A balancing act

A balancing act

22 September, 2016 •Data has permeated all facets of our lives. It is more available and accessible than ever before. In just a few hours one person can create a multitude of data points from just one mobile device. This is what Gabriel’s* morning looks like:

- 6:10 am: He logs in to Facebook and likes several friends’ photos

- 6:35 am: He tops up his airtime on his phone

- 7:35 am: He calls his sister to find out how much he owes her

- 8:45 am: He transfers the money to her mobile money account

- 8:50 am: He downloads the Little Cab App just launched by Safaricom and catches a ride to his “kiosk” in downtown Nairobi

The data landscape has evolved rapidly over the past two decades. Many of us are now active data producers, rather than just users, and we are willing to share our personal information on a variety of platforms. The evolution in the types and volume of data available has also brought about innovations in the ways in which data is used. Data has allowed the world to respond to global challenges, be more efficient, empower individuals and make better predictions. Alternative data, coupled with advanced analytical capabilities, has the potential to create new markets for financial services, improve the consumer experience, reduce costs, allow new providers to enter these markets viably and thus ultimately advance financial inclusion.

The data points created by Gabriel in his morning routine could be used by innovative companies to better understand what financial products he needs, and even design a customised product solution, based on his demonstrated behaviour. Jumo, an African mobile money marketplace provider, uses data points such as call records, airtime usage, type of phone used, text messages sent, data purchases and mobile money transactions as well as machine learning methods to assess a customer’s credit risk. This, in turn, drives down the costs of credit and increases the likelihood of returns. Social Lender, a lender based in Nigeria, uses their proprietary algorithm to develop a person’s social reputation score using their social media data, which allows users to borrow funds based on their social reputation rather than a traditional credit score. And it’s not just the fintechs who are using data to their advantage – the smallest to the largest actors in the financial sector are using data and analytics to sharpen risk assessment, drive revenue and reduce costs.

As the mobile and online footprints of customers are expanding rapidly across all income groups, low-income individuals are becoming increasingly more connected and thus are also creating an expansive digital trail. In sub-Saharan Africa alone, there were 386 million unique mobile subscribers, and Africa as a whole had over 100 million monthly active Facebook users in 2014 and 334 million internet users in 2016.

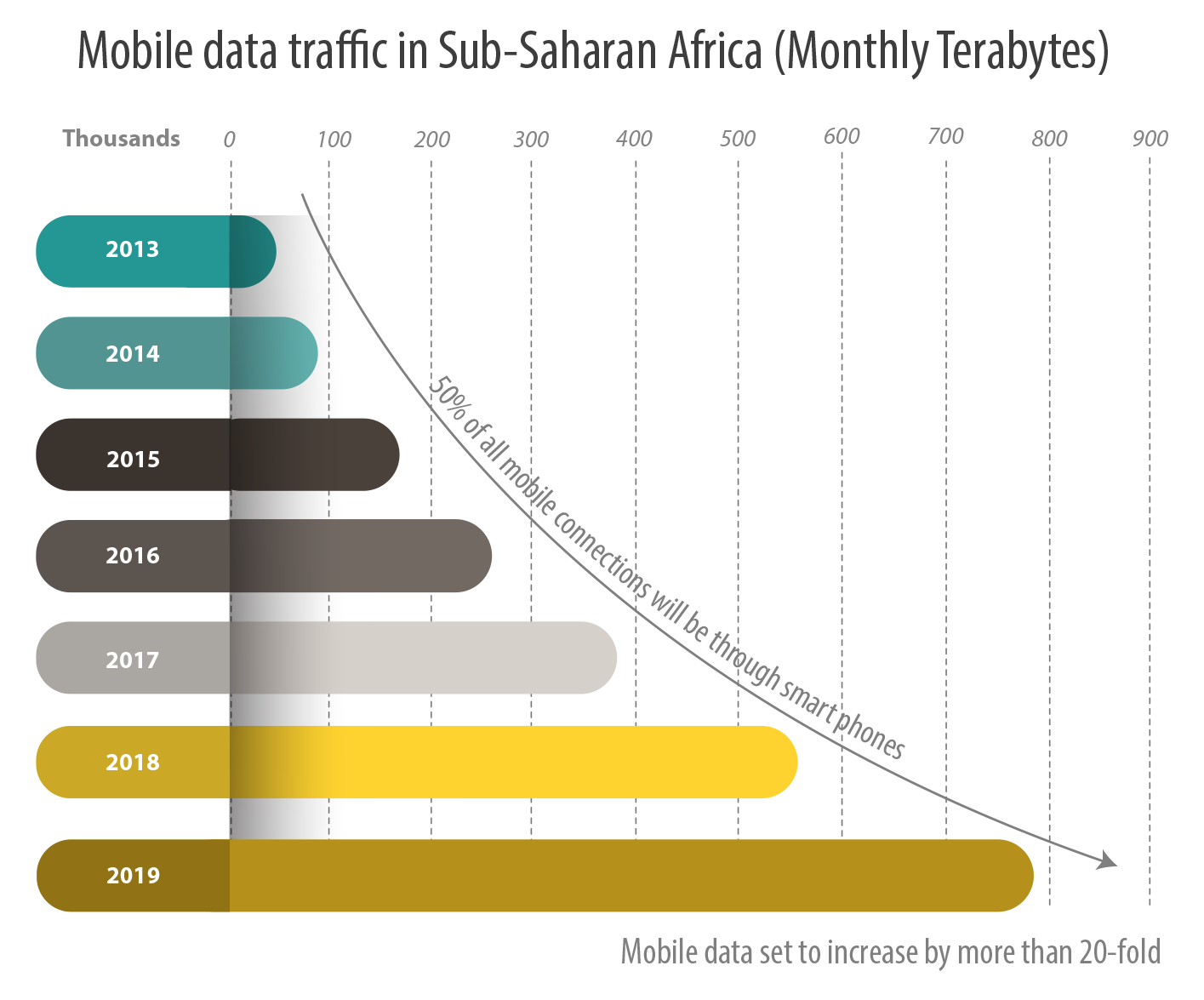

Further, the growth in the adoption and use of smartphone devices – as highlighted in the figure below – is creating a wealth of digital data. Combining this with the improved analytical capabilities of service providers has given rise to unprecedented opportunities to overcome access barriers in providing services such as credit and insurance to low-income customers. Beyond the access barrier, the use of alternative data allows tailoring services based on a granular understanding of clients, to meet their needs, to build trust and even personal relationships.

It’s important to remember, however, that behind the facts and figures lies an individual, whose rights need to be protected. With increasing scope and potential for abuse, it’s necessary to protect the security and privacy of individuals’ data whilst still encouraging the free flow of information and the sharing and use of data for innovation and societal benefits.

The data protection discussion encompasses both data security and data privacy, which although they are often used interchangeably, have distinct differences. Data security refers to the accuracy, confidentiality and availability of the data. Data security policies address issues such as ensuring that only the required information is collected, that it’s kept safe and that it is discarded when it’s no longer needed. Data privacy, on the other hand, is commonly defined as the appropriate use of data, meaning that data should only be used for the agreed upon purposes. In short, data security addresses issues related to the collection and storing of data, whereas data privacy focuses on the appropriate use of the data. And when we think of data protection, it is the combination of these two elements.

Whilst the benefits of our digital footprints are vast, with the increasing types, complexities and volume of data comes the increasing scope and potential for risk and abuse. Discrimination, security breaches, monetisation of personal data, data loss and lack of anonymity are all enduring concerns.

Today many companies have specialised in uncovering new customer insights by mining social media data and integrating it with other enterprise or public curated data, which they then sell to enterprises wanting to gain a better understanding and more holistic view of their customer. These customer insights enable companies to then develop products focused on clients’ needs. In particular, financial service providers utilise social media data and combine it with customary financial data not only to build and manage customer relationships but as a cost-effective way to automate decision making, for example in lending, or even with regard to corporate decision making.

It is therefore essential that an effective legal environment prevents and punishes abuses in the use of personal data and enhances citizens’ rights to privacy. This legal environment will ensure that private sector entities understand implications of legal and regulatory matters for innovative business operations.

In the same way, transparent and easy to understand information of individuals is necessary when giving away private data for obtaining access to services: When signing up for Facebook and other apps on his phone, Gabriel would have had to sign a consent form, however, he might not have realised that his personal information would be sold and used for behavioural profiling. And, that the behavioural profiling could later affect his ability to get credit or increase his limit.

The private sector has a role to play as well – today it is little disputed that privacy is best dealt with when built in the design stage of a product: Businesses use data to connect information, identify patterns and personalise interactions to maximise their business results. The objective of integrating privacy into design may even be the motor of innovation in product design.

Finding the sweet spot between enhancing financial inclusion through innovative data and analytics while simultaneously safeguarding personal information was the focus of a panel discussion facilitated by the i2i at the AFI Global Policy Forum (GPF) in Fiji on 7 September 2016. The discussion closed with a call to action for the AFI Network to support efforts to create a safe and enabling environment for enhancing financial inclusion. The AFI Network responded to the call to action by adding this topic to their working agenda during the closing session of the GPF.

To find out more about the AFI Global Forum. To learn more about the innovative uses of alternative data and how this can enhance financial inclusion, take a look at i2i’s latest client insights focus note.

*Pseudonym used

insight2impact (i2ifacility) was funded by Bill and Melinda Gates Foundation in partnership with Mastercard Foundation. The programme was established and driven by Cenfri and Finmark Trust.