The new currency in microinsurance: does data access trump client volume?

The new currency in microinsurance: does data access trump client volume?

9 October, 2024 •Lessons from scaling retail health microinsurance in Kenya

We’ve all been there. You wake up feeling unwell and, being a rational person, you turn to Dr. Google. Perhaps you search for “low-cost clinics near me” or “affordable treatment for the flu.” Within seconds, you’re flooded with thousands of articles, and, for the next few weeks, you’ll see ads for local clinics, over-the-counter medications, and discount health services on your social media feed and YouTube ads. One simple query about affordable healthcare triggers a wave of targeted solutions. This targeted advertising is a norm today – it relies on the vast amounts of data it collects to deliver ads tailored to our specific needs. This data is invaluable across the healthcare value chain, enabling insurance providers to develop better policies and products.

Yet, despite the insurance industry’s heavy reliance on risk modelling data, we are often limited to a handful of basic, standard policy options. This is usually because insurers underinvest in analysing the data they have and fail to leverage opportunities to access new data, missing out on providing more tailored, effective insurance solutions. To explore and address this challenge, Britam partnered with CarePay in Kenya to distribute micro health insurance via mobile wallets[i]. This blog shares some of the key findings from a study on the partnership and distribution model, funded by the Swiss Capacity Building Facility (SCBF).

The amount of data aggregators have on their clients is as important as the number of clients they have

Microinsurance is a volume business – due to the low cost of premiums, providers need access to many clients to make the business case work. This is why partnerships with aggregators[ii] like CarePay, whose MyHealthFunds (MHF) mobile savings wallet has over 4 million users, are so important. However, a key finding of this study was that access to your aggregation partner’s customer data is as important as the number of clients the aggregator has, because a large number of aggregator clients does not automatically translate into a large number of potential clients for the microinsurer.

Britam’s partnership with CarePay meant that they had access to a sample of demographic and transactional data from CarePay’s My Health Funds (MHF) wallet users. This meant that it was possible to analyse how many MHF users were saving and transacting with their wallets and, more specifically, how many were saving enough to pay for Bima ya Mananchi (BYM) insurance premiums.

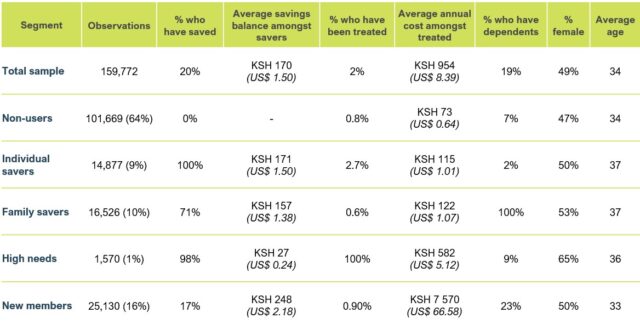

Consumer research on Kenyan consumer spending habits, conducted by Frontier Consulting[iii], found that only 5% of Kenyans used insurance to fund hospitalisation expenses, with most (63%) relying primarily on personal savings, supplemented by some form of borrowing (4%). This would imply that savings wallets would be an effective vehicle for distributing micro health insurance. However, analysis of MHF wallet user data showed that although the uptake of the mobile wallet was high, utilisation rates (in terms of savings rates and wallet balances) were low, with most not even saving enough every year to cover an annual insurance premium. Our analysis also showed that the average savings balances were about KES170 (USD1.3) compared to the annual cost of a BYM premium, KES3,200 (USD24).

Successful partnerships depend on how effectively you use aggregators’ data to understand the true size of your target market

These low savings balances raise the question of whether mobile wallets are the best way to distribute insurance, and the answer to this question is again in the aggregators’ data. Having demographic, transaction and/or behavioural data on an aggregator’s clients makes it possible to conduct a more nuanced segmentation analysis, and more accurately target and risk-stratify clients.

Under this collaboration, Britam was able to use data on CarePay’s active customer base in the early phases of product design to conduct segmentation analysis on mobile health wallet users. This analysis identified five distinct customer groups as shown in the figure below.

Key characteristics from each segment, identified through the data, include:

- Non-users, who constitute 64% of the customer base, do not actively save – posing a challenge for targeting health microinsurance products

- Individual savers, making up 9%, have minimal healthcare needs and the highest incidence of positive savings balances

- Family savers, at 10%, save more frequently due to dependents, showing significant potential for targeting

- The high-needs group, though only 1%, incurs higher healthcare costs and is predominantly female

- New members, comprising 16%, display higher-than-average savings balances but low savings frequency

- Only 36% of MHF clients actively use the wallet, with low overall saving frequency and amounts

This type of segmentation analysis can also identify potential pitfalls and groups that can present higher risks for insurers, enabling insurers to better target customers. For example, the table below shows that the high-needs group constitutes just 1% of the sample, but they have the highest savings rates, healthcare utilisation rates and higher annual health costs than individual and family savers. On one hand, this could show that although the high-needs group is relatively small, they may have a higher propensity to demand health insurance products. However, on the other hand, this group most likely represent “super-utilisers“ who disproportionately drive healthcare costs despite being a small share of the population. Access to aggregator data makes this type of nuanced segmentation possible because by understanding the risk pool better, insurers can design better-targeted products that both provide better value to customers while being competitively priced.

Now, going back to the question of whether mobile wallets are the best way to distribute insurance; one would be tempted to conclude that, based on the numbers presented in the table above, mobile wallets may not be a promising distribution strategy. However, it should be noted that Britam had very limited access to CarePay’s customer data. Existing data sharing agreements between CarePay and the other insurers that used their platform meant that Britam did not have access to the data of clients that had already purchased insurance from other providers (both private and NHIF). Therefore, Britam did not have access to the full sample of clients who had an expressed willingness to pay for health insurance and therefore they did not have the opportunity to cross-sell BYM to them. This means that although the MHF platform boasts millions of users, due to the limitations created by the data-sharing agreement with CarePay, Britam’s total addressable market was much lower than initially estimated.

The key takeaway: Access to client data is essential to a successful partnership between microinsurers and aggregators

Data is essential for understanding the target market and evaluating product-market fit. The ability to do this depends heavily on the data-sharing agreements between the insurer and the aggregator. In this case, although Britam had access to CarePay data, this access was limited. However, this limited data was still able to reveal that, despite high user numbers for the mobile wallet, active usage and savings were low. This finding has been corroborated by CarePay’s own analysis.

Therefore, insurers must carefully evaluate data-sharing agreements with their aggregation partners to gain a more nuanced understanding of their customers. Once they access this data, investing in advanced data analytics becomes crucial. This understanding of the customer base is not just a marketing strategy, it is essential for the development of the insurance market. Without it, insurers risk failing to deliver value, which directly affects customer willingness to purchase insurance. If clients perceive little value in insurance, they are unlikely to engage with these products.

Ultimately, strategic partnerships and data-driven approaches are the keys to reaching underserved populations, increasing uptake of micro health insurance, and thus improving access to high-quality, affordable healthcare.

This blog forms part of a two-part series on lessons from scaling retail health microinsurance in Kenya. See the other blog in this series, “Kenyans are value maximisers, not cost minimisers”.

[i] In 2021, Britam and CarePay partnered to co-develop and distribute a health microinsurance product through CarePay’s mobile savings wallet, My Health Funds (MHF), on the M-TIBA platform. This collaboration aimed to address a critical challenge for microinsurers: reaching enough clients to achieve scale. With approximately 4 million customers already using the M-TIBA wallet, a tool provided by CarePay to enable targeted savings for healthcare expenses, the partnership created a significant opportunity to offer microinsurance to these individuals. This initiative also allowed Britam to expand its Bima ya Mwananchi (BYM) product, which provides affordable access to private healthcare facilities, by leveraging CarePay’s customer insights and distribution network. This partnership underscores the importance of strategic collaborations in reaching underserved populations.

[ii] Aggregators are platforms or intermediaries that bring together various stakeholders, like customers and service providers to create a seamless and efficient marketplace.

[iii] This research is forthcoming by Frontier Consulting and is based on a sample of 498 respondents