Nigeria’s proposed e-hailing tax could stifle innovation and dampen gig workers’ livelihoods

Nigeria’s proposed e-hailing tax could stifle innovation and dampen gig workers’ livelihoods

28 May, 2020 •Digital platforms are a quick and convenient way to match prospective customers to gig workers, and more than 50% of a surveyed[1] sample of mobility workers in Nigeria said that they were better able to reach customers through joining an e-hailing platform.

To put this into perspective, web traffic data suggests that the top three e-hailing platforms (Uber, GIGM and Bolt) in Nigeria reach around 4.3 million consumers annually (SEMRUSH, 2019). Further, in 2019, Nigeria’s e-hailing sector became a popular destination for venture capital investment, with reports of Gokada and Max.ng having raised USD5.3 million and USD7 million, respectively.

Lagos State Government’s proposal to tax e-hailing platforms comes at a time where the industry is only just lifting off. Between 2018 and 2019, 11 new e-hailing platforms launched operations in Nigeria, which brought the total number of players in the market to 21 (insight2impact, 2020). Moreover, this emerging sector is characterised by a high degree of churn with new platform players often entering and then exiting the market shortly thereafter: Our data shows that the average lifecycle of Nigeria’s e-hailing platforms is only two years.

Regulators in Africa – specifically in Kenya, Nigeria and South Africa– are increasingly viewing the proliferation of e-hailing platforms as an opportunity to increase government revenues through collection of tax and/or licensing fees from these platforms, as well as from the workers on the platforms. In Nigeria, the Lagos State Government is considering an initial licensing fee of ₦10 million for e-hailing platforms with fewer than 100 drivers and ₦25 million for those with more than 1,000 drivers. Subsequent to this, they would be liable to pay an annual renewal fee of ₦5 million and ₦10 million respectively, with the Government expecting to earn a proposed tax revenue of 10% for each e-hailing trip.

Transport regulators lack reliable data for evidence-based policy.

Government officials still lack reliable data to make evidence-based policy around this early-stage industry, and we think that premature taxation and/or red-tape could end up stifling innovation and unduly affect the livelihoods of the drivers, for many of whom platform work is an essential source of income[2]. In partnership with Lagos Business School, insight2impact carried out a survey of platforms and gig workers in early 2020 to better understand the dynamics at play within Nigeria’s platform ecosystem, and the results shed some light on the potential implications of the recent regulatory proposals by the Lagos State Government for this mobility sector.

Business sustainability of e-hailing platforms is seemingly under more pressure than other e-commerce players in Nigeria.

Our analysis of the unit economics of platforms operating in Nigeria shows that e-hailing platforms have relatively higher costs associated with customer acquisition than other e-commerce players. An interview with an e-hailing operator in Nigeria revealed that the platform only earns USD3 in revenue over a customer’s lifetime for every dollar spent by the platform on acquiring that customer, and it takes at least two months for the platform to recover the cost of customer acquisition. We also found that the gross margin[3] of the e-hailing platform is reportedly lower than that of freelance and logistics/courier platforms that were interviewed (see Figure 1), indicating that the profit margins for this specific market are relatively more constrained. Moreover, for the six months prior to the survey, the e-hailing platform reported a decline of 8% in gross revenues, which could be a signal of business sustainability pressures mounting even prior to the Government’s tax proposal.

Figure 1: Gross margins of platforms surveyed in Nigeria, in US dollar terms

Note: Survey conducted with freelance (2), logistics/courier (1) and e-hailing (1) platforms in Lagos, Nigeria, between 12 February and 13 March 2020

A 10% tax per trip may impede the livelihoods of Nigeria’s e-hailing drivers.

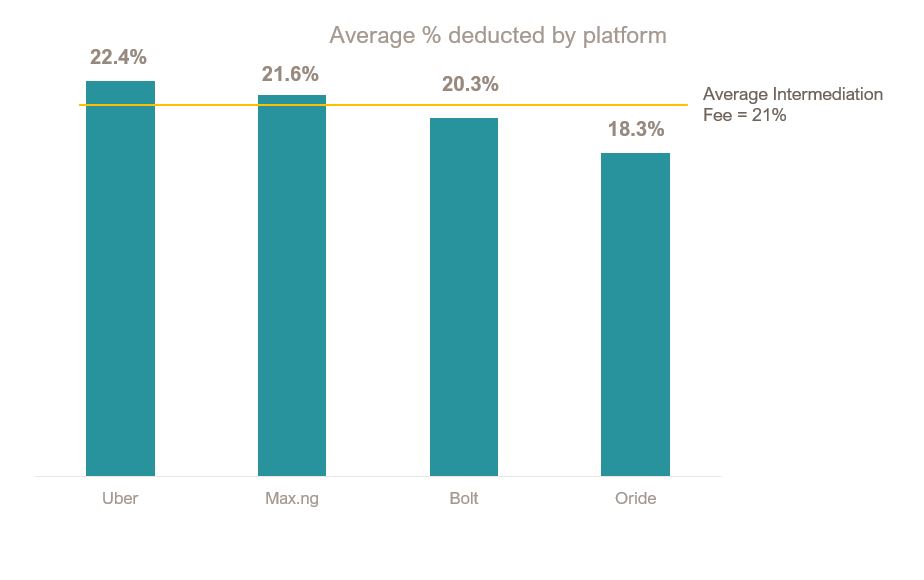

Drivers on Nigeria’s e-hailing platforms rely strongly on platform work as a source of income: 42% of surveyed e-hailing drivers reported that platform-mediated income made up more than 80% of their total monthly income. On average, these e-hailing drivers report earning an equivalent of USD409.9[4] per month, which is much higher than the minimum living wage of USD77 per month for Nigeria. Although drivers earn beyond the minimum wage in Nigeria, they are subject to relatively high platform deductions: On average, drivers reported a 21% intermediation fee levied by platforms per trip completed. In addition, during the COVID-19 crisis, drivers face a marked declined in demand for travel and have incurred additional operating costs related to sanitisation of vehicles and the purchase of protective masks and sanitisers. Additional deductions in the form of the proposed 10% tax (per trip) will further narrow the net wages that they earn and are likely to put further strain on these workers’ livelihoods.

Figure 2: Average intermediation fee (%) deducted from driver income, by e-hailing platforms in Nigeria

Note: 138 e-hailing drivers were surveyed in Lagos, Nigeria, between 18 March and 20 April 2020. Drivers were asked what percentage of the transaction price was deducted by the platform.

Policymaking for digital platforms needs to be informed by reliable evidence, yet this evidence is presently limited. What our early analysis shows is that the proposed fees on e-hailing platforms in Lagos may end up prematurely stifling early-stage growth of this industry. A good understanding of the unit economics of platform business models is important if regulators intend to implement policies that underpin the development of innovative sectors such as e-hailing, and authorities need to better work with industry to monitor and track (transactional) data for the ecosystem. Moreover, the impact of proposed government taxes on the livelihoods of e-hailing workers should be considered.

For more on this research initiative, contact digitalplatforms@cenfri.org.

[1] The Survey was conducted from 18 March to 20 April 2020 on a total of 138 drivers in Lagos, Nigeria.

[2] Sixty-seven percent (67%) is the average proportion of income derived from platform work, by Nigeria’s e-hailing driver survey respondents.

[3] The gross margin is the difference between the average unit revenue received off a transaction and the average cost of that transaction.

[4] Exchange rate; USD 1 = ₦390.3 accessed at https://www.xe.com/