Sink or swim: Who is recovering as South Africa eases its lockdown restrictions?

Sink or swim: Who is recovering as South Africa eases its lockdown restrictions?

6 June, 2020 •On 1 May 2020, South Africa lowered its lockdown restrictions to Level 4 – a level at which the economy began reopening and several significant restrictions for South African citizens were eased.

With some businesses reopening and reduced restrictions on movement, the difficult trade-offs between public health and economic recovery are top of mind for both the government and the people of the country.

The easing of lockdown saw an increase in the spread of the virus, with infection rates doubling every 12 days under Level 4 lockdown, compared to 15 days under the stricter Level 5. A look at the COVID-19 Tracker sheds some light as to why this might have been the case: travelling more and reducing their efforts to limit contact with others.

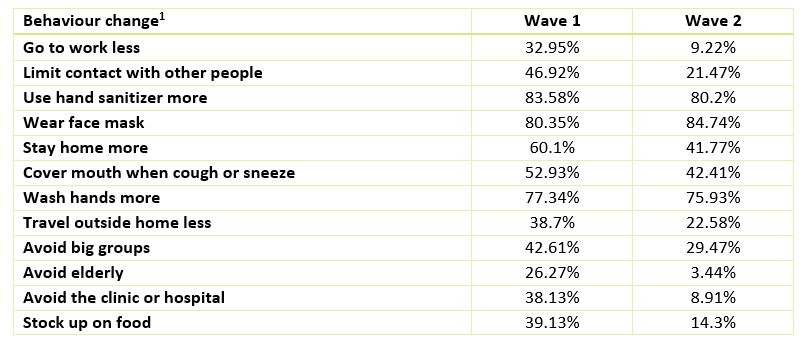

During the week of 21 to 28 May, reported adherence to individual-level behaviour changes – such as wearing masks and washing hands more regularly – remained high (84.74% and 75.93% respectively); but with the economy that had opened up again, people were going to work more and seeing more of other people.

The reduced lockdown level (first to Level 4 in May and to Level 3 at the beginning of June) is in response to government pressures to balance the impact and spread of the virus with social and economic effects. With COVID-19 cases escalating in the country, we’re left asking who has been returning to work, and is this return resulting in better health and financial outcomes for the most at-risk portions of the populations?

As we noted before, the effects of the lockdown are not equal, and this inequality persists with the decreased restrictions. More women (11.1%) report “going to work less” than men (7%) do, and 10.26% of black Africans report “going to work less” more than any other racial group in the survey.

Still, people reported that they’re out again and, with the return to work, we would expect to see increases in income and improved financial resilience. However, despite going back to work, 27.7% of respondents reported a lower income – up from 18% in the previous wave at the end of April, increasing to 32% for black Africans, compared to 18% of white South Africans. In addition, 7% of the interviewed admitted to having had to change jobs since the beginning of the pandemic.

While South Africans’ financial resilience seems to be improving (73% of respondents reported that they would not be able to gather together R5,000, down from 82% in April) a stark picture emerges when looking at their main source of income: Only 44.5% receive regular earnings, while 24.7% admit not being able to cover their living expenses and a further 13.7% are able to scrape by thanks to the help of friends and family. Unsurprisingly, default is on the rise: 6.26% of respondents now reported having missed a payment on their loan (up from 2.1% in April), with 33% of them saying that they needed money for essentials, and a further 14% have lost their source of income.

With unemployment rates increasing in the country, the need to borrow, sell and access government support is only likely to increase. The data suggests that those who are struggling financially are having to resort to multiple sources of financial health.

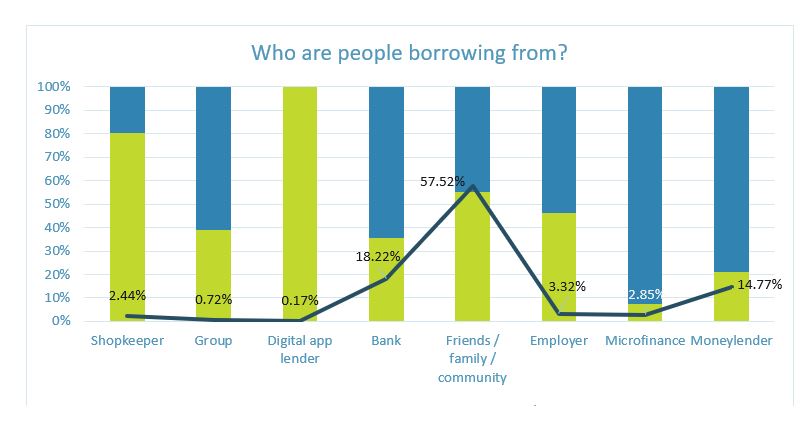

Most individuals are borrowing from friends and family, with a small percentage borrowing from formal financial institutions – only 18.22% of individuals who borrowed money in the past 14 days sourced their loans from a bank, and even fewer (2.85%) did so from a microfinance institution – raising questions on the role of traditional financial services in helping the recovery. In contrast, 14.77% borrowed from a moneylender, where the interest rates are higher and the terms less favourable for those who need to take out the loans, raising potential consumer protection issues. In general, women are borrowing far more than men are, and nearly 80% of those who took a loan from a moneylender are women.

Twenty-two percent (22%) of those who borrowed money in the past 14 days have also had to sell assets, and the need to access government support has increased dramatically over the two waves of the survey (from 6% to 23%).

Finances are not the only source of strain for South Africans. Fifteen percent (15%) of respondents reported not being able to access medication when they needed it in the past seven days, up from 7.9% in the previous wave. The rising infection rate and onset of winter – which brings with it a host of additional health concerns – may be putting further strain on the healthcare system, with the most common reasons cited for not accessing medication when needed being overcrowded healthcare providers or the medication being unavailable.

With ongoing and, in many ways, worsening financial constraints and an increase in health concerns, it is unsurprising that South Africans are more worried than ever before. Sixty-two percent (62%) of respondents report being very likely to seek medical attention for mild COVID-19 symptoms, which is an increase from 43% in the previous wave, and over half of the country’s population reports being “extremely worried” for their personal safety and the safety of their families.

This difficult picture highlights the tough choices the Government is forced to make: It is these increasing pressures to rescue the economy and save jobs that have pushed them to further reduce restrictions from Level 4 to Level 3. But, as the President said, “the easing of some restrictions does not mean that the threat posed by the coronavirus has passed or that our fight against the disease is over”. Our next blog will look at the effects of further opening the economy, and whether the hopes of the Government have been met.

[1] Although the survey is nationally representative, the samples across the two waves are not directly comparable, with some demographic measures being dissimilar across the two waves.