A woman’s financial life: Does traditional data get it?

A woman’s financial life: Does traditional data get it?

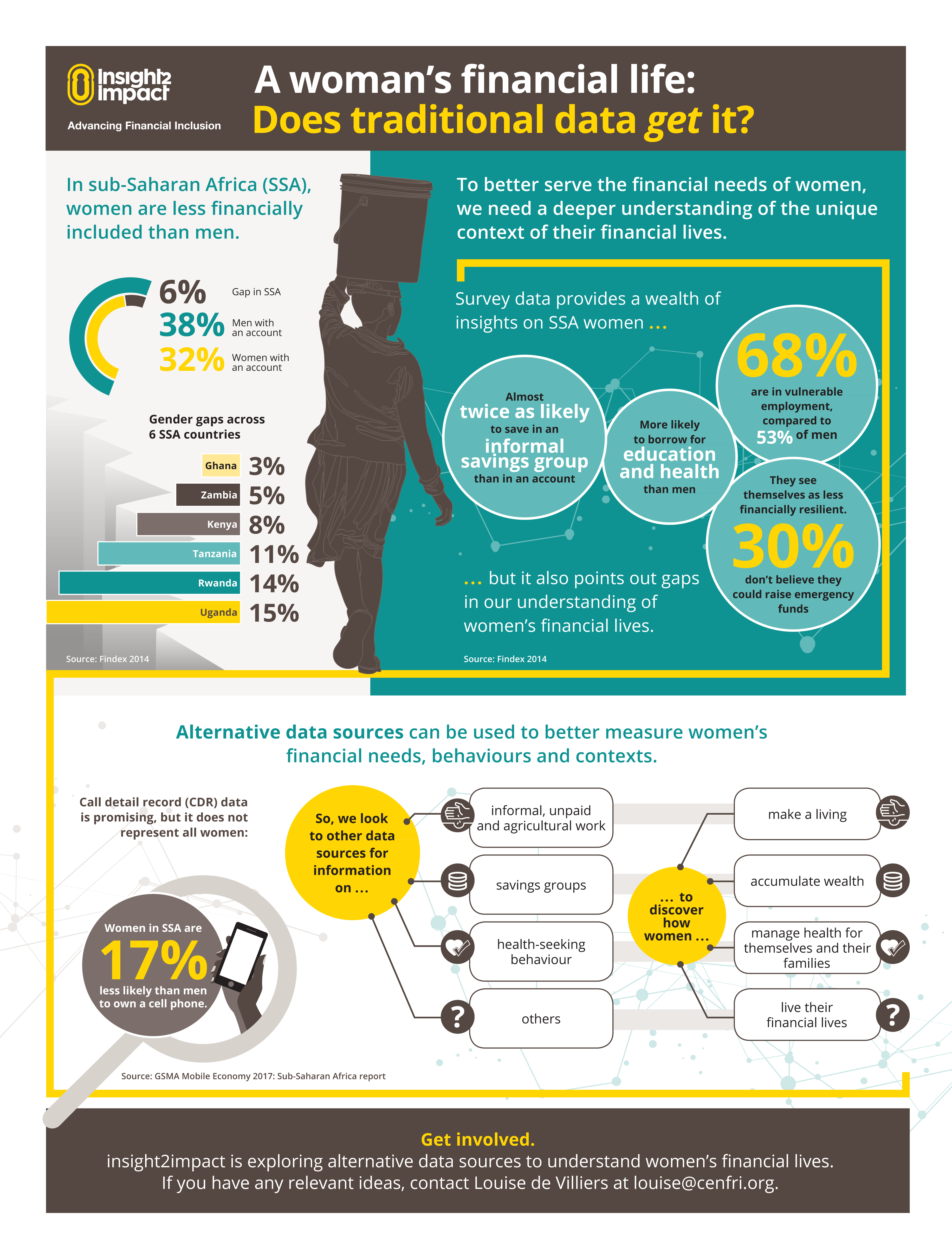

8 March, 2018 •Whereas financial inclusion has seen a steady increase over the past few years, this positive trend has not necessarily taken women along. A gender gap in financial access and usage persists, and has not decreased over the years. Our efforts at understanding and closing the gender gap are hampered by the lack of sex-disaggregated data collection and reporting.

Many traditional sources of data fail to categorise customers as male or female and might simply be less valuable for understanding women’s financial needs and lives. For example, with more women in informal employment or unpaid labour, data on formal income sheds less of a light on women’s economic lives, and with fewer women making use of formal credit, data from Credit Bureaus will underrepresent the female experience. In this infographic, we pose the question: Which types of alternative data might we access to better understand women’s financial lives?

insight2impact (i2ifacility) was funded by Bill and Melinda Gates Foundation in partnership with Mastercard Foundation. The programme was established and driven by Cenfri and Finmark Trust.