Proof of Address must fall

Proof of Address must fall

4 December, 2018 •We all know that sinking feeling when the bank tells you that the proof of address you brought does not meet the required standard. You then have to go back home and search for an original official document sent to your address in the last month or so that is not an electronic statement but rather a hard copy. Considering that you don’t even check your snail mail anymore, you’re not sure if you’ll be able to find the right documents. Be it a hand-written lease, utility bill or the like, the need for proof of address to assert an identity is pervasive across the telco and the financial services industries. But where did this need to prove where you live come from?

In response to the issue of money laundering, The US Banking Secrecy Act of 1970 introduced the Customer Identification Programme, which required financial institutions to ascertain the identity of customers by obtaining the name, date of birth and physical address of the prospective client. At the time, proof of address was a useful way to prove identity, because in the absence of electronic databases, customer profiles were stored via tin-stamp address-o-graph systems. As such, it was a relatively robust, unique identifier because your address was literally cast in metal. Also, in absence of interoperable databases, it was the only way of cross-verifying an identity because people’s addresses were kept across multiple, independent institutions. People without multiple independent relationships were not considered valuable enough to have a bank account.

However, with the advent of technology (especially the personal printer) and the expansion of formal financial services into new frontiers, the value of proof of address as a unique identifier has decreased significantly. Indeed, a piece of paper is no surety that a person is who they say they are. It is possible to edit or change documents, create fake documents or use the valid documents of another person and assume their identity. Moreover, in an age of labour mobility, people do not necessarily stay in the same place for extended periods and move around frequently. Thus, a document that supposedly proves where someone lives is merely one of a myriad of identifiers (and a relatively weak one). Apart from habit and false perception of its robustness, there is no clear reason why proof of address is being relied on as an identifier.

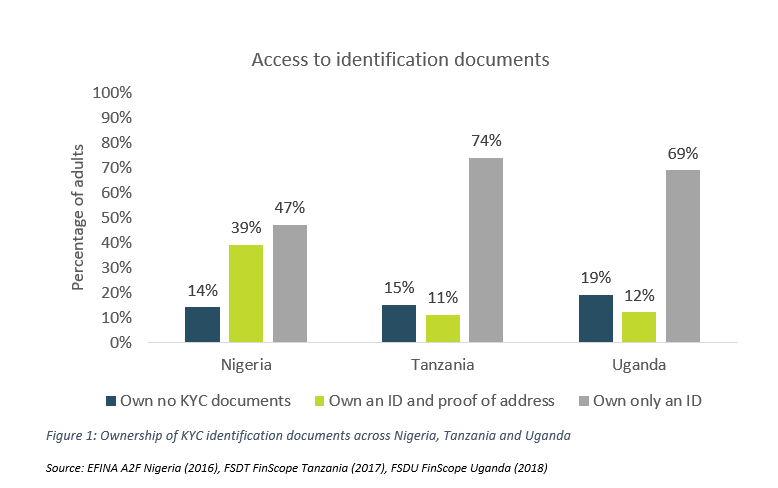

In the developing-country context, proof of address is a much more significant problem. This is because many individuals in these countries do not actually possess proof of address or even have a formally surveyed address. This results in a large number of people being excluded from formal financial services. Figure 1 shows the percentage of the adult population that have different levels of identity for the KYC process in three countries (Nigeria, Uganda and Tanzania).

As shown above, across the three countries, relatively small portions of the population actually have both an ID and proof of address. In most cases, individuals have at least an ID but do not have proof of address. It is particularly stark in Uganda and Tanzania, where a little more than 10% of the population have an ID and proof of address, which means that almost 90% of the population does not have the ability to prove where they live. Consequently, they cannot access a range of necessary formal financial services even if they wanted to. Although many developing countries have tiered KYC regulation – which allows citizens to access restricted formal financial services – proof of address is almost always a requirement for conventional bank accounts without transaction limits.

Considering how unlikely lower-income people are to possess proof of address, it is problematic that this relatively poor identifier is paramount to the KYC process. What is worse is that financial exclusion ultimately leads to the development of informal financial services, which facilitate money laundering and illicit financial flows. When consumers are unable to access formal financial services, the need for financial services does not disappear; therefore they choose to make use of informal options instead. Cenfri has found a stark example of this in Making Access Possible DRC: Formal remittances decreased from USD100 million to USD5 million as a result of stringent KYC regulation, with the estimated informal remittance flows growing significantly over the same period. The irony is that, by spending inordinate amounts of money on inappropriate compliance with AML regulation, we’re not actually stemming money laundering but rather advancing it. As such, relying on proof of address as a key identifier is a risk to financial integrity.

#Proofofaddressmustfall

In a forthcoming study that Cenfri conducted for the Alliance for Financial Inclusion, we argue for the removal of proof of address as a key requirement for more effective consumer due diligence. Under the risk-based approach and with the advent of new technology, there are a multitude of innovative and robust ways to identify customers on a risk-sensitive basis. Ultimately, this will reduce one of the barriers to formal financial services for consumers and reduce money laundering.

This work forms part of the Risk, Remittances and Integrity programme, a partnership between FSD Africa and Cenfri.