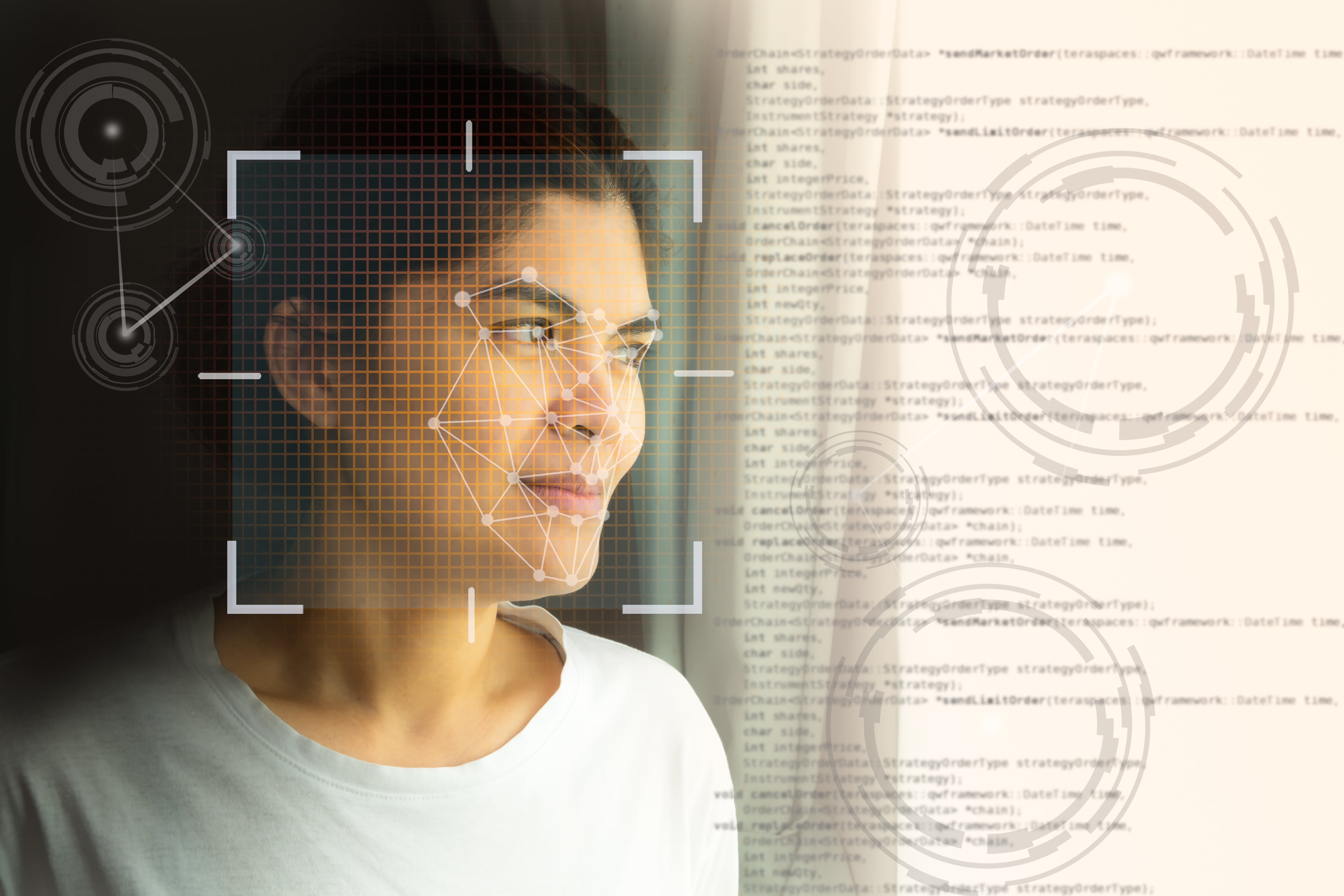

Identity proofing for COVID-19 recovery

Guidance for regulators, financial service providers and market facilitators Globally, millions of people are excluded from accessing the formal financial services that meet their needs. This is at least partly due to the way the Financial Action Task Force (FATF) recommendations are implemented by countries, and customers needing to provide