Making consumers interoperable: Biometrics and financial inclusion in sub-Saharan Africa

Making consumers interoperable: Biometrics and financial inclusion in sub-Saharan Africa

20 April, 2018 •A recent study by the World Bank shows that as many as 1.1 billion people live without basic proof of identity. Being able to prove one’s identity is an important enabler in society. It allows one to access critical services, such as health services, government grants and education. It is especially important for the financial sector, where the absence of proof of identity makes it nearly impossible to open a bank account or collect a basic remittance.

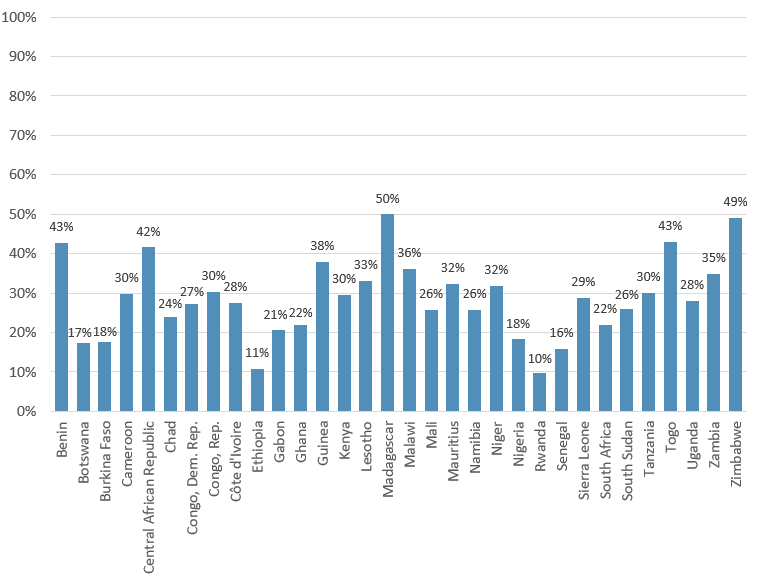

In Africa, the lack of proof of identity is a critical barrier to engaging in the formal financial sector. The graph below (based on Findex 2017 data) shows the percentage of adults without an account at a financial institution who stated that the reason for not having an account is due to a lack of documentation. In some cases, lack of identification can lead to up to 40% of the adult population being denied access to financial services.

Percentage of adults that cite lack of documentation as a reason for not having a bank account

Source: Findex, 2018

But why is the lack of proof of identity such a barrier to financial inclusion? The problem is that potential account holders have to provide a multitude of documents to comply with financial service providers’ (FSPs) Consumer Due Diligence (CDD) and Know-Your-Customer (KYC) Requirements. Many poor people lack access to such documents, such as basic identity documents and proof of address (POA), with POA typically being the most problematic.

While consumers are often willing to go to great lengths to get access to a bank account, other solutions are emerging. For example, biometrics.

Biometrics is a way to identify individuals based on physical or behavioural traits. This includes fingerprint, facial-scan, iris, hand-geometry or behavioural data (such as movement patterns, place of work and social media activity).

For consumers, biometrics are more convenient, as they don’t require individuals to keep a multitude of documents that can easily get lost, damaged or never delivered in the first place.

For providers, biometrics form a significantly more robust form of identification than something like paper documents and proof of address (PoA). They are highly resistant to fraud and falsification attempts. They provide a much more reliable means of confirming the identity of customers, leading to improved risk mitigation measures and therefore lower compliance risks, operational risks and credit risks. It’s also much cheaper to do a once-off scan of individuals’ fingerprints rather than continuously storing, updating and searching for documents and other sensitive information. As to the value of addresses in proving identity, one has the question of whether fraudsters have been caught at their provided proof of address?

For the sector, biometrics can be used to authorise access to personal data, to prepopulate forms and agreements, and as verifiable signatures. This puts the relationship between the financial sector and consumers on a different footing of trust and opens the door to meet a wider range of financial needs while limiting lock-in by providers. In essence, biometrics makes the consumer interoperable with the broader financial system.

But, if biometrics is such a great solution, why is its implementation slow and fragmented in Africa? The reality is that implementing biometric identity systems is not easy. One of the biggest challenges is the balance between the costs of setting up and managing the system and the use cases for using the system. In India, the national biometric identity system Aadhaar has gotten this balance right. The Aadhaar system can be used for many different services across the economy, such as opening bank accounts, drawing money at ATMs, applying for a driver’s licence and receiving government subsidies.

In Africa, most biometric identity systems are set up in siloes to serve specific industries, limiting use-cases and undermining the scalability of the system. For example, some African countries have separate identity systems for the voter registration, financial services, health insurance, driver’s licences and national security. In some jurisdictions, a consumer may very well have as many as 10 unique identities, each one relevant to a specific use-case. This undermines the scalability of the system and thus its viability.

So, why not leverage identity systems that are already in place? The problem is that biometrics technologies don’t talk to one another so easily. In fact, biometric templates (the mathematical files created from biometric data) are not interoperable unless they are created according to the same standard or protocol. This means that one cannot simply take all the biometric templates from each identity system and merge them to create a consolidated database, because they are all created differently and rarely speak to one another.

However, it is not all doom and gloom for biometrics in Africa. Our research with Financial Sector Deepening Africa (FSD Africa) revealed that there is potential to integrate existing identity systems. Using the source code of the existing system, the biometric templates can be unlocked to access the original biometric data. This data can be integrated into new templates, which conform to the same standards.

Unfortunately, accessing the source code is not so simple. Biometric vendors generally restrict access to the original source code. This means it is up to the discretion of the vendor as to whether the source code will be shared with new biometric initiatives. This is a key issue in Africa that needs direct attention from policymakers, regulators and donors.

Leveraging existing biometric initiatives opens the door to the possibility of harmonisation of disparate identity systems within and across different jurisdictions. This has the potential to greatly increase the use-cases and value propositions of biometric identity systems. The aim is to leverage these disparate systems to create widespread robust identities for consumers that will have an impact on the ability of consumers, especially vulnerable consumers, to access key services, including financial services.

These are only a few considerations for the future of biometric identity systems in Africa. See our latest note Biometrics and financial inclusion: A roadmap for implementing biometric identity systems in sub-Saharan Africa for a more detailed discussion on the potential of biometrics in financial inclusion and how to go about implementing a biometric identity system.

This work forms part of the Risk, Remittances and Integrity programme, a partnership between FSD Africa and Cenfri.