The curious case of migration and remittances in SSA

The curious case of migration and remittances in SSA

24 April, 2018 •Migration is on the rise in sub-Saharan Africa (SSA), both in terms of migrants going to live abroad as well as within the region. With an ever-increasing need among these migrants to frequently and securely send money back home to support their networks of dependants, one would expect formal remittance flows in the region to rise proportionally with migrant flows. Yet this is not the case. A Cenfri report series looks at some of the reasons behind the mismatch between migrant flows and remittance flows as part of a broader approach towards understanding the barriers to formal remittances in SSA.

Remittances are one of the most important and tangible links between migration and positive development outcomes. According to a well-established body of literature, remittance-receiving households are often less likely to live in poverty, more likely to have improved educational and health outcomes, and are often more resilient to financial shocks. Formal remittances, in particular, have the added benefit of promoting access to financial services given the need to engage with some form of financial institution or transfer company, a bank or mobile money operator for example, to send or receive payments. This, in turn, creates opportunities to increase foreign exchange flows into the formal financial sector, enhance the depth and breadth of banking penetration, and grow the level of deposits and availability of credit intermediated through local banks. This implies that when formal remittance markets grow, they may not only contribute towards financial-sector development, but also the economic growth of SSA. It is for this reason that global development bodies such as the G20 and United Nations Sustainable Development Goals have prioritised inclusive and affordable remittances as a vital component of the international development agenda.

To assess the current effectiveness of formal remittance corridors within SSA to facilitate these development gains, we overlay intra-regional migration patterns with formal remittance flows to understand how well a specific corridor is functioning.

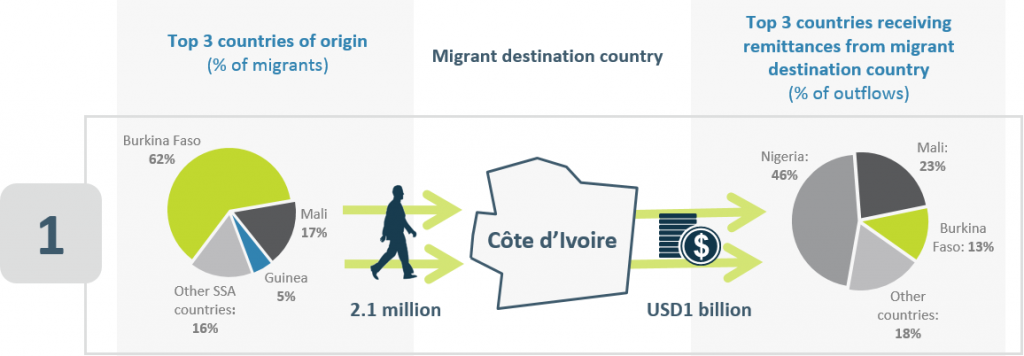

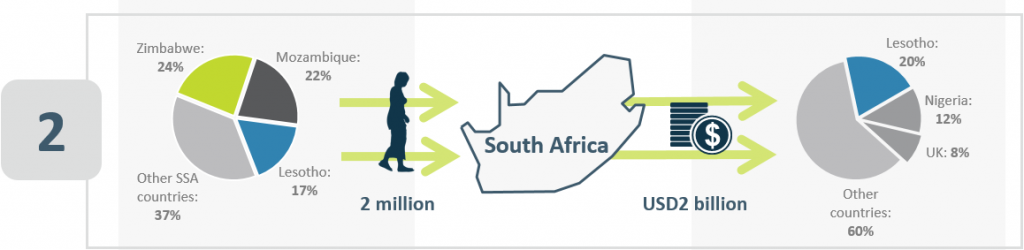

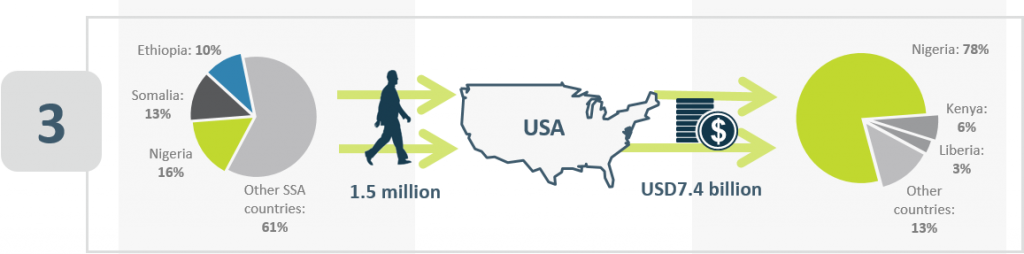

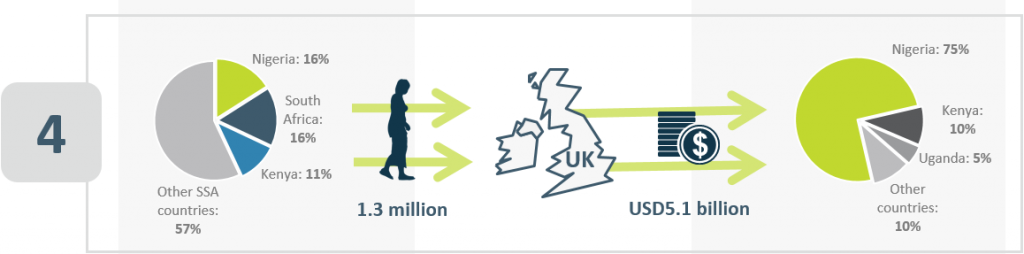

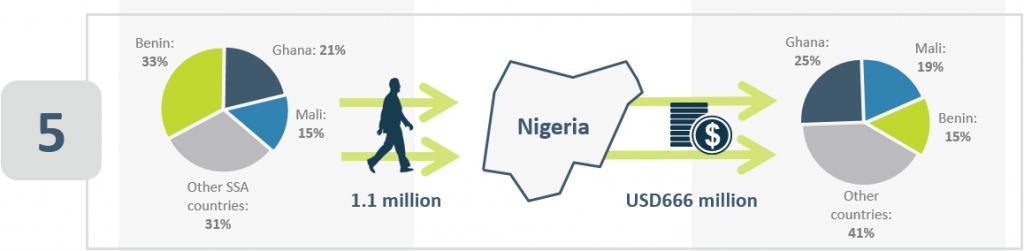

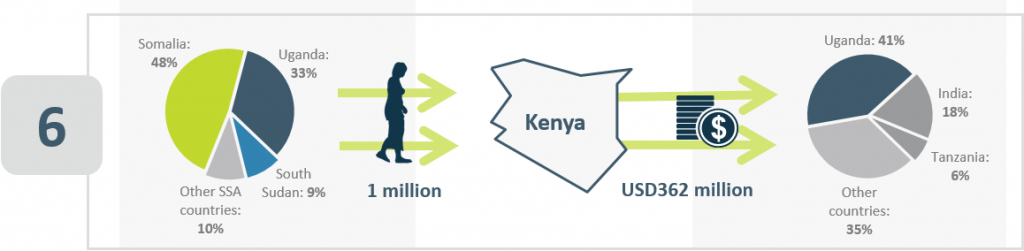

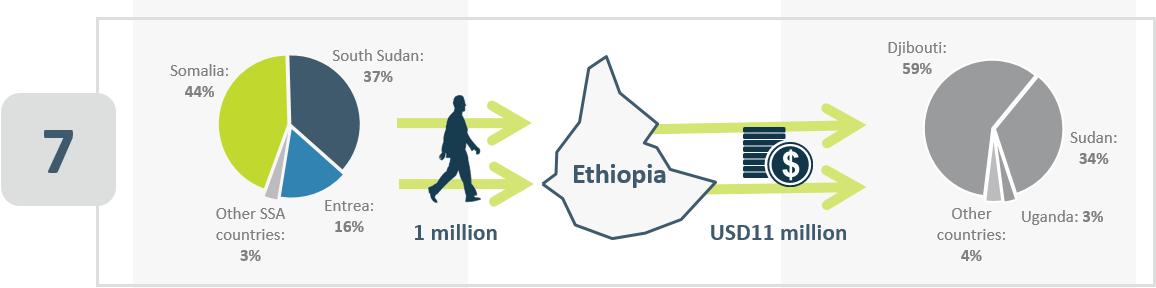

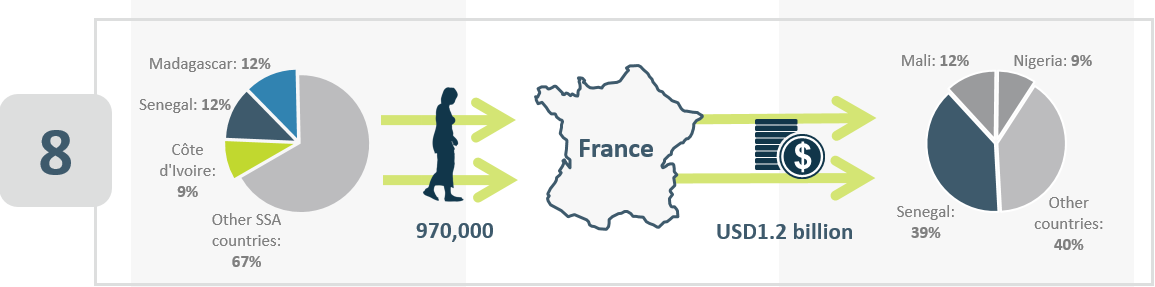

The figure below shows data for formal remittance flows and migration patterns among the top destination countries, both within and outside of Africa, for the SSA diaspora. Looking at regional migrants in particular, it appears that while intra-regional remittances increased from USD11 billion in 2012 to USD15 billion in 2016, the alignment of these flows with migration patterns In other words, for many SSA countries, a mismatch exists between the proportion of migrants that reside in foreign countries and the proportion of total formal remittances sent back to migrants’ countries of origin.

Figure 1: Top destination countries for SSA migrants in 2016 | Source: World Bank remittances data, 2017; United Nations, 2015

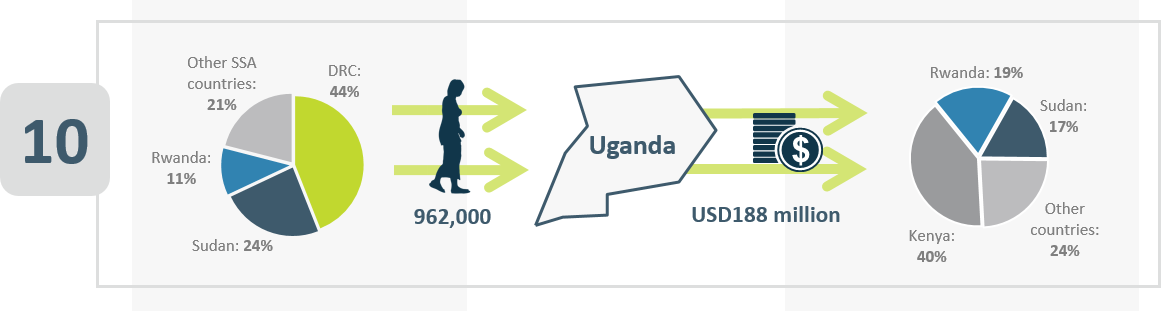

A clear example of this mismatch is Côte d’Ivoire. The figure above shows that – despite Burkinabe people constituting 62% of Côte d’Ivoire’s migrant population – only 13% of remittance payments were sent to Burkina Faso in 2016. Similarly, the Democratic Republic of the Congo fails to even feature as a top receiver of formal remittance payments from Uganda, despite it representing the largest part of the migrant population in Uganda.

Because of these disconnections in flow patterns, formal remittance channels appear unlikely to tell the entire story of how migrants remit within SSA. Given the lack of complete data on remittance flows and migration for some SSA countries, these flows are more likely to significantly underestimate the true extent of both intra-regional remittances and migration in SSA. This seems to be a strong indication of significant values of flows that may be going unseen through informal channels rather than those that are formal.

The use of informal mechanisms suggests the existence of prominent barriers to both access and usage in the formal SSA remittance market. These barriers appear to deter the use of formal remittances for a substantial proportion of SSA migrants. This reinforces findings from a 2016 FinMark Trust report on cross-border remittances in SADC, in which formal corridors were often found to be less trusted and convenient compared to informal channels, as well as relatively unaffordable for migrants who tend to remit small values at high frequencies. This is in addition to onerous Know-Your-Customer regulations that prohibit individuals who do not have proof of identity from accessing formal remittance services.

To ensure that formal remittance corridors meet the growing needs of intra-SSA migrants, these barriers to accessing formal remittance services need to be better understood, so that they can be overcome. Until this happens, formal remittance channels are likely to remain inaccessible and mismatched with migration trends prevailing in SSA. This may, as a result, undermine the potential of formal remittance corridors to act as a lever and lifeline for the financial inclusion and wellbeing of both migrants and their dependants back home. Furthermore, these barriers may inhibit the financial support offered by families to migrants working abroad, such as in Uganda where substantial remittances flow to Kenya despite its low occupancy of Kenyan migrants.

The unpacking of these barriers for further insights into formal remittance corridors (both within and into SSA), and how they relate to migration flows, is available in the seven-part series that explores remittances and the barriers to the development of the formal remittance market in SSA.

This work forms part of the Risk, Remittances and Integrity programme, a partnership between FSD Africa and Cenfri.