Voluntary take-up: The holy grail of microinsurance

Voluntary take-up: The holy grail of microinsurance

22 October, 2018 •Last week, Cenfri was in Brussels to present at the BRS microfinance lunch on what we deem to be the holy grail of microinsurance – voluntary take-up (something highly desirable but very hard to achieve). The BRS microfinance lunch is a semi-annual series that provides an opportunity for the KBC (a large bank insurer based in Brussels but operating across several countries in Europe) to learn about innovations they are supporting in banking and insurance in the global south.

Our presentation looked at the significant gains that have been made in microinsurance over the last decade, on the back of large aggregators like banks, microfinance institutions, mobile network operators (MNOs), retailers and utility companies, but also why we have ultimately fallen short in achieving voluntary take-up.

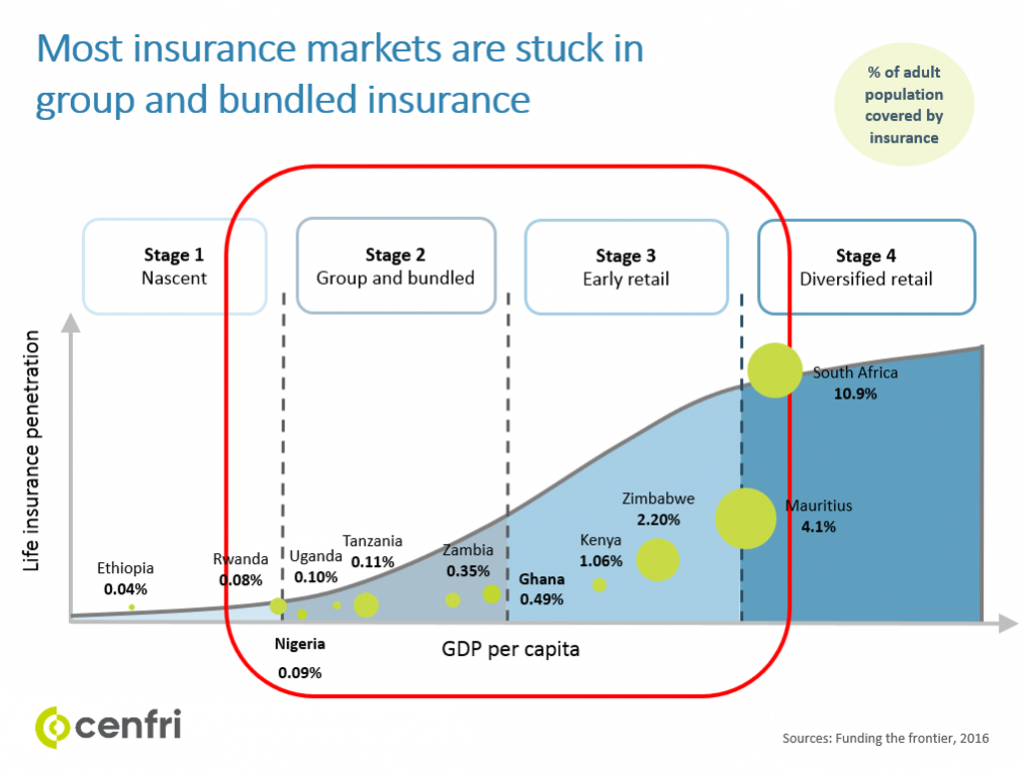

We believe voluntary take-up is critical for insurance market development because it is at that stage where the business case for insurance kicks in as providers are incentivised to offer value to the consumer. The figure below shows that in the stage before this – Stage 2 – the incentive is for insurers to develop group or compulsory products that meet the needs of the intermediary. For example, products that help manage the exposure of loan books from lenders or incentivise loyalty for mobile network operators. It is in this stage that most of the countries in sub-Saharan Africa is located.

While these products don’t necessarily speak to the risk needs of consumers in this stage, they still do provide important incremental gains in risk management and massive gains in terms of people reached with insurance. If this stage is managed appropriately, insurers offer consumers a small slice of risk coverage in return for building awareness and trust in insurance at little or no cost to the consumer.

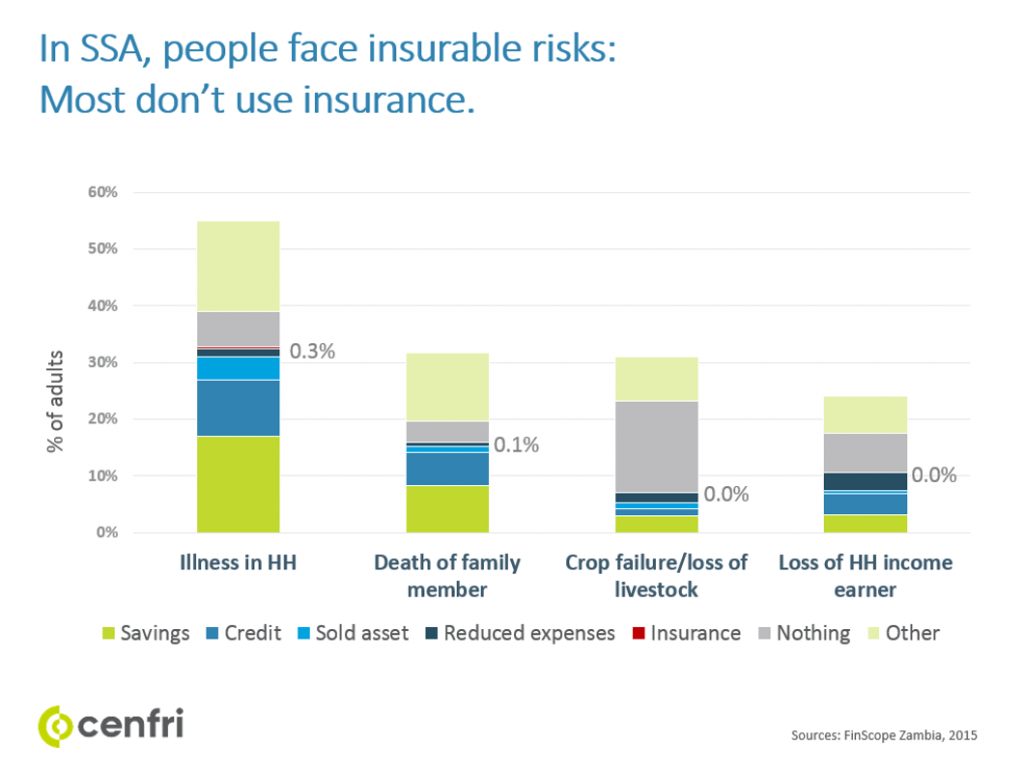

The figure below shows that this stage is often not managed appropriately by the market, and there is a tendency to offer poor value, evident by low claims ratios and the preference by consumers to use other mechanisms to manage risks (even if they are covered). Consumers opt to rely on friends and family, use savings from under the mattress, sell assets or cut down expenses. Even the few that do use insurance prefer to take it up from informal providers such as burial societies in South Africa. Thus, while the group and compulsory stage is necessary, it will not by itself progress to voluntary take-up if consumers do not perceive that they derive value from it.

What is required to unlock voluntary take-up of microinsurance?

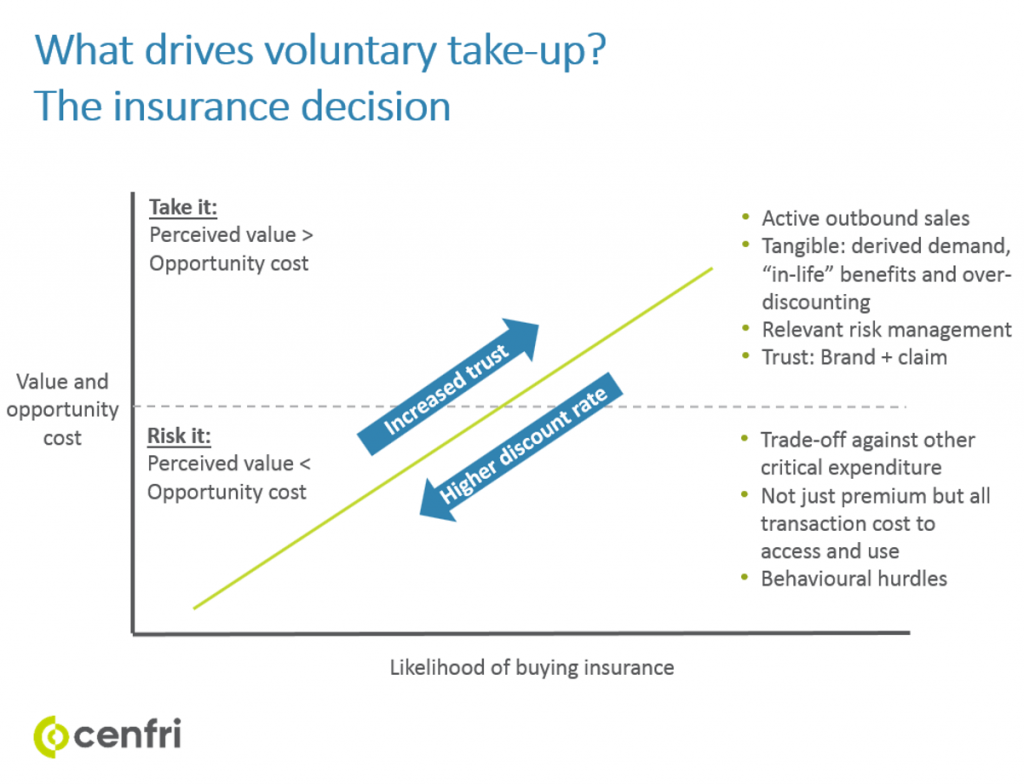

We believe there are a number of factors that contribute to a consumer deciding whether to take up insurance. We introduced these factors via our insurance consumer decision frameworks, which are shown in the figure below. This framework shows that there are factors that drive take-up of insurance (take-it) and those that deter the take-up of insurance (risk-it). These are often linked to the perceived value from the consumer.

For instance, consumers often do not take insurance (risk-it) because the opportunity cost of them giving up money today for money in the future is high given their limited incomes. In most cases, formal providers are not able to offset this with the perceived value of their insurance offerings. They have limited outbound capacity in the areas where these consumers live – which increases the cost to access, to use and, most importantly, to understand and engage consumers in ways that build trust and relevance.

These realities are not easy to overcome, particularly in sub-Saharan Africa where we spend much of our time. Many institutions – public and private – are invested in trying to make this work; and with our partners FSD Africa and MasterCard Foundation, we have been exploring the potential of the latest wave of technological innovation (e.g. data, insurtech and digital platforms) and behavioural interventions to overcome these realities.

Our preliminary findings show that most of the innovations are focused on business problems, which – while critical to bring down high costs structures in emerging markets – may not tilt the consumer insurance decision in favour of voluntary take-up.

But there are pockets of innovation in sub-Saharan Africa that we are taking note of.

- Mobile 2.0. BIMA is best known for its global mobile microinsurance model, which has registered more than 1 million customers worldwide. This model relies heavily on outbound capacity. It has more than 3,700 agents globally, and its call centres have conducted more than 260,000 telephonic consultations. It is now leveraging the trust and brand it has built through this outbound engagement to offer its BIMA Doctor product on a voluntary basis. The product speaks to relevant needs of consumers by providing 24/7 access to health consultations and discounts at BIMA’s networks of hospitals, clinics and pharmacies.

- Beyond mobile. Chinese digital insurer Zhong An Online has earned headlines by selling 5.8 billion policies to 460 million customers in China. It has done this by fitting its business model into the existing interactions in the digital ecosystem in China. Its bestselling policy reimburses online shoppers for the cost of returning an unwanted item on Alibaba’s e-commerce platform. It has also partnered with one of the largest travel booking agents, and it overlays weather data with the consumer data it receives to target individuals with flight delay insurance. In sub-Saharan Africa, Jumia (the continent’s largest e-commerce platform) is evolving from simply being a new channel for insurers to introducing similar products. For example, in Kenya, Jumia has recently introduced a three-month guarantee in a bid to enhance customer confidence in online shopping.

- Reinventing agency. Hollard (the largest private insurance company in South Africa) and Kaizer Chiefs (the largest football club in Africa) partnered to offer a funeral insurance product through physical co-branded stores. They use technology and data to bring down the cost of policy administration and ongoing communication with consumers, but ultimately their business model is about investing in infrastructure in areas closer to the communities they want to reach with their products. The results have already shown higher persistency levels than the digital or outbound channels.

We are excited about the opportunities that technology and data are creating to achieve voluntary take-up, specifically:

- Better aggregation. Digital platforms are looked to as the new distribution channel to support scale in microinsurance (after MNOs). But, unlike with MNOs, they aggregate a broader range of consumer groups (e.g. merchants) and facilitate a more diverse range of transactions.

- Enhanced outbound capacity to engage consumers in a meaningful way. Smartphones and digital platforms enable access to new data sources that can be used to identify relevant risks and target consumers with insurance products that fit into an existing behaviour (e.g. fly delay insurance). It also enables providers to offer more valuable services to consumers that extend beyond risk to improved risk managmenet services (e.g. access to healthcare consultations).

- More payment options. Technology can get closer to the consumer and helps to build outbound capacity and integrated payment mechanisms. For example, our digital platform study across eight countries in sub-Saharan Africa found that platforms accept a range of payment options, including card (70%), cash (38%), mobile payments (37%), bank transfers (27%) and PayPal (20%).

But we are also cautiously optimistic. Consumers will only take up products that speak to their risks and that provide tangible, in-life benefits for the consumers that consider their existing entrenched behaviour. Insurers and other actors in the insurance value chain need to get these basics right and should not only rely on new innovations.

Next month, we will host a plenary session at the 14th International Microinsurance Conference in Zambia, with Richard Leftley from MicroEnsure, Amolo Ng’weno from FIBR and Adrien Lebegue from Zhong An, to continue this conversation around how we can create the right incentives for technology and data to drive voluntary take-up and to support inclusive insurance market development. Follow the conversation on Twitter at #14thimc.