CBDC — The next frontier of mobile money?

CBDC — The next frontier of mobile money?

17 April, 2020 •Many discussions around retail central bank digital currency (CBDC) today revolve around ambitious policy-focused use cases. Most recently, in the face of potential competition from a growing assortment of innovative private crypto-assets like Bitcoin and stablecoins such as Facebook’s Libra, central bankers around the world have been consumed with the possibility of implementing CBDC as a solution to regain control over their national money supply.

CBDC has also been championed as a power tool for an array of economic policy use cases. These use cases range from improving the targeting efficiency of monetary policy and streamlining national payment systems to enhancing the traceability of illicit flows and enabling the final push towards cashless societies.

However, the relevance of CBDC for consumer financial needs remains unclear. This lack of clarity stems from the fact that despite the broad ambitions of its proponents, most notably in terms of digitising cash, limited consideration has been given to how retail CBDC[1] could practically incentivise the use of digital payments for improved financial inclusion, particularly when private crypto-assets are yet to achieve mass appeal.

Moreover, how could CBDC circumvent the potential digital financial exclusion that may result from its introduction? These questions are especially relevant for developing countries in regions such as sub-Saharan Africa (SSA) where, although more than 450 million adults possess a mobile phone subscription and over 50 percent of the population own a mobile money account, cash firmly remains king for nearly 60 percent of people paying for regular expenses like utility bills.

It is exactly this level of digital financial readiness, however, that begs the following questions: a) Why hasn’t the mobile money model completely succeeded in SSA? and b) Is there a potential use case for retail CBDC to help overcome its constraints for greater usage and improved contribution to financial inclusion?

In this article, we set out to understand the current major barriers to mobile money in SSA and the transformative impact retail CBDC could have on financial inclusion if applied through mobile money networks.

Mobile money as a gateway

Mobile money has been the gateway to formal financial services for millions across SSA. As a service, mobile money provides the ability to access financial services and conduct financial transactions using a mobile phone or other digital device. It does so by enabling customers to go to an agent and exchange cash for electronic value (in the form of e-tokens) that can be stored in an electronic wallet (e-wallet) that is hosted by a mobile money operator (MMO) scheme. This value can then be utilised to transact with other e-wallet holders using either the same or a different MMO scheme and platform. The cash value within these e-wallets is held in an escrow account, backed by a partner commercial bank, which can be accessed by customers to withdraw or cash out by exchanging e-tokens for physical cash at an agent. These mobile-money rails therefore allow customers to transact over distance in e-money, usually by entering the recipient’s mobile number, without the need for a bank account. In SSA, the success of mobile money is clear. The bank account penetration rate is still well below 40 percent, but the growth of mobile money has been considerable, particularly in reaching previously unbanked populations.

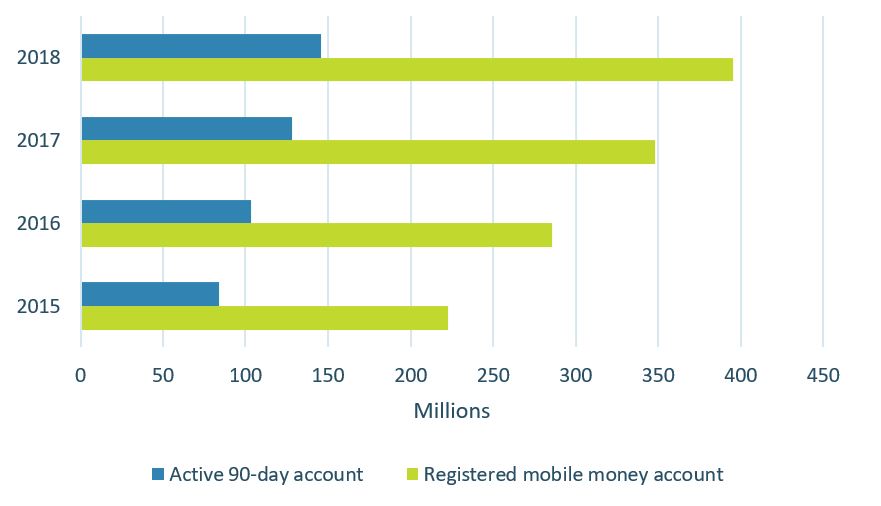

Source: GSMA (2015, 2016, 2017, 2018)

This growth is illustrated in Figure 1 above by the increase in registered mobile money accounts—from 223 million in 2015 to nearly 400 million in 2018. In terms of mobile money use, the number of active 90-day mobile money accounts has also grown impressively from around 84 million to nearly 146 million between 2015 and 2018. Despite these gains, shortcomings in the fundamental design of mobile money make it an imperfect digital substitute for cash. These design limitations are evident in three key areas:

- Although mobile money e-tokens can be transferred between individuals and exchanged for cash, the value of e-tokens is not denominated in national sovereign currency on a one-to-one basis in the same way that cash is. This implies that one e-token cannot easily be interchanged with the e-tokens of a different provider, or directly with cash. A real-life example: a consumer buying groceries by tendering physical cash could not be expected nor compelled to receive change in e-money tokens from any given mobile money scheme. There are notable examples of e-money being discounted by consumers in favour of hard currency precisely because it is not the same instrument with the same value or risks.

- Unlike cash, which enjoys universal acceptance, mobile money e-tokens are often only accepted by the provider or scheme and selected merchants/suppliers, thus limiting its usefulness for consumers. Additionally, the unique value of e-tokens makes it inappropriate for consumers to compare the value of different goods or services priced in different e-tokens and impractical to have stores of different e-tokens to accommodate a variety of merchants.

- Unlike cash, mobile money is not backed or issued by central banks but rather private MMOs. This characteristic creates a key distinction between how consumers view mobile money relative to cash and how easily it can be supplied by MMOs in given markets. More specifically, consumers may be more cautious with a mobile money instrument than a state-guaranteed one. This type of reaction lowers levels of consumer trust and limits usage of, or any reliance by a consumer on, that instrument.

Overall, these limitations imply that mobile money is neither a direct digital substitute nor a replacement for cash, but rather a unique, non interoperable[2] alternative payment instrument.

Mobile money constraints

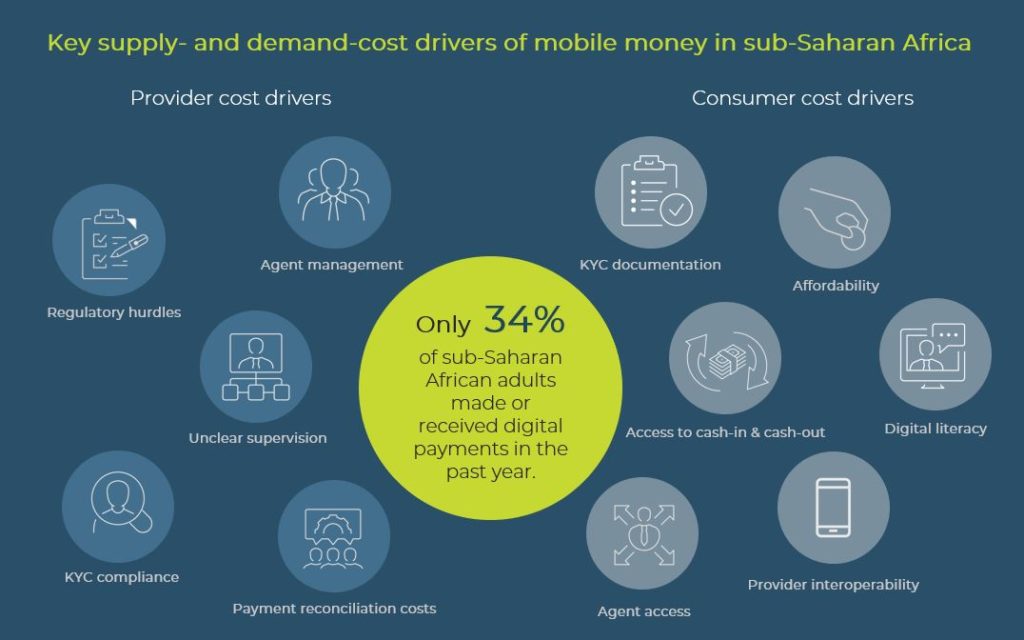

In its current form, mobile money faces a myriad of constraints preventing it from being a cost-effective and broadly adopted solution for consumers. These constraints can be broadly grouped into two main categories: consumer/demand cost drivers and provider/supply cost drivers.

According to the 2017 Global Findex Survey, as Figure 2 shows, only 34 percent of adults in SSA report having made or received a digital payment in the last year. This suggests that, while mobile money has made notable inroads in some countries and certain use cases (particularly peer-to-peer remittances), the majority of the SSA population still use cash for everyday expenses.

For mobile money, one of the largest barriers is a lack of trust and understanding or awareness regarding its use. Its lack of central bank backing and unreliable acceptance at different agents or vendors particularly reinforce low trust in mobile money among both low-income and middle-income earners. Furthermore, agents are more concentrated in urban areas, implying that the already financially constrained rural population are required to travel far to cash in or cash out (CICO), if they are able to receive at all.

Value chains are also not yet sufficiently digitised to incentivise the acceptance of e-money at all points. The digital ecosystem therefore remains shallow and dependency on cash remains high. For many consumers, shallow ecosystems can result in high CICO transaction costs in terms of not only time and effort to travel to CICO points, but also monetary expenses such as fees.These costs have the potential to inhibit the number of active consumers of a MMO scheme and the number of consumer interactions within such mobile money agent networks.

In support of the above, two recent GIS studies undertaken by Cenfri indicate that the MMO agent ecosystem expands the financial service reach by no more than five kilometres from a traditional brick-and-mortar financial institution.

Mobile money, unlike cash, is also subject to an array of e-money[3] and other regulations that can hinder both the incentive to use and the business case to provide the service. These regulations necessarily stem from the inherent risks mobile money schemes pose to the broader stability of the financial system, as well as monetary policy, given its co-circulation with central bank money (i.e. physical cash) and its potential to undermine the integrity of the system. This is due to the potential for internal operational failure, security threats and susceptibility to disproportionate taxation, among other reasons. Examples in SSA include:

- The imposition of mobile money taxation on mobile transfers (e.g. Kenya and Uganda)

- Rules-based customer due diligence and know-your-customer procedures that limit access for consumers and impose high compliance costs for providers

- Stringent licensing and partnership requirements

- Regulatory uncertainty between different regulators within the digital payment space (e.g. delegation of power between Communications Authorities and Central Banks)

Supply cost drivers are among the most severe constraints faced by MMOs. In addition to the burden of onerous regulation, supply cost drivers can range from poor national infrastructure such as underdeveloped electricity, roads and network coverage, to high operational costs relating to the management of agent network systems and the maintenance of liquidity for both e-money and the transportation of cash. In addition to these, one of the most constraining costs for suppliers relates to the clearing and settling of mobile money transactions.

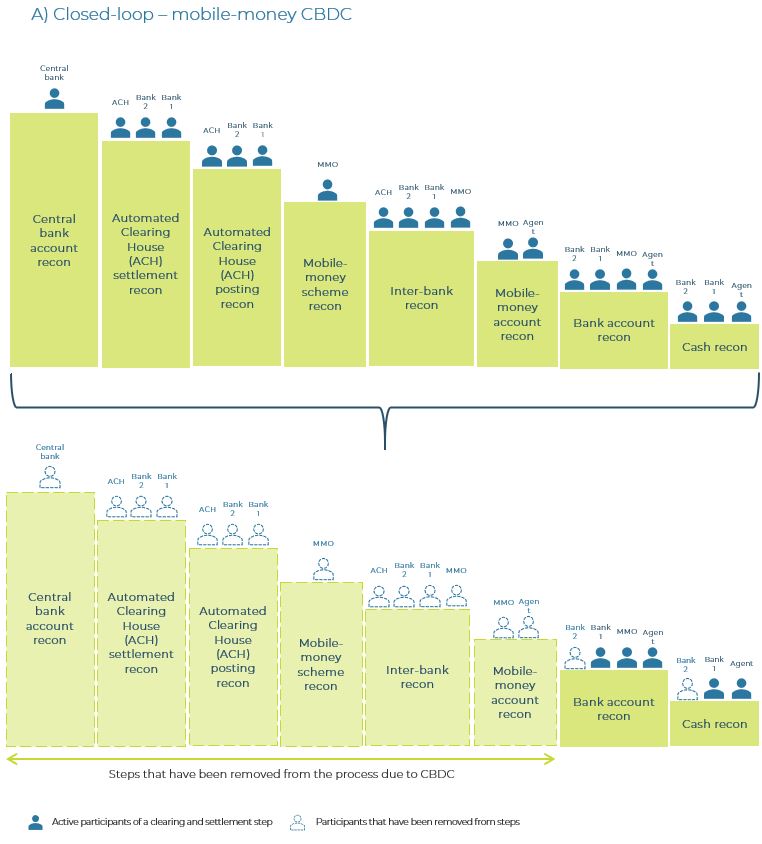

As illustrated in Figure 3, in order for an MMO to reconcile a transfer between two individuals on its own closed-loop network, a range of costs are incurred due to the multitude of sequential steps and third-party intermediaries that are involved in the reconciliation of a single transfer. These intermediaries can include agents, commercial banks, and the local or regional automated clearing house (ACH), as well as the central bank

itself. The costs these actors resultantly impose can range from cash to mobile money schemes and ACH reconciliation costs. These costs, both in terms of time and money, are often passed on to consumers through higher transaction fees.

For MMOs seeking to facilitate transfers across different networks, these costs can be even greater. This stems from the fact that although all mobile money schemes may be functionally the same, the design of each provider’s token is fundamentally different, thus requiring bespoke channels to clear and settle payment between different providers via standard, stepwise national legacy payment systems.

As a result, additional costs relating to e-money accounts and regional bank payment reconciliation may be added on top of existing closed-loop costs. These costs can disincentivise MMOs to support mobile money interoperability to the detriment of consumer convenience and/or can lead to higher costs for consumers to transact.

Source: Authors own

CBDC as a streamlining solution

Retail CBDC can offer a streamlining solution to these MMO reconciliation costs. The essential value of retail CBDC is its ability to act as a direct digital substitute for cash, given its denomination on par with national sovereign currency and status as a universally accepted legal tender within a jurisdiction. Where retail CBDC could therefore feasibly play a role is in the reduction of clearing and settlement reconciliation costs. This could be achieved by underpinning or defining all mobile money schemes and value in terms of a retail CBDC. The universal acceptance of CBDC would enable the clearing and settlement of a multitude of uniquely defined mobile money schemes to be standardised for providers, thus facilitating interoperability between different instruments and channels. This would enable MMOs to send and receive CBDC from any MMO, financial institution or point-of-sale facility with greater ease.

Moreover, the existence of a commonly defined mobile money instrument would effectively reduce not only the number of third-party intermediaries involved in reconciliation processes for providers,[4] but would also reduce the complexity and cost of these processes.

Figure 3 highlights these cost savings through the elimination of actors such as the ACH and the central bank, as well as their associated steps and costs typically involved in both closed-loop and open-looped reconciliation processes. Reducing the complexity of such processes could benefit providers further by lowering settlement risks inherent to stepwise payment systems.

For providers, lower costs and risks to mobile money could ease operational constraints and support investment into more innovative product value-add and delivery.

For consumers, greater interoperability between different mobile money schemes could have the additional effect of increasing the convenience of sending money across platforms at greater speeds and lower transaction costs, thereby encouraging more active consumer use. These gains may, in turn, allow for improved consumer utility by enabling more frictionless and near-instantaneous micropayments, as well as additional mobile money use cases to rival the appeal of physical cash.

CBDC can strengthen mobile money offerings in SSA, but an enabling environment is needed to minimise its risks for exclusion. Mobile money has made inroads into digital payments across SSA, but providers continue to struggle to make a profitable business case. MMOs face numerous barriers to providing mobile money, ranging from context and regulation to driving use among low-income populations.

However, an assessment of how well CBDC could address these constraints reveals that, although it is by no means a silver bullet for financial inclusion, by reducing provider constraints relating to reconciliation costs, CBDC could play an enabling role for providers to offer more affordable and innovative mobile money services.

Other benefits of retail CBDC for mobile money may include faster transaction speeds, greater trust in mobile money and improved convenience or utility to transact across providers to increase active consumer use relative to cash.

However, it is important to recognise that the application of CBDC itself could also introduce or reinforce barriers to mobile money use in SSA. Among others, these barriers could include strengthening digital inequality gaps or incentivising additional rent-seeking costs by providers if interoperability becomes perceived as a threat to business profits.

Therefore, in order for an inclusive CBDC roll-out and digital ecosystem to be established, policymakers and regulators will need to think carefully about structural issues such as access to digital identity and infrastructure, but also regulating for innovation and the contextual realities that may undermine the value of CBDC for consumers and businesses. If these considerations are effectively taken into account, whether through test-and-learn approaches or tailored country diagnostics, CBDC could indeed represent the next frontier for mobile money and unlock its original goal to financially include the unbanked in SSA at an unprecedented scale.

[1] CBDC can be designed as either a wholesale or a retail currency. CBDC in its retail form is most similar to physical cash, given its design to reside within either an e-wallet or an account and to be utilised for frequent and relatively low- to medium-value transactions. In its wholesale form, CBDC represents central bank money that is used to facilitate wholesale payments on national payment systems such as the current real-time gross settlement system.

[2] Mobile money schemes are essentially closed loop as their instruments are not interchangeable. The instruments and schemes can be made to appear interchangeable through complex clearing and settlement mechanisms to switch instruments.

[3] Short for “electronic money,” e-money is stored value held in the accounts of users, agents and the provider of the mobile money service. Typically, the total value of e-money is mirrored in (a) bank account(s), such that even if the provider of the mobile money service were to fail, users could recover 100 percent of the value stored in their accounts. That said, bank deposits can earn interest, while e-money in most schemes cannot (GSMA, 2010).

[4] This comes from its ability to replace these intermediaries with algorithmic protocols or governance rules to trigger reconciliation through some form of automatic consensus among participants. This is in contrast to the step-by-step procedures within legacy systems that require intermediaries to clear and settle payment sequentially (Cooper et al, 2019).

This article was first published on Central Bank Payments News.

This work forms part of the Risk, Remittances and Integrity programme, a partnership between FSD Africa and Cenfri.