From financial inclusion to inclusive finance

From financial inclusion to inclusive finance

19 October, 2020 •The power of frameworks to catalyse change

In this age of information, we increasingly rely on data to inform our decisions. But it is not just the data itself which is important for decision making. The utility of data for policy and investment very much depends on the paradigms and frameworks which guide our thinking and inform our questions. In the words of Thomas Kuhn, “The answers you get depend upon the questions you ask.”

Below, we’ll discuss the power of frameworks in shaping research and providing insights for financial inclusion policy and investment. The central character in this story is the FinAccess survey, conducted approximately every three years through a collaborative partnership under the FinAccess Management team (FAM). Led by the Central Bank of Kenya, the FAM collaboration also includes the Kenyan National Bureau of Statistics and FSD Kenya, with contributions from the private sector.

FinAccess was born as a result of a commitment between the public and private sectors to measure financial inclusion. Since its inception, FinAccess has played an important part in framing Kenya’s financial inclusion agenda, enabling us to measure ourselves against our African peers and track our progress. Indeed, early commentators on financial inclusion in Kenya went so far as to suggest that FinAccess helped to put the concept of financial inclusion on the map, enshrining it as part of the country’s financial sector lexicon. This underlines the power of frameworks to inform our thinking and support new policy directions – and ultimately, new investments.

Assessing the benefits of formal financial inclusion

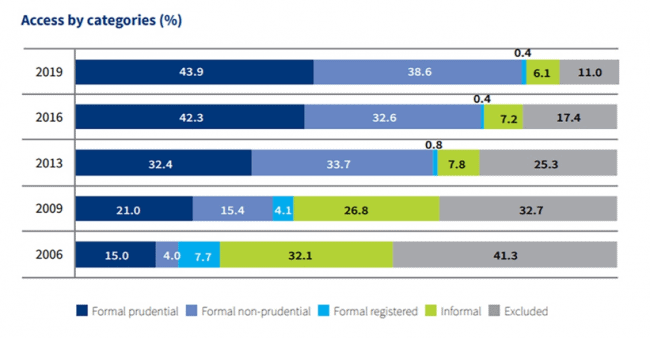

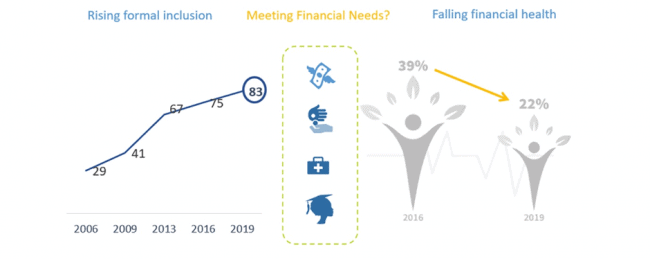

For instance, the financial access strand in the survey, which measures financial inclusion in terms of the formalisation of accounts, has provided impetus and support for the formalisation agenda. With 83% of the Kenyan population now “formally included,” the success of this paradigm, of which FinAccess is a part, has resulted in a three-fold increase in the uptake of formal accounts since 2006 when uptake of formal accounts was first measured. However, the financial access strand measures an individual’s financial inclusion status by their highest level of formality, thus obscuring the fact that they may simultaneously use other less formal devices alongside formal ones. Indeed, though 83% of Kenyans currently use formal accounts, 62% also use informal devices, including loans, gifts and other financial support from friends and family. Nevertheless, the access strand shows that the percentage of the population who ONLY use informal financial tools is just 6%, reinforcing the formality framework as the primary way to measure financial inclusion success.

More recently, however, and especially with the rise of digital credit and concerns about over-indebtedness, policy makers and others have begun to ask questions about whether formalisation in and of itself necessarily delivers the development gains we had hoped for. Are formal accounts really yielding the quality of service that adds real value to the lives and livelihoods of lower-income Kenyans? And if not, why not?

Shifting from financial inclusion to inclusive finance

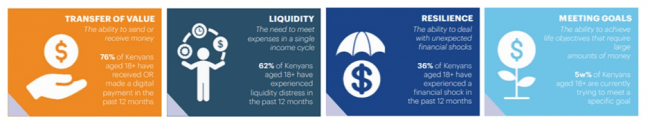

As we wrestled with these questions in the development of our 2016-2021 strategy, the FSD team reversed the concept of financial inclusion, focusing instead on “inclusive finance.” This new framing helped us shift our attention from broadening formal access to improving the power of finance to drive an inclusive economy. More concretely, it focused our strategy on maximizing the potential value of finance across three dimensions: helping people manage liquidity, manage risk and invest.

We were not alone in recognising that our traditional frameworks for financial inclusion were not helping us to deliver the social and economic outcomes we sought. The Central Bank of Kenya was similarly concerned. In the words of the bank’s governor, Dr Patrick Njoroge, “…while we have succeeded in enhancing access to financial services, we are lagging behind on other dimensions of financial inclusion, particularly on usage and quality.”

Understanding these more complex dimensions of financial inclusion requires different tools, frameworks and metrics. Both in Kenya and across the globe, thinkers and practitioners are increasingly coming together to invest in reshaping our metrics and analytical frameworks to support a shift in direction. In the U.S., the concept of financial health is gaining currency. In South Africa, under the auspices of insight2impact, financial inclusion practitioners have developed FinNeeds, a new framework for measuring financial needs. The FinNeeds framework reverses the perspective taken thus far: Instead of measuring the uptake of accounts, the framework begins by asking about how people are meeting four core financial needs (managing liquidity and risk, achieving goals and transacting), and then looks at the extent to which formal accounts have been used to address these.

Eye-opening data on the real impact of financial access

In the realm of research it is easy to become embroiled in a technocratic exercise, divorced from policy and action. This is where the importance of the FinAccess survey and partnership comes in. The FinAccess survey provided the perfect opportunity to articulate new frameworks like FinNeeds, and to develop new metrics to measure the extent to which finance was fulling its core functions in supporting household economies.

In developing the questionnaire for the FinAccess 2019 survey, the FAM team partnered with thinkers across the globe through a series of intensive workshops, as well as piloting and testing the new metrics. The 2019 survey was testimony not only to the power of frameworks to change our thinking, but to the significance of collaborative effort in shifting our practice. In the words of Bobby Berkowitz, a technical expert with insight2impact who participated in this effort, “…the context around the FAM collaboration helps me to appreciate the importance of institutional structures in making things happen.”

And the result of this new approach?

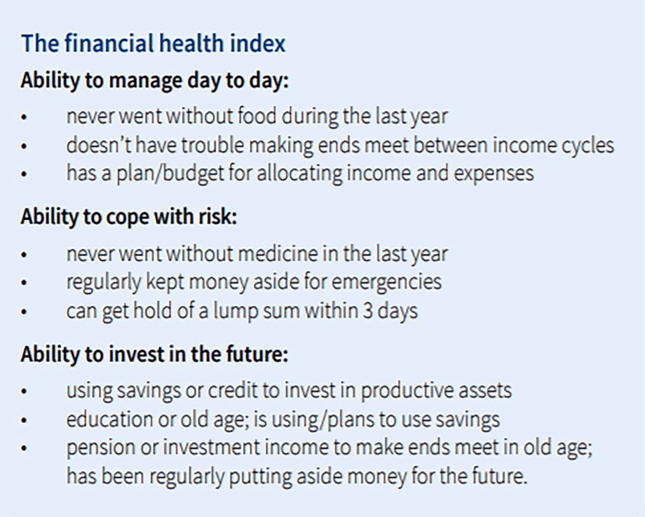

The data from FinAccess 2019 opened our eyes, focusing our attention not just on the expansion of inclusion but on its impacts on people’s lives and, by extension, Kenya’s development goals. The first surprise was yielded by the multidimensional financial health index, which was developed by FSD Kenya from existing questions in the FinAccess 2016 survey to provide a metric focused on financial health outcomes.

The 2019 survey found that, despite the upward trend in uptake of formal accounts, financial health had actually declined – not just a little, but quite substantially – since 2016. During this time, Kenya had gone through an election period and a series of droughts in various parts of the country, which had undermined the financial and economic resilience of lower-income households and constricted their opportunities for growth. Clearly, the gains in financial inclusion were not yet sufficient to offset these broader dynamics and enable many households to weather these storms.

Incorporating the FinNeeds framework allowed the survey to reveal this dynamic. The framework sat neatly between the financial health and financial access metrics discussed above, giving us some clues about the disconnect between rising financial inclusion and falling financial health. For example, while the financial access metrics focused on formal account ownership, the financial health index used indicators of people’s financial status (such as whether they have trouble making ends meet between income cycles, whether they can get hold of a lump sum at short notice in times of need, etc.) as proxies for their ability to manage liquidity and risk and invest in their futures. Meanwhile, the FinNeeds framework revealed the financial strategies and devices that individuals use to address their liquidity, risk and investment needs. This gives us insights as to how uptake and usage of formal accounts is adding value in helping people to address their financial needs and strengthen their financial health.

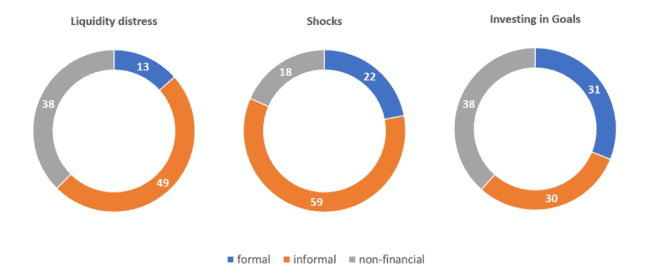

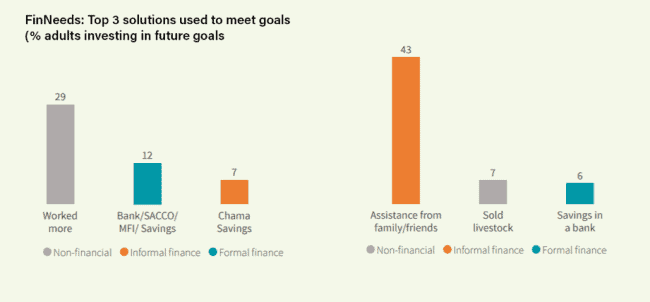

More surprises emerged from the data analysed under the FinNeeds framework, revealing how people were meeting their financial needs. For instance, while we were aware of the importance of informal services, previous FinAccess surveys had not conveyed the extent to which these remained central to people’s lives. The FinNeeds data highlighted the relatively limited role played by formal financial devices in helping people to meet their needs. Instead, it showed how people rely on informal financial relationships – especially with friends and family – and non-financial strategies such as selling assets or seeking more work, to meet their liquidity needs and manage shocks. Might this partly explain why the rise in formal inclusion did not appear to be impacting financial health?

At the same time, the FinNeeds data also revealed the importance of formal finance for meeting goals. Nearly a third of those who were trying to meet a goal reported that they used a formal financial device – mostly a savings account – as the main way to achieve it.

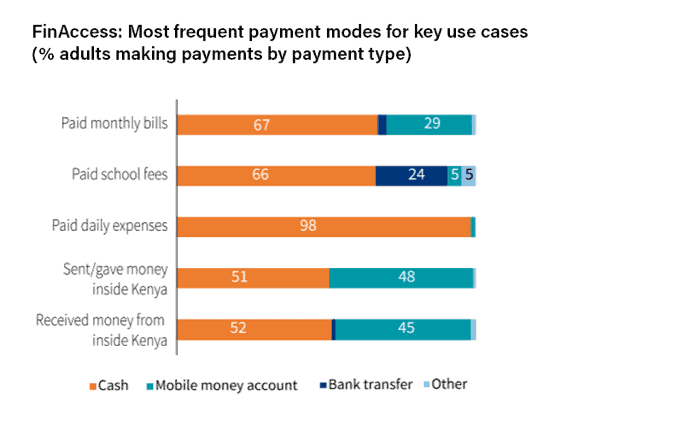

A subtext to the FinNeeds data is the hidden role of digital payments in managing liquidity and shocks. Despite the fact that a very high proportion of respondents reported that they mainly relied on friends and family to meet these needs, the survey showed that digital channels are widely used for interpersonal remittances. This reveals the importance of formal (mobile money) accounts in conjunction with social networks for addressing liquidity and shocks.

A need for formal and informal financial devices

The conclusion from the data is that formal devices are important – whether directly or indirectly – in helping people to meet their financial needs. But they are by no means the principle means to do so, and people still routinely turn to informal or non-financial alternatives. This points to the need for policy makers and private sector actors to innovate, creating a diverse financial sector that improves the power of both formal and informal infrastructures to meet a diverse array of needs. It also highlights the need for better services and investment vehicles to support the economies in which low-income people are engaged. However, while the data and analysis emerging from these new frameworks have been widely discussed in media and policy circles, the path between research and policy is a long one, and patience is needed as we look towards a concrete policy shift inspired by this new thinking.

In sum, FinAccess 2019 has enabled us to make great strides in our understanding of the value and importance of financial inclusion for Kenya’s development goals. This has been possible through the collaborative effort of central bankers, national statistical departments, global financial inclusion practitioners and thinkers, and local market facilitators. Tabitha Mwangi, an economist from the Kenya National Bureau of Statistics, sums up FinAccess’ impact, calling it “a major example of success for partnerships in the National Statistical System.”

As we look towards FinAccess 2021, the hard work that went into developing the 2019 survey will serve us well. Serendipitously, the FinNeeds framework and the financial health index will also provide us with the tools we need to address the question on everyone’s lips: How has COVID-19 affected people’s financial lives? Had we not had these frameworks, we would not have been so well prepared to address this and other critical development questions. In 2021, we’ll have completed close to two decades of tracking financial inclusion, putting the impacts of the current pandemic into a longer-term perspective in relation to people’s financial and economic lives. The collaboration between FSD and its partners in the public and private sectors, as well as with our colleagues from think tanks across the world, has made this possible. It is my hope that this kind of partnership will become even stronger as we join hands – not just to track financial inclusion, but to support inclusive finance.

This article was first published on Next Billion as part of the Openi2i series an initiative of Cenfri and Finmark Trust.