Kenyans are value maximisers, not cost minimisers

Kenyans are value maximisers, not cost minimisers

7 November, 2024 •Lessons from scaling retail health microinsurance in Kenya

It is often assumed that people with limited income will always choose the cheapest option available. However, this isn’t always the case. Take Mercy, a single mother in Nairobi[i], for example. When buying school shoes for her children, she opted for a more expensive, durable brand, knowing it would save money in the long run and provide better comfort. Nuanced analysis of Britam’s Bima ya Mwananchi[ii] (BYM) client data showed that they behave similarly – they prioritised value over cost when choosing micro health insurance options.

Low-income consumers know that “cheap” does not equal good value

The traditional approach to microinsurance has focused on a common belief that “since the target population of microinsurance is lower-income households, it is absolutely necessary to keep premiums as low as possible in order to have a product they can afford to purchase.” This traditional logic follows that low-income consumers do not take up insurance because they can’t afford it even when it is very cheap therefore there is no viable market. So, insurers will hide behind poorly designed low-cost products and blame low uptake on the fact that their clients are “poor”.

The quantitative and qualitative analysis of Britam BYM client data shows that consumers know that “cheap” does not necessarily equal good value. Consumers, even low-income ones, will pay more if the product they are purchasing meets their needs and provides good value.

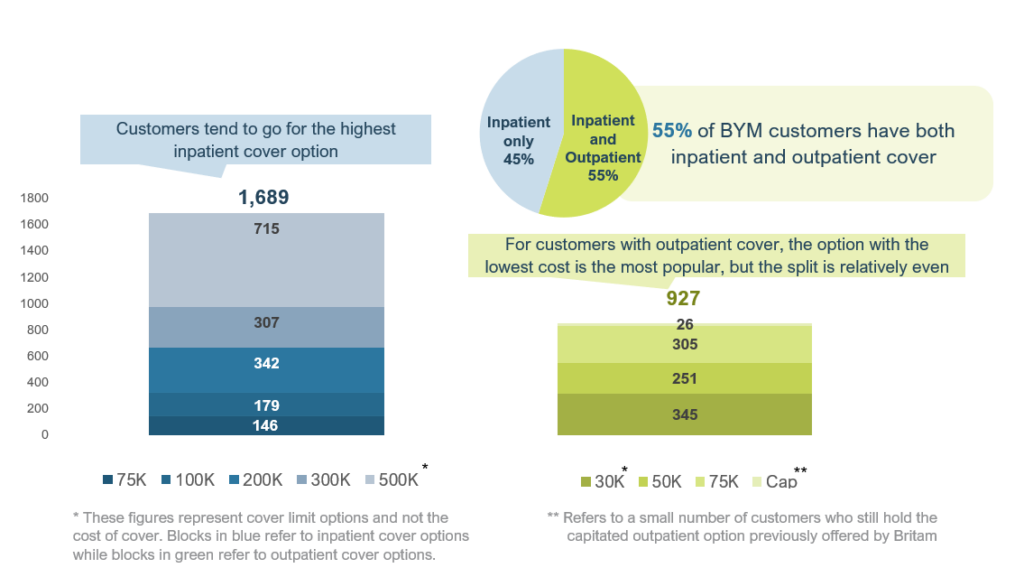

Qualitative interviews conducted with Britam’s BYM clients in mid-2022 revealed a high demand for outpatient cover option. In response, Britam introduced an outpatient product as an add-on to inpatient cover. Figure 1 below shows the uptake of inpatient and outpatient health microinsurance among Britam’s BYM customer base. The blue bar graph shows the total number of BYM clients, with each segment of this bar representing the uptake of different levels of annual inpatient cover, ranging from KES 300,000 to KES 500,000 (approximately USD 2,300 – 3,800). The green bar graph shows the number of BYM clients that also chose to sign up for additional outpatient cover, with cover options ranging from KES 30,000 – KES 75,000 (approximately USD 230 – 580).

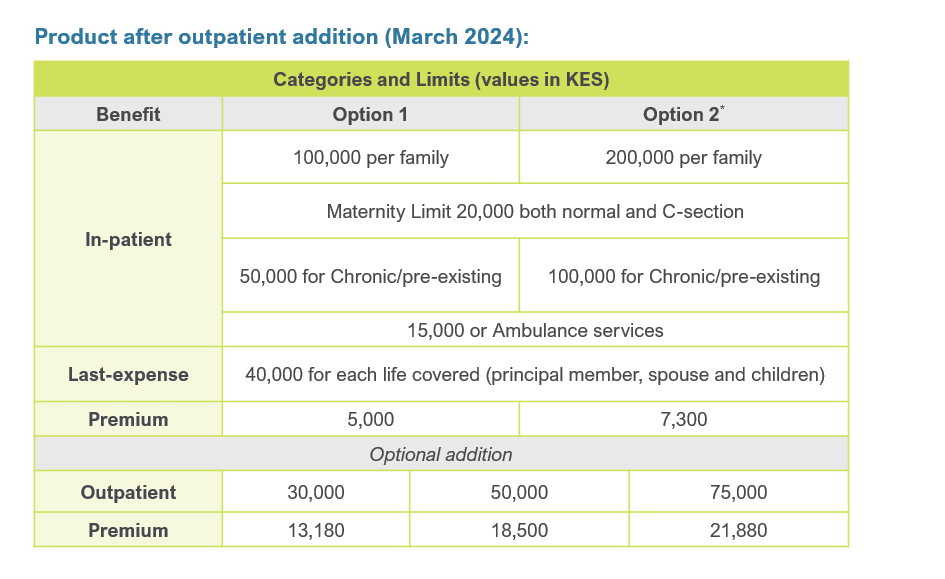

Figure 2 below shows BYM cost comparison of in- vs out-patient cover between two policy options. Depending on the policy option, the addition of out-patient cover can more than double or triple the cost of the premium.

Together Figure 1 and Figure 2 are very clear illustrations of how BYM customers prioritise value over cost. Firstly, 55% of BYM clients choose to add outpatient cover, which is an optional rider, to their BYM policy. Secondly, for both inpatient and outpatient policies, the majority of BYM clients are not choosing the cheapest cover – in fact, 60% choose the two highest cover options for both the inpatient and outpatient policy options. In other words, BYM customers are willing to pay more to make sure that they have access to more the comprehensive coverage, better network of easy-to-access to health facilities, and higher-quality healthcare providers that these more expensive policy options provide.

Retail health microinsurance is viewed as a complement to the NHIF, rather than a substitute

Qualitative interviews also investigated how mandatory National Health Insurance Fund (NHIF), and soon the Social Health Insurance Fund (SHIF), contributions might impact demand for retail health microinsurance. It was hypothesizing that “price-sensitive” lower-income consumers would not pay for both NHIF and BYM, therefore NHIF would be a competitor to retail micro health insurance. However, interviews with a purposive sample of 60 BYM customers showed that over half of respondents held both NHIF and BYM covers. Reasons for dual cover included: mandatory NHIF contributions for salaried employees; additional BYM coverage through work; and using NHIF for children and BYM for themselves.

In addition to this, BYM customers were making a value trade-off between BYM and NHIF. They were choosing to pay for BYM inpatient cover to get access to better quality hospitals but were choosing NHIF for outpatient services because it was more affordable than BYM outpatient cover. So, we see consumers are not necessarily treating NHIF and BYM as substitutes – rather, they are optimising the value propositions of both products by treating them as complementary and paying for both. This further drives home the point that micro health insurance customers are making trade-offs that maximise their value rather than minimising their costs. Therefore, health insurers in Kenya should consider positioning their products as complementary to NHIF, emphasizing the superior benefits and quality of private insurance.

BYM clients generally perceived private insurance to offer access to better healthcare facilities, and they viewed private insurance as offering them peace of mind. The assurance that health insurance coverage will allow access to reputable private facilities is seen as a major value proposition and indicative of how much these customers value quality.

Know your customer!

Financial service providers are relatively familiar with KYC for compliance, but when it comes to understanding the needs of their customers, they tend to fall short. None of the insights described above would have been possible without deliberately speaking to BYM clients. So, for insurers to design better products and more effective target marketing, they must understand what consumers value which requires upfront investment, ongoing consumer research and data analytics. In addition to this, partnerships with aggregators should not just be about the number of clients insurers have access to, but also about accessing data on these clients for better market segmentation analysis and more effective targeted marketing strategies (see the other blog in this series, “The new currency in microinsurance: does data access trump client volume?” for more detail)

However, knowing your customer does not end once a policy is purchased and the client is onboarded. The insurance sector has the most expensive acquisition costs of any industry, therefore retaining clients is essential to making the business model work. Retention rates for health insurance in Kenya are generally low. The NHIF has an overall retention rate of only 41%. Britam’s BYM product, however, performs better with an estimated retention rate of 60-70%. Nevertheless, there is room for improvement. By upgrading data management processes to automate key metrics like renewal and retention rates, insurers can gain timely insights into customer behaviour, identify trends, manage product performance proactively, and even upsell value-added services.

Value is the key to unlocking uptake in the Kenyan insurance market

One of the key lessons from Britam’s journey to scaling retail health microinsurance in Kenya is that consumers prioritise value over price. The health microinsurance market, currently estimated to be valued at USD 19 billion, has massive potential if insurers can adequately address low-income consumers’ specific needs[iii]. Just like other consumers, or perhaps even more so, low-income consumers demand value from their products, and offering a cheap, poorly designed and targeted substitute will simply not work.

By understanding and responding to the specific needs of low-income consumers, insurers can drive uptake and improve retention rates, even for higher-priced products. Strategic use of consumer data and research enables insurers to create compelling value propositions that resonate with their customers. Britam and CarePay’s partnership demonstrates that by leveraging digital platforms and providing value-added services that respond to consumer needs, insurers can effectively reach and serve underserved populations, and ultimately transform the healthcare landscape in Kenya.

This blog forms part of a two-part series on lessons from scaling retail health microinsurance in Kenya. Read the other blog here.

[i] Fictional identity created for illustrative purposes

[ii] Britam and CarePay partnered in 2021 to co-develop a health microinsurance product and distribute it through CarePay’s mobile savings wallet, My Health Funds (MHF) on their M-TIBA mobile savings wallet platform[ii]. The partnership aimed to solve one of the key issues facing micro insurers – reaching enough clients to achieve scale. M-TIBA facilitates healthcare financing via mobile wallets, linking patients, providers, and payers. The wallet already had roughly 4 million customers onboarded who could be targeted with microinsurance at the start of the partnership. This collaboration enabled Britam to scale its Bima ya Mwananchi (BYM)[ii] product using CarePay’s customer insights and distribution network, highlighting the importance of strategic partnerships in reaching underserved populations. Funding provided by the Swiss Capacity Building Facility (SCBF) enabled a study on the effectiveness of this distribution model, which this blog draws from.

[iii] According to the Microinsurance Network, this is calculated as the median premium for health microinsurance products in each region multiplied by the target population for each focus country. The total value is comprised of USD 3.35 billion in Africa, USD 8.25 billion in Asia and the Pacific, and USD 7.41 billion in Latin America and the Caribbean.