Tipping the scale in favour of payment systems in sub-Saharan Africa (SSA)

Tipping the scale in favour of payment systems in sub-Saharan Africa (SSA)

28 November, 2018 •For a moment, cast your mind back over the last week. How many payments did you make with your credit card during the week? The answer is most likely quite a few. This will have much to do with you having access to a bank account, fees being affordable and most merchants accepting credit cards. It’s cheap and it’s easy. Unfortunately, this is not the case in most African countries. Most people do not have access to formal financial institutions and do not make use of formal payment channels. Those that do, pay much higher fees to do so. The outcome? A high level of financial exclusion and low activity in the formal financial sector. Welcome to the world of payments and remittances in SSA.

Cenfri’s latest payment ecosystem research explores the state of national and regional payment systems in SSA, with a view to ultimately support remittances, and it takes a closer look at the key insights from the region’s payments landscape.

The study has identified three cross-cutting themes that are crucial to the development of payment systems at a national and regional level:

- Scale

- Fit-for-purpose payment system infrastructure

- The need for regulation that mitigates risk while it promotes innovation

Of these three themes, our research has revealed that achieving scale is arguably the main goal that decision-makers should pursue for achieving an efficient, sustainable payment system that ultimately supports consumer welfare.

Scale in this context refers to the number of transactions processed over a payment system or through a given channel. As the volume of transactions in a system increases, the average cost of the payment service is likely to decrease for consumers and operators. Logically then, a lack of scale can often act to undermine the business case for payment ecosystem development, be that at a national or regional level, and can therefore compromise dependent use cases such as remittances.

In the SSA context, interoperability is a key consideration in achieving scale. Interoperability of payment systems enables the seamless participation of multiple proprietary payment platforms, products and providers. This promotes competition and ultimately leads to efficiency gains by facilitating more affordable and accessible payment channels for a wider consumer base. Whether through regulation or buy-in from payment service providers (PSPs), achieving interoperability is a crucial aspect for creating a critical mass that can fully unlock the benefits of scale. In Nigeria, for instance, interoperability is mandated through regulation. As a result, all authorised PSPs are required to connect to the Nigerian Central Switch (NCS). This facilitates interoperability among the various PSPs. It enables them to leverage existing infrastructure to expand payment services to more people, through a variety of instruments and at a lower cost.

In the past, each payment channel required its own system for processing payments, multiplying the infrastructure needed and fragmenting any potential scale. However, advances in technology have opened the door to the possibility of using a single infrastructure to enable the seamless integration of these facilities. We can call it “channel ubiquity”. This creates a frictionless environment for payments as they become interchangeable within the system, as opposed to interoperable between siloed systems. Ubiquitous channels prevent the duplication of infrastructure, thereby increasing efficiency, improving control and lowering risk and cost. It facilitates scale more easily, as users from all channels converge onto the same platform layer.

In the present climate, however, effective cash reticulation networks and infrastructure remain key in supporting scalability of payment systems. Despite the ubiquity of mobile devices across SSA and the growing systemic importance of digital payments in developing economies, consumers retain an overwhelming preference for the use of cash. For example, a Cenfri study in Madagascar found that 99% of people’s expenses are still paid in cash. For many rural consumers this can be attributed to a lack of reasons for using digital payments – Why should one have mobile money when the nearest market vendor only accepts cash? This underlines the need to develop effective cash reticulation systems in the interim until retail value chain digitisation can support cashless ecosystems. In the context of achieving scale, the challenge in the short term is to ensure that adequate cash-in–cash-out infrastructure exists to facilitate the growing use of electronic and mobile payment instruments.

However, as SSA begins to integrate economically, achieving scale within the confines of fragmented national payment system frameworks is becoming increasingly redundant. Many national governments, if they have not done so already, are instead exploring how a critical level of scale can be achieved through regional payment system integration initiatives.

According to SWIFT’s latest regional payment system report, integration of SSA’s regional payment systems is playing an important role in driving national and regional economic growth. Supported by rising trade volumes, this growth is creating the demand for more efficient cross-border facilities and services such as trade and remittance transactions. In response, the establishment of modern integrated regional payment systems is widely considered an enabler of increased intra-regional trade and labour mobility that relies on remittances. The successful deployment of new systems, such as the East African Payment System that caters for members of the East African Community and the SADC Integrated Regional Settlement System (SIRESS), is a clear testimony of the benefits of regional integration of payment systems.

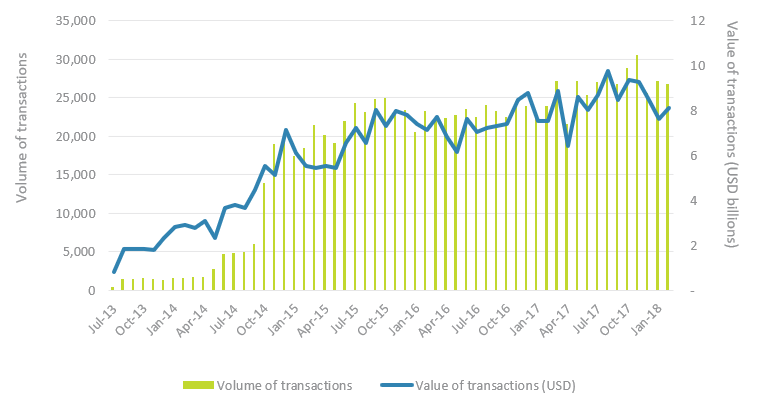

Since the launch of SIRESS in July 2013, 43% of intra-SADC cross-border payments are now executed through the system. The system (which facilitates real-time, large-value interbank settlements between SADC banks and non-banks) has directly enabled a rapid increase in the volume and value of cross-border transactions processed. By February 2018, SIRESS had reached the USD339 billion settlement mark.

The value and volume of transactions processed by SIRESS from July 2013 to January 2018

Source: SADC Payment System Oversight Committee (2017) and SADC Committee of Central Bank Governors (2018)

Cenfri’s study (a two-part note series) grapples with the quest for interoperable scale faced by national and regional payment systems in SSA, with a view to improving particular use cases such as remittances and trade. It goes on to provide details on other essential insights that are emerging from the region. The suitability of existing middle-mile payment infrastructure is placed under the microscope while the regulatory measures that frame the region’s payment ecosystems are also investigated. The study will provide useful imperatives for policymakers and donors on how to develop payment systems that are more efficient and inclusive and that contribute to greater regional payment systems integration.

This work forms part of the Risk, Remittances and Integrity programme, a partnership between FSD Africa and Cenfri.