What use is financial inclusion, when you can’t pay the bills?

What use is financial inclusion, when you can’t pay the bills?

8 December, 2016 •The 2017 budget, unveiled by the Minister of Finance Honourable Felix Mutati in Zambia earlier this month incorporates new austerity measures but has incorporated significant increases in social welfare benefits. . However, restricted liquidity conditions in the Zambian economy have significantly impacted access to capital and finance, hindering the expansion of productive enterprises and investment in assets for most households.

Financial inclusion is a powerful policy lever available to government to help deliver on the social welfare mandate, within the current Zambian context. With that in mind, the Zambian government is currently in the process of drafting a national Financial Inclusion Strategy. Ensuring that consumers are at the centre of such a strategy could also help leverage the government’s broader policy objectives, such as reducing school dropout rates and improving productivity of small, medium and micro enterprises and farmers. However, achieving good outcomes for consumers will also require the government to work with financial service providers to ensure a conducive financial sector policy and regulatory environment.

During a recent Making Access Possible (MAP) country visit, we had the opportunity to speak to government officials and regulators, financial service providers, civil society and ordinary customers. These discussions suggested a number of key areas in financial inclusion that could contribute to the government’s core policy objectives. Four of these are outlined below.

Leveraging the value provided by informal providers

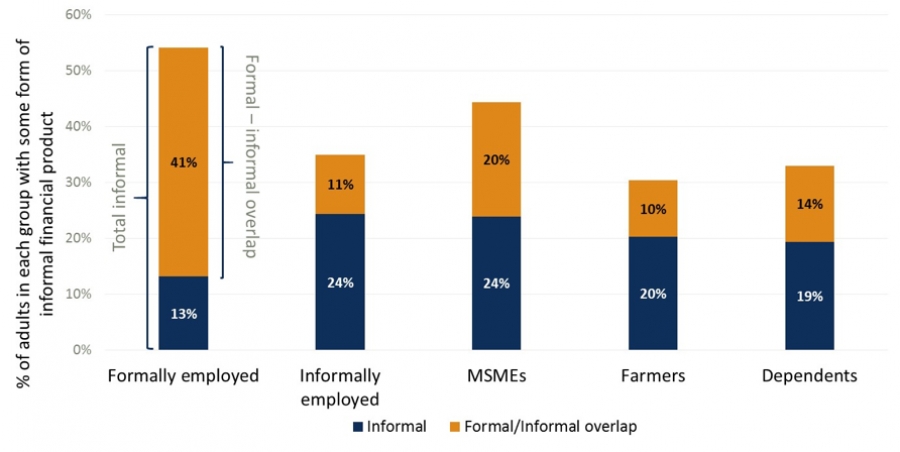

The 2015 Finscope survey found that 38% of Zambian adults currently use an informal financial service provider to either save or borrow. These providers offer a valuable service to Zambians for two main reasons. They provide a financial service to those unable to access the formal sector, particularly in the case of credit. And, more commonly, they offer users greater value than they might receive from formal products. The graph below shows that many informal users also use formal products. Informal products are critical for many Zambian adults to reduce their vulnerabilities, manage their liquidity and access lump sums to fund large, lumpy expenses like school fees and business or farming inputs. Serving the large but sparsely populated rural areas with formal financial services is very challenging. Informal provision is central to maintaining and improving livelihoods for the rural poor – a central plank of government policy.

Designing targeted savings products

One of the benefits for many users of informal savings groups is the self-discipline built into the product design. Savings groups enable users to effectively build up a large sum of capital for a specific need. From our qualitative interviews, we heard the story of a single mother saving in a bank situated two hours away (to prevent her from taking out money unless there was a significant emergency) and similarly, a childless, single man investing in a baby savings account in a bank. Savings products designed for specific long-term needs can significantly improve livelihoods. For example, a savings account only accessible in the months that school fees are due may not only attract demand from customers, but also help to ensure that fewer children drop out of secondary school – an explicit objective of the government.

Developing the insurance industry

For high cost, infrequent risk events, insurance is generally the most effective financial tool to protect individuals. This is particularly true for those living on or just above the poverty line, to avoid them falling into poverty. Insurance penetration in Zambia is very low, just 2.8% according to the 2015 FinScope Consumer Survey. Supporting the development of the insurance industry in Zambia and broadening the reach of insurance can therefore help to reduce the vulnerability of Zambian adults. As an example, Focus and Mayfair’s weather index insurance product has illustrated this dynamic by shielding a number of low-income smallholder farmers from the adverse financial effects of the droughts over the last two years. Research suggests that this type of product may even be instrumental in keeping more girls in school.

Building trust through consumer redress

Users of financial services in Zambia have no clear channels to make complaints and get help fixing problems. Complaints can be lodged with a range of different institutions, including the Bank of Zambia (BOZ), Pensions and Insurance Authority (PIA), and the CPCC (Competition and Consumer Protection Commission). However, these institutions face major challenges in effectively addressing financial services user complaints. Regulators have the power to punish providers, but generally lack capacity. Their focus is naturally on regulating the overall market and its institutions, rather than dealing with individual consumer complaints. Civil society consumer protection agencies generally lack the technical skills to deal with complaints. In addition, they lack the power to bring providers directly to account, typically being forced to work through regulators or the judicial system. The implication is that users who want to complain about financial service problems in Zambia find it confusing, time consuming and largely fruitless. This, in turn, undermines consumer trust in the providers and allows greater room for providers to exploit customers. The relatively limited use of formal financial service providers in Zambia, due to this lack of trust, means that consumers fail to benefit from financial tools to meet their needs and reduce their vulnerability.

The MAP Zambia study will explore these issues and many more through detailed research and analysis. Throughout the course of the project, we will endeavour to identify the greatest barriers and opportunities faced by financial inclusion and financial sector development in Zambia.