The role of insurance for growth in Africa

The role of insurance for growth in Africa

11 September, 2017 •Does insurance matter for welfare and growth? Within the microinsurance discourse, the answer to this question is usually considered from the risk mitigation point of view: By helping people to mitigate risk, it makes them more resilient, thereby impacting on household welfare. Then there’s also an intermediation role. By acting as institutional investors, insurers aggregate domestic capital and mobilise it into long-term investments. Thus, it is commonly assumed that insurance strengthens capital market development for growth.

But what if it is not so straightforward? Recent research conducted on the link between insurance and capital market development across fifteen Sub-Saharan African countries highlights that this link should not be assumed. Insurance and capital markets alike are underdeveloped. The region includes countries with among the lowest insurance penetrations in the world (for example Nigeria at 0.3% premium to GDP and Ethiopia at 0.5%), as well countries that compare well with even developed markets, such as South Africa. When disregarding South Africa, overall insurance penetration is only 0.9% of GDP – the lowest of all regions in the world.

Debt markets are by and large dominated by short duration government securities. Corporate debt markets are mostly non-existent, and when they do exist they are generally small, illiquid and built around a few issuers. Equity markets are concentrated in South Africa, Nigeria, Kenya, Mauritius and Zimbabwe. Overall, insurance markets in sub-Saharan Africa are not naturally evolving to serve what seem to be clear and significant capital needs. Why is that? And what can donors and governments do to strengthen the link? This question cannot be answered by considering the region as one homogenous market. It requires a step back to consider the stages of market development that countries are at.

Four stages of insurance market development

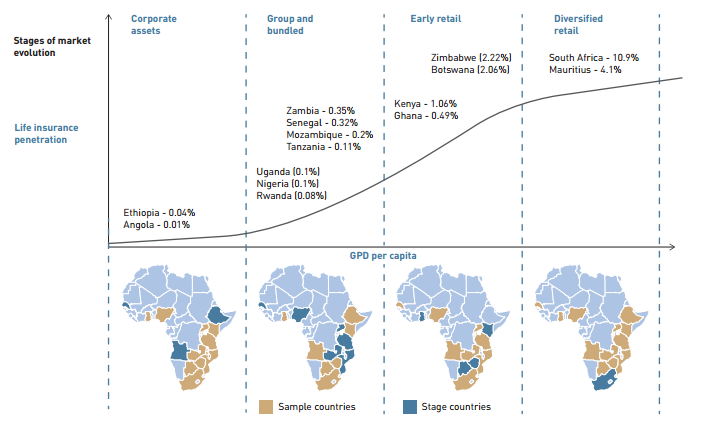

The fifteen countries analysed are classified into four stages of insurance market development, with a corresponding progression in the investment strategy followed. The stages are strongly correlated with the level of income in the country as well as the level of development in the retail life insurance market.

The stylised progression presented in Figure 1 above is as follows:

- Stage 1: Corporate assets. In this first stage, corporate asset insurance dominates the market and distribution is broker-driven. Retail insurance is limited and life insurance has a small share in total premiums. Total insurance penetration is below 1% of GDP. Insurers typically invest in real estate and bank deposits and, subject to local investment requirements, place much of their investments offshore. They have limited balance sheets and reinsure most of their business abroad.

- Stage 2: Group and bundled. In stage two group-based, compulsory and bundled retail insurance emerges alongside corporate asset insurance. Thus there is rapid growth in the number of individuals covered, but with limited types of insurance cover offered on a compulsory or embedded basis and driven by the needs of aggregators used for distribution purposes. Typical examples are compulsory credit life or third party liability vehicle insurance. Furthermore, recent innovation has seen mobile insurance dramatically extending the reach of insurance through embedded and “freemium” products aimed at securing client loyalty for mobile networks and incentivising airtime purchases. Retail distribution infrastructure remains limited, as distribution is achieved through negotiations with large aggregators rather than individual sales transactions. Due to the compulsory or embedded nature, consumers are often unaware of their cover. As in stage one, insurance provides mostly risk cover, with very little contractual savings. Brokers still play a prominent role, now also signing up group-based retail insurance. The share of life insurance in total premiums grows, but remains below 30% in the sample countries. Overall insurance penetration is still below 3%. Where the typical investment portfolio is concerned, insurers begin to also invest in government securities, although this is marginal. Bank deposits and real estate remain the main investments.

- Stage 3: Early retail. At this stage, limited individual retail insurance – mostly funeral insurance – begins to grow, and along with it agent-based sales. In the sample countries, insurance market penetration tends to break through the 3% barrier, but remains below 5%. Contractual savings are starting to emerge alongside risk cover, meaning that the industry’s liabilities are becoming more long-term. Life’s share in total premiums now typically ranges between 30% and 75%. Insurers invest more heavily in government securities, but bank deposits and real estate remain prominent investments.

- Stage 4: Diversified retail. In the final stage, there is a diversified individual retail market and a developed contractual savings market, with agent-based, direct and alternative distribution sales alongside broker sales. In the sample countries, life insurance now represents 75% and upwards of total premiums and penetration is 5% of GDP and beyond. Insurers have longer-term liabilities and invest in a full range of assets, including collective investment schemes, equity, corporate bonds and other sophisticated investment tools. Government securities now play a more limited role.

Government and banks pull the strings initially. It is clear from the stages overview that insurance market development does correlate with capital market development: In the early stages, insurance and capital markets alike are underdeveloped and by stage four both markets are more developed. However, insurance markets do not automatically contribute to capital market development. A key finding of the research is that in stages 1-2 and to some extent stage 3, in which most countries in Sub-Saharan Africa are located, insurers have a limited role as institutional investors in developing capital markets. Rather, government itself, via its role in determining investment requirements and as issuer of government bonds, has the strongest role in investment allocation. Furthermore, much of insurers’ investments are channelled via banks. Thus governments and banks initially hold the strongest levers in driving asset allocation.

Insurance becomes a driving force only once the retail life market is developed. It is not until the retail life insurance market develops that the link to capital market development really becomes significant. Once there is a strong retail life presence and the long-term contractual savings market is established, it results in asset portfolios and liabilities of increasing size and maturity. These asset portfolios then require more advanced investment instruments. This, in turn, puts increasing pressure on domestic capital market development. It is thus only once the market progresses to the latter stages (late stage 3 to stage 4) that insurers come to their own as institutional investors and drivers of capital market development. This illustrates the importance of developing the retail life insurance market in unlocking the potential of insurance as a driver of capital market development.

What stands in the way?

There are a number of factors that prevent insurance markets from progressing from one to the other and hence from fulfilling their full intermediation role. Unlocking the role of insurance in capital market development thus requires an understanding of the various barriers to insurance market development. The key factors identified for Sub-Saharan Africa (SSA) are:

- Low incomes. Income levels in SSA are severely constrained: When taking USD 5 a day as rule of thumb for when a person becomes insurable through traditional models, more than 80% of the market would not be viable to insure.

- Awareness and trust. Informal risk-coping mechanisms are preferred to formal insurance and there remains a widespread lack of awareness of insurance.

- High levels of financial exclusion. Insurance penetration does not leapfrog general financial inclusion. SSA has the lowest bank account take-up in the world, at 30% on average, although it

varies significantly in the region. - Lack of infrastructure and distribution channels. Poor infrastructure limits the number of touch points that insurers have with consumers, as well as insurers’ ability to communicate with clients and receive payments. A shortage of agent networks and a skills deficit further challenge distribution.

- Lack of domestic skills and a shortage of data. There is insufficient data to design products and effectively regulate industry. A shortage of skills and experience also limits the industry’s

ability to design and roll out products. - Limited incentive to expand coverage. Insurers are often profitable in the early stages of market development, with limited incentives to push development to the next stage. They serve large corporates and group schemes and a small segment of wealthy individuals. Moving to the next level requires overcoming major infrastructure and business model challenges to develop innovative distribution channels that can reach a broader and geographically dispersed population on an individual or small-group basis with lower-premium products.

- Substantial barriers to move into individualised retail. A particularly difficult transition point is moving from head-office-based business to a more widely distributed and diverse retail offering. At this stage, the business model and environmental impediments become particularly pronounced. The research found very little business incentive to pursue this transition, a situation that is exacerbated by uncertainties in the economic environment.

- Reforms increase regulatory burden. Wide-scale regulatory reforms across the region have resulted in higher entry barriers that are not well calibrated to the domestic market realities and stage of development. Many regulators are in the process of creating exempted spaces for microinsurance, but this process is not integrated with overall regulatory changes.

- Regulators are not keeping pace with innovation. Where this is the case, they risk excluding or constraining innovative models that are essential for market development. Mobile insurance, for example, has spawned many innovative models that regulators need to respond to.

- Poor industry coordination. There is generally insufficient coordination both within industry and between industry and government. Where platforms for coordination across industry and government exist, this has supported market development.

What can be done?

Insurance does still matter. Not all is doom and gloom. Once insurance “breaks free” beyond the initial stages, it can lead to capital market development. But unlocking that role requires a deliberate effort by governments and market players to overcome these barriers.

Not just business as usual. The low-income realities, lack of infrastructure, distribution challenges and limited skills in sub-Saharan Africa mean that developing the retail life market will not be possible merely through “business as usual”. Disruptive innovation as witnessed in the bundled and early retail market stages is required to grow the retail presence of life insurance beyond the top-end formally employed market. This includes leveraging mobile networks to offer insurance cover to large groups of people. Utilising the scale of outreach to build awareness, trust and appreciation for the value offered by insurance is critical to build a basis for the next stages of development.

Calibrate strategies through a concerted effort. It is important to calibrate the expectations of what can be achieved in building the link between insurance and capital markets to the stage of development and the structural barriers to progression in a particular country. In the early stages of development, the starting point is leveraging government as key determinant of capital allocation. In parallel, active and deliberate coordination is needed to progress insurance markets through the development stages, with policy and market interventions at each stage calibrated to the realities of that particular stage.

Development partners have a strong role as catalysts of change: by enhancing coordination and exchange between parties, by building an evidence base of rigorous market information to inform strategies and regulation, by supporting experimentation by governments and market players, and in building capacity and skills.

Conclusion

Insurance still matters – it can and does contribute to capital market development. However, the sub-Sarahan experience shows that the link is not automatic. Insurance only really contributes to capital markets once longterm insurance markets such as life insurance and contractual savings take off. In sub-Saharan Africa, building these markets requires deliberate policies to overcome structural barriers to insurance market development. Not all markets will require the same approach: Policies need to be calibrated to the different stages of market development. The reward? An injection of capital that can contribute to a range of broader policy objectives beyond insurance market development.

This article was first published in the Microinsurance Network State of Microinsurance 2016 magazine.