An analysis of ID proxy initiatives across the globe

An analysis of ID proxy initiatives across the globe

29 November, 2019 •BankservAfrica and Cenfri investigate the role of ID proxy initiatives in transforming payment ecosystems in Africa and beyond.

Real-time instant payments have become a hallmark of the digital economy and financial system. As part of our growing work in payment ecosystems, this report clarifies and investigates proxy and addressing services as a critical lever for adoption of instant or near instant payments as part of the evolution of payment systems in sub-Saharan Africa.

What are central proxy identification systems?

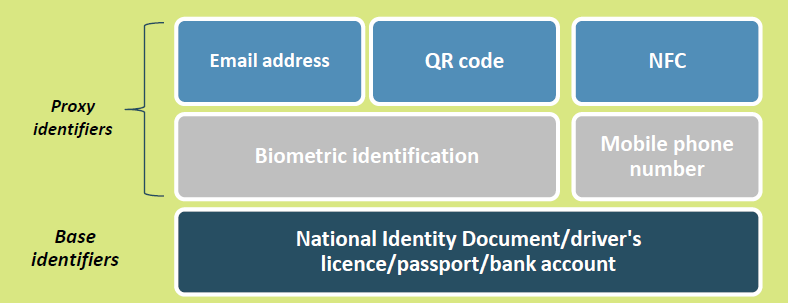

Proxy services allow payments to be successfully made using only an agreed identifier, such as a mobile number or national identity number. A robust and efficient proxy registration system is vital to the success of an instant payment system and it has the potential to address financial inclusion.

Proxy systems enable consumers to transact more easily without the need to register a beneficiary with a bank name, bank account number or branch code, as well as providing payer confirmation of beneficiary details.

Furthermore, if sufficiently robust, proxy systems can be key in defending against reverse look-up attacks, automated skimming of consumer information, incidences of false positive beneficiary identification and fraud in a system that is potentially vulnerable to the rapid interception of account information and theft.

This report provides a useful first step in navigating the landscape of identity proxies and it is structured as follows:

- An overview of the ID proxy landscape

- Demonstration cases on how proxies’ function and the related benefits and risks with each proxy type

- The analysis outlines the advantages and disadvantages of five potential ID proxies to consider for the development of a rapid payment system in South Africa

It is clear that proxy services need to meet accessibility verifiability and security, trustworthiness, uniqueness, privacy, customer experience and cost needs but there is often a trade-off between accessibility and financial inclusion, on the one hand, and security and verifiability on the other hand.

The report concludes with key considerations for implementing ID proxies for rapid payments:

- The cost for infrastructure, installation and achieving buy-in from merchants and customers

- The potential need to implement a combination of ID proxies simultaneously to facilitate seamless real-time payments for consumers

- Preconditions and recommendations to ensure optimal outcomes which considers local context

Read the report on the ID proxy initiatives across the globe.

This work forms part of the Risk, Remittances and Integrity programme, a partnership between FSD Africa and Cenfri.