Reading between the data

Reading between the data

7 November, 2016 •In 2014, 22.2% of adults in Zambia were covered by insurance. In 2015, just 2.6% were. If you are working on insurance in Zambia you would probably think the magnitude of this change was because of the discontinuing of the Airtel Life product. But even if you exclude Airtel Life from the 2014 data, it captures three times more insurance policies than the 2015 data. So why the mismatch?

In Zambia, there is a mismatch between the number of insurance policies reported by providers versus those self-reported by consumers. The mismatch is not bad reporting or survey design, but simply that many adults do not know that they have insurance. The 2014 data is from the Landscape of Microinsurance in Africa study which collects data on the number of insurance policies through provider consultation, whereas the 2015 data is from the FinScope Consumer Survey and (as the name suggests) from interviews with consumers. Many of the products that providers report are compulsory, embedded or group policies. This often leads to consumers not being aware, and thus not reporting, that they are covered, while providers continue to collect premiums without worrying about being called to pay claims. Exploring why this is the case reveals some interesting insights into the existing Zambian insurance market and its future development.

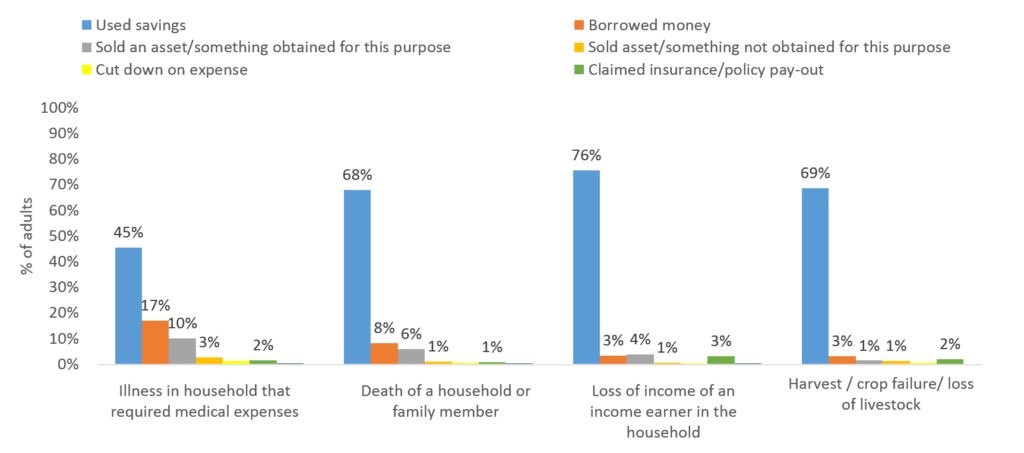

First, the low use of insurance does not reflect the risk experience of most Zambians. As in any other developing country, Zambians are subject to a range of different risks. However, as the figure below shows, few rely on insurance to deal with these risks. It shows that more than three-quarters of adults experienced an insurable risk in the last year, but largely used savings together with credit and the sale of assets to mitigate it.

This begs the question, given the risk experience in Zambia, why do adults prefer to use other risk mitigation mechanisms rather than insurance? And, if insurance can be a better risk mitigation mechanism, how do we change this behaviour?

Step 1: pay claims

A market dominated by compulsory, embedded and group policies is not in itself negative. Chamberlain et al. (2016) explain that this is a necessary stage for most developing insurance markets. However, if the beneficiaries are unaware of the insurance cover, they may not claim on the insurance product. Where such claims are automatically settled, consumers will not be aware of the role that insurance has played in reducing their liabilities. In both these cases, the lack of awareness undermines the development of the insurance market. In order for a retail insurance market to develop beyond a compulsory, embedded and group policies to the next stage of voluntary retail sales existing consumers need to be made aware of the value that insurance provides them.

Hence, pursuing compulsory product lines with low awareness and, as a result, low claims may be lucrative in the short-term. However, it undermines the perceived (and actual) value proposition of insurance amongst consumers and the potential for long-term market development.

This is the situation in which the Zambian insurance market currently finds itself. The existing compulsory insurance cover presents a good opportunity to grow both awareness of and appreciation for, insurance products if these are offered in a way that provides value to the policyholders. However, instead claims ratios are low and insurance products are not perceived as providing value. The Pensions and Insurance Authority of Zambia (the insurance supervisor) reported claims ratios of 40% in the Life industry and 38% in General in 2014. Anecdotal evidence suggests that for some products, claims ratios may be as low as single figures. Additionally, two of the major barriers to using insurance products identified by FinScope respondents were that “insurers don’t pay when you claim” and that they “don’t trust insurance companies.” If consumers have no faith that the insurer will pay claims then the product has no value to them.

Step 2: design better products

Paying claims is critical to demonstrate the value of insurance after a risk event, but getting consumers to take up insurance in the first place requires products that actually meet their needs. For example:

- Adults face multiple risks. Bundling insurance products that cover multiple risks can better meet needs and hence offer greater value. For example, the index insurance products offered by Focus and Mayfair (insurance companies in Zambia) not only offer farmers cover against adverse weather but, understanding that they also face a range of personal risks, bundles it with funeral cover and intends to add hospital cover in future.

- Formal insurers are competing with informal providers. Informal risk mitigation mechanisms are used by a large portion of Zambian adults: 38% of adults indicate that they use some form of informal financial services (FinScope, 2015). Whilst most of these informal products may not be insurance type products, most can be used to manage insurable risks. For example, borrowing from friends and family or using the savings from under the mattress to pay for transport fees to get to the government hospital. These products are not only used because they have low barriers to entry, but even adults that can use formal services, prefer to use them. Informal products are effectively competitors to formal providers. Understanding this, and why they are preferred, is a critical step for providers looking to drive further uptake.

- Insurance products lack tangibility. Insurance is a credence product. Given that many insurance markets start with micro-life or funeral products, adults only derive value after someone has died. This often makes it hard to sell to first time buyers. Insurers in other markets sometimes overcome this by offering in-life benefits to policyholders to add tangibility to their insurance policy, something not currently prevalent in Zambia. In-life benefits also enable providers to maintain an on-going relationship with the consumer. Traditionally, a consumer will only engage with the insurer when they purchase the policy and when they claim, which may be many years later or by one of their family members after they are dead. In-life benefits facilitate an ongoing interaction, making it easier for the provider to maintain a relationship with a consumer.

The mismatch between demand and supply-side data reveals a market with low awareness and a likely lack of value for policyholders. Whilst this may be initially lucrative, this short-sighted approach should be a concern for providers and policymakers. The profits currently enjoyed by incumbent providers will erode over time as competition increases (Zambia has seen the number of insurers triple of the last 10 years) and most importantly, undermines the long-term development of the insurance market as there is no basis for voluntary sales to grow. For policymakers, this also limits the potential of insurance to contribute to capital markets.

Although there is some evidence of insurers beginning to innovate with product design and targeting new markets, reading between the data reveals many insurers still asleep at the wheel – undermining the potential contribution of the industry to the welfare of adults in Zambia.