-making process to assess and select Ghana as a preferred holiday destination. Based on our research and data analysis, the most visited public websites to research Ghana as a tourist destination include visitghana.com, viewghana.com, easytrackghana.com, motac.gov.gh, and yearofreturn.com. These sites are mostly visited by people from the USA, Ghana, and the UK. The location of the visitors is based on the viewer’s VPN. Therefore, visitors flagged as being in Ghana are likely international tourists searching for things to do once already in Ghana. The majority of the visitors to these sites have found them through direct and organic searches (i.e. they either entered the URL or searched via a search engine like Google). Very few site visits are through digital referrals from other websites, and no visits to the websites stemmed from social media or other external links, such as from emails. [Sources: Authors own analysis from SEMRush analytics, October 2023; UNWTO, 2023; and GTA, 2023].

- What this means in practice: The data shows that these websites are not maximising their visibility to potential tourists and that they are not effectively channelling website visitors through to related websites to guide visitors towards building an itinerary. By not effectively using their digital presence, website visits are not translating into physical visits. Our research and data analysis suggests that for every 10 people who arrive in Ghana, approximately only 2 visit the official tourist websites. This reality becomes starker when comparing to other countries. The VisitRwanda website, for example, receives more than double the number of visits that VisitGhana does, and Rwanda also receives 20% more tourists than Ghana.

The time to turn virtual voyagers into actual adventurers is now! Evidently, achieving success for Ghana’s tourism sector is not just about adopting digital tools, it’s also about using them effectively to channel tourists through the tourist decision making process.

Public and private sector operators in the tourism landscape can tap into a global audience and present themselves as the ideal tourist destination/activity by capitalising on their digital credibility through their digital presence. They can then make it almost too easy not to pass on by adding a secure, simple, and stylish book and pay here button right there on their own page.

The tourist journey no longer starts at the airport, it starts online. The time to showcase iconic landmarks, local experiences, and must-see attractions online is now.