Diving into the data

Diving into the data

10 May, 2017 •Micro, small, and medium-sized enterprises (MSMEs) are recognised globally as a major engine of growth and employment creation. Access to finance is their most commonly cited barrier to growth. The IFC estimates that there are between 200 and 245 million formal and informal MSMEs in developing countries that do not have a loan or an overdraft, but require financing. That amounts to an estimated financing gap of US$2.1 to US$2.6 trillion.

In Zambia, MSME development is one way of reducing reliance on the mining sector and building a more diverse and resilient economy. In 2016, the Zambian government reaffirmed its commitment to increased MSME access to finance in the Patriotic Front’s manifesto.

Exploring differences in MSMEs in Zambia

Evidence shows that MSMEs are not all the same. They require different policy interventions if they are to contribute to the growth objectives set out by the government. For example, compare two real Zambian MSMEs: Oliver and Irene.

Oliver trained as a mechanical engineer, but now runs a computer accessory company which supplies Government and other large clients. Oliver currently has two employees, and would like to expand his business as the demand for computer accessories is increasing in Zambia. Irene runs a small informal hairdressing business out of her home, earning between K100 (US$10) and K300 (US$30) per week. She does not have any employees and does not plan to expand her business, as she is one of a handful of informal hairdressers located in the area.

Oliver and Irene are amongst the more than 1.35 million MSMEs identified in the 2009 Zambia FinScope MSME Survey. As with Oliver and Irene, the scale and nature of businesses differ greatly among entrepreneurs. As a result, so do their financial needs and their potential to contribute to balanced economic growth and increased employment.

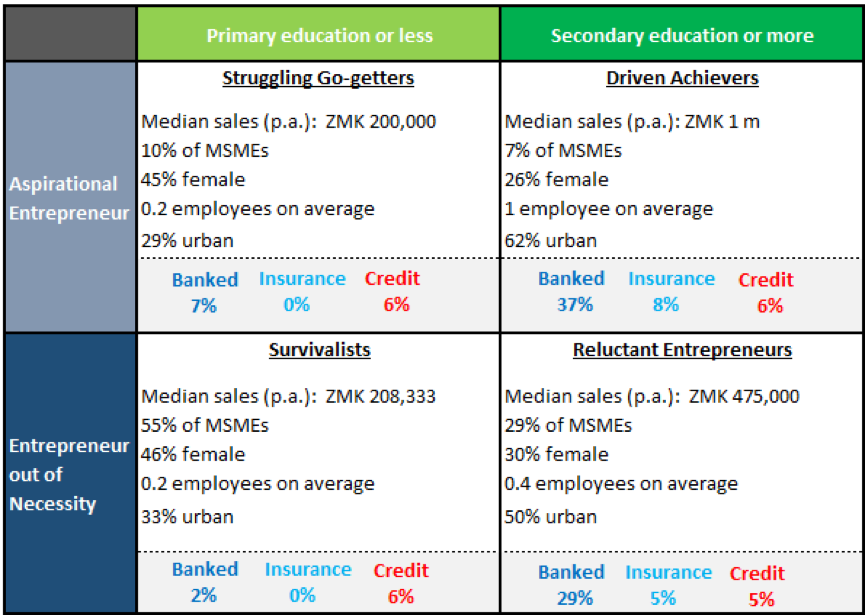

For the Zambian government to realise MSME potential, it needs to understand the differences between MSMEs and how to tailor policy interventions to help these varied businesses to grow. FSD Zambia has begun looking at the differences under the Making Access to Financial Services Possible (MAP) project conducted by Cenfri. We have taken a deep dive into the MSME data, looking at MSMEs based on their willingness and ability to grow. Willingness was assessed based on their reason for operating an MSME, and ability was assessed based on their level of education. We identified the following four segments (also captured in the Figure below):

- Driven Achievers (7%) are motivated to grow and are more likely to have the skills to do so, due to their educational attainment. This is reflected in two measures of their success: their larger size and higher monthly average sales.

- Struggling Go-getters (10%) would like to be entrepreneurs, but their lower education levels may mean that they do not have all the skills to be successful.

- Reluctant Entrepreneurs (29%) may not want to be entrepreneurs, but they have some skills, as indicated by their higher than average educational attainment, and may therefore have a greater chance of success in business.

- The Survivalists (55%) have neither the skills nor the desire to be MSME owners. They operate MSMEs out of necessity, to earn incomes.

What do these figures tell us about their needs?

Driven Achievers are the most likely to be able to absorb credit, use it productively and be able to make repayments to providers. The credit uptake figures for this group are of concern. Whilst the Driven Achievers indicate higher take-up of payments, savings and insurance products than the other segments, formal credit penetration is almost identical across all four segments. This suggests that too limited a number of MSMEs are receiving the financing they need to contribute to a more diverse and resilient economy.

Struggling Go-getters have the aspiration to grow, but not the skill, and policy interventions should focus on capacity building to migrate them to the Driven Achievers segment.

The Survivalists and Reluctant Entrepreneurs play a critical role in maintaining the livelihoods of a large number of Zambian families and hence should be supported, but may require interventions that focus on household resilience rather than enterprise growth. Targeting these individuals with credit could be a problem for their businesses if they are unable to use the funds to grow, and could be damaging if borrowing is too high, leading to a cycle of debt.

Take Oliver and Irene. Oliver may be able to use additional financing to grow his business and contribute to Zambia’s broader growth and employment objectives. Irene, on the other hand, is likely to be reluctant to take on additional financing as opportunities are limited. If she does, she is likely going to find it hard to grow her business in that area, and may incur additional interest rate expenses that could put her in a cycle of debt. Understanding these differences is thus a critical starting point in the design of any policy or intervention that targets MSMEs.