What we’ve learnt about the risk protection gap in sub-Saharan Africa from Finscope consumer data

What we’ve learnt about the risk protection gap in sub-Saharan Africa from Finscope consumer data

12 February, 2020 •A significant portion of the population in Africa is underinsured, leaving them exposed to risks and unable to manage and recover from them.

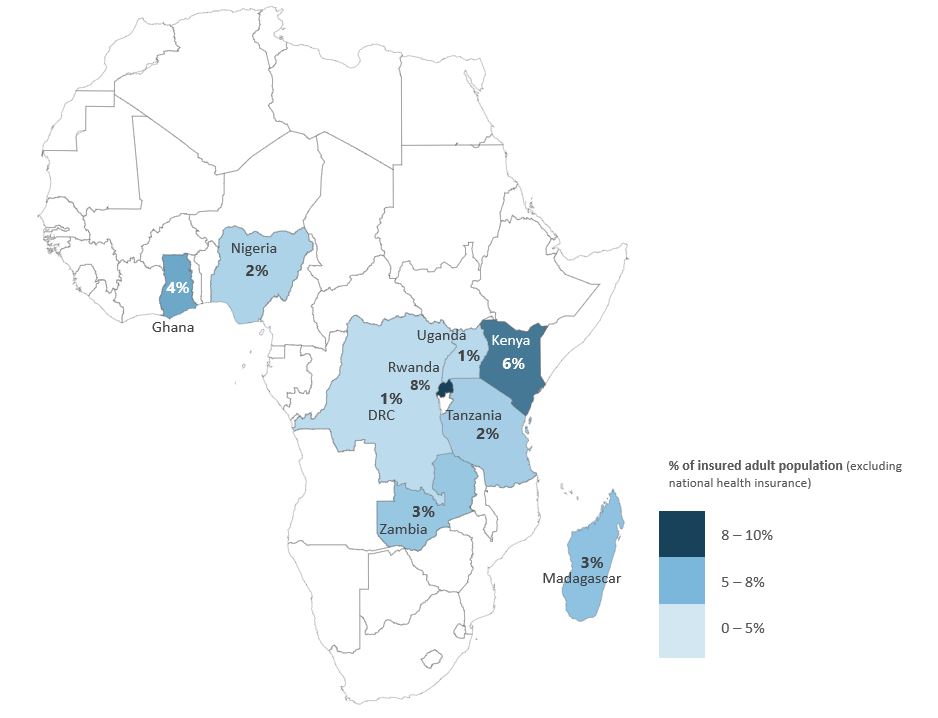

Less than 10% of the adult population in nine sub-Saharan African (SSA) countries have private insurance, as shown by Figure 1, despite 54% (122 million individuals) of the total population across these countries having experienced an insurable risk in the last year.

The disparity between the uptake and need for insurance indicates that there is a large risk protection gap in Africa. Using FinScope datasets (which are nationally representative consumer surveys implemented by local governments and stakeholders to gauge consumer realities, perceptions, needs and current usage of various types of formal and informal financial services), we were able to develop a better understanding of the risk protection gap in SSA.

Sources: FinScope DRC (2014), Ghana (2010), Kenya (2016), Madagascar (2016), Nigeria (2018), Rwanda (2016), South Africa (2016), Tanzania (2017), Uganda (2018), Zambia (2015) and Zimbabwe (2015)

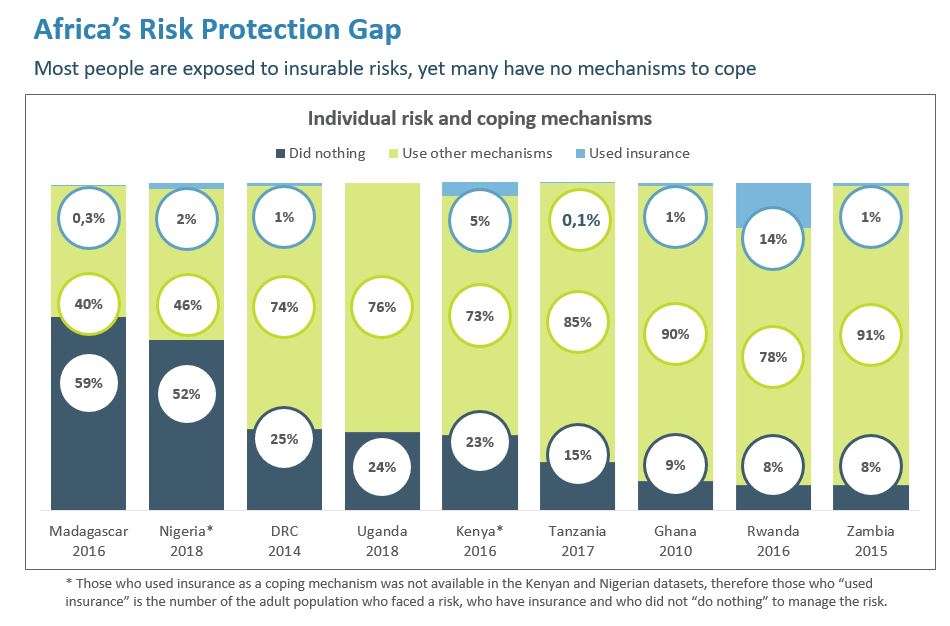

In the literature, the risk protection gap for individuals is defined as the difference between total losses and insured losses. According to a report by Swiss Re (2019), Africa’s economic losses totalled USD1.3 billion and insured losses totalled USD0.2 billion, which equates to a risk protection gap of USD1.1 billion or 85%. Based on the demand-side data available through the FinScope datasets, we defined the risk protection gap as the number of individuals who used coping mechanisms other than insurance to manage insurable risks, or who did nothing and therefore couldn’t manage the risk event. We estimate that 39 million people across our focus countries did nothing to manage risks they faced that were insurable, whereas only 2.4 million individuals used insurance (Figure 2). Most individuals – 80 million – used other coping mechanisms.

*The data for those who used insurance as a coping mechanism was not available in the Kenyan and Nigerian datasets, therefore those who “used insurance” was calculated by looking at the number individuals who faced a risk, have insurance and who did not “do nothing” to manage the risk.

Note: There is a discrepancy between the number of individuals who used insurance as a coping mechanism and those who have private insurance in Rwanda; however, it is likely that these individuals used government-provided insurance or insurance provided by social groups to cope.

Sources: FinScope DRC (2014), Ghana (2010), Kenya (2016), Madagascar (2016), Nigeria (2018), Rwanda (2016), South Africa (2016), Tanzania (2017), Uganda (2018), Zambia (2015) and Zimbabwe (2015)

What are the main risks faced by individuals in SSA?

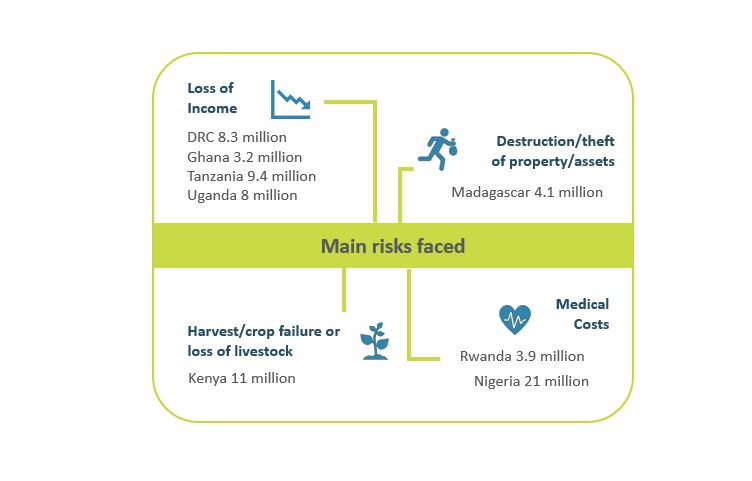

The most frequent insurable risk faced was loss-of-income due to disability, illness or death of a main income earner, which affected 45 million people across the nine countries. The second-largest risk faced was harvest/crop failure or loss of livestock, affecting 37 million individuals. Figure 3 breaks down the main risks faced by each country.

Figure 3: Main risks faced per country

Sources: FinScope DRC (2014), Ghana (2010), Kenya (2016), Madagascar (2016), Nigeria (2018), Rwanda (2016), South Africa (2016), Tanzania (2017), Uganda (2018), Zambia (2015) and Zimbabwe (2015)

How do individuals in SSA cope with risks in the absence of insurance?

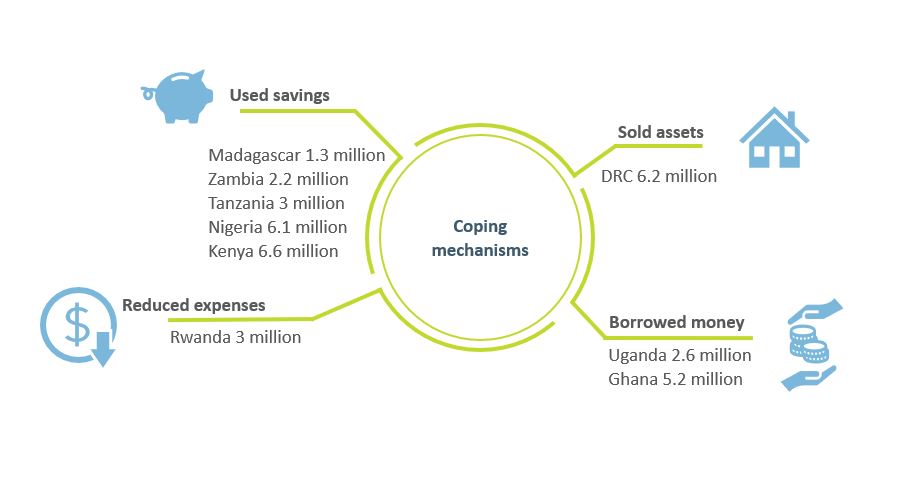

Across SSA, 30 million individuals who faced an insurable risk used their savings, and 20 million individuals borrowed money. Figure 4 illustrates the main coping mechanisms used by individuals in each country. Using inadequate coping mechanisms to deal with risks can either keep or push these individuals into poverty, as they are unable to build resilience in the face of shocks. Insurance, which transfers the risk to the insurer, is a key mechanism by which individuals manage unexpected shocks, as it allows households to grow their financial assets, mobilise savings and access other services such as credit, health and education.

What do individuals identify as key barriers to having insurance?

Across the selected countries, 33 million individuals report that they do not have insurance because it is too expensive, and 30 million individuals report that they do not have insurance because they don’t know where to get it from or how it works. These barriers can be partly addressed by improving the design of products. Design features such as offering flexible and/or timely premium payment options for low-income individuals (e.g. scheduling premium payments when money is readily available, for instance after a harvest), creating simple products, developing more effective marketing strategies and by considering alternative distribution models to reach more consumers.

However, better awareness of insurance and lower premiums will not always translate into higher demand. Insurers also need to think about how individuals access and experience the products and related services. This includes the difficulty of purchasing or renewing policies, filing claims and the ease with which premiums can be paid and payouts received. If insurers want to increase the demand for and ensure sustained usage of their products, insurers need to focus on increasing the value proposition of their products for consumers and make product benefits more tangible. Possible interventions to add value include using behavioural interventions, such as offering discount cards for pharmacies or suppliers of agricultural inputs or providing value-added services such as roadside assistance (with vehicle insurance). These factors are all likely to increase the perceived value of the product, enhance customers’ engagement with the firm to improve retention and ultimately improve their financial health and resilience.

What does this mean for insurers, policymakers and development partners?

There is no quick fix when it comes to closing the risk protection gap. Individuals in SSA struggle to deal with risks due to the low uptake of insurance and using welfare-reducing coping mechanisms, leaving them financially and economically worse off. This perpetuates the risk protection gap and has further implications on individuals’ ability to build productive assets, save and build resilience. As a starting point in addressing the gap, insurers need to understand what drives individuals to use financial services and use different types of research to understand the underlying factors behind low insurance uptake. This can be done by using client-centric data and making use of publicly available consumer data, such as the FinScope datasets, to help insurers segment the market and develop tailor-made products and strategies.

Footnote

South Africa was not included in the analysis because there was no data on the types of risks faced and coping mechanisms used to manage those risks. Insurance uptake in South Africa is relatively high – 61% according to FinScope (2018) – compared to the other sub-Saharan countries. This is driven by informal insurance instruments which are used to manage funeral costs, with 34% of individuals belonging to a burial society.