Digital platforms’ role in African digitisation and gig work on the back of COVID-19

Digital platforms’ role in African digitisation and gig work on the back of COVID-19

21 April, 2020 •Recent research by insight2impact [1] shows the number of digital platforms – virtual marketplaces – in operation across Africa increased by 37% between 2018 and 2019. These platforms had already been estimated to provide income-generating opportunities to 4.8 million workers across seven countries in 2018. As industries affected by physical-distancing COVID-19 measures race to reconfigure value chains, could platform business models hold the key to accelerated digitisation? Moreover, what will happen to the livelihoods of platform workers who have been engaging in place-based working activities, and who are strongly dependant [2] on this source of income? We explore these and other burning issues in this blog.

Platform business models and workers pivoting in response to COVID-19 measures

There are clear winners and losers emerging in the platform ecosystem amid the COVID-19 crisis. The sudden disruption of economic activity brought on by COVID-19 means that many companies have had to rethink their business strategies, with demand for face-to-face services, non-essential goods and leisure providers having been heavily curtailed. Anecdotal evidence suggests African businesses have already started pivoting towards the provision of essential goods and services, leveraging platform business model features:

- In South Africa, Bottles which has traditionally been a platform operating in the sales and distribution of alcohol could no longer operate due to government restrictions on liquor trade and entered into an agreement with retailer Pick ‘n Pay to leverage its last-mile delivery network to deliver essential groceries to consumers during lockdown.

- Nigeria, eCommerce and payments startup Jumia is partnering with vendors to use its ePayment and last-mile delivery capabilities to offer contactless delivery of food and other necessities to all areas, including remote and rural locations.

- GetBoda, a logistics/courier platform, reported a 150% increase in demand for delivery services during one week in April, which they expect to rise further, based on Caribou Digital’s applied research.

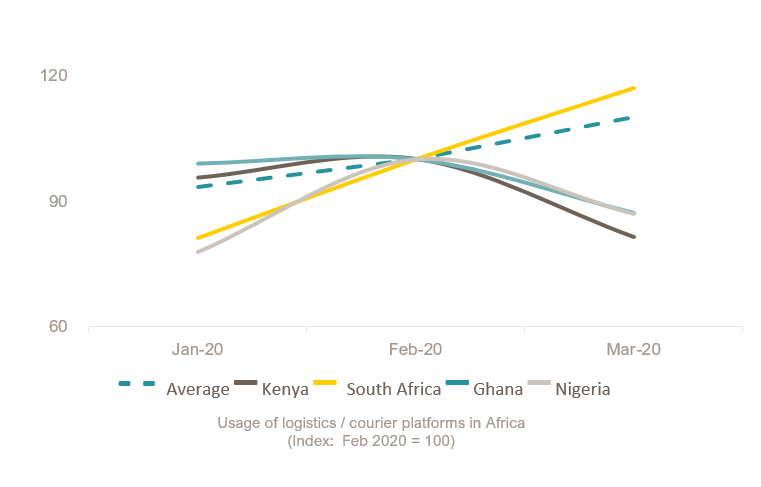

These are only a few of examples of how platforms have been pivoting in response to the crisis, and we think that logistics/courier and on-demand shopping service operations are likely to flourish in the very near term as physical-distancing measures remain in place. Early high-frequency data we analysed for March shows that in South Africa, where the government put a national lockdown in place, user activity on logistics/courier platforms has rapidly risen (see Figures 1 and 2). Many lockdown measures across key African countries only started to be implemented from late March, but we expect this trend of rising demand for logistics/courier services to continue and take hold in other key markets.

Figure 1: Overview of lockdown measures for selected African countries

Figure 2: User activity on logistics platforms in South Africa rapidly rise; other markets likely to follow

For platform workers, the ability to pivot work activities as consumer demand shifts will have a strong bearing on their ability to be financially resilient. For platform workers in the e-hailing sector for instance, they already have the necessary skills and equipment to shift from transporting people to transporting goods. For local artisans, there is the option of moving toward producing much-needed personal protective equipment, such as masks for health workers. Despite the potential for these shifts in work activities, we think most types of platform workers may find it challenging to pivot work activities in the near term, due to the variation in skills, regulatory requirements (licenses), capital assets and/or raw materials required in new sectors of work. Moreover, in the e-commerce sector, as it becomes more difficult to import products due to COVID-19 trade restrictions imposed, securing and maintaining inventory locally will become pivotal for those workers and platforms who seek to continue operations in the online shopping sector.

Limited social protection highlights vulnerability of platform workers

In addition to difficulty pivoting work activities, platform workers generally lack the social protections that traditional employees have access to. There is potential for donors and the larger development community to get involved in this challenge as the current crisis has highlighted the vulnerability of workers across the world [3]. Platform workers are particularly vulnerable as they lack many of the formal protections that traditional employees are afforded, such as paid sick leave and limits on dismissal. Depending on the geographic context, platform workers fall somewhere between employees and self-employed and global labour legislation does still generally not account for adequate employee protections. As stimulus packages are being prepared around the world for businesses and workers impacted by COVID-19, platform workers may be left out from support initiatives, as has happened in Malaysia.

Immediate support is required to protect platform worker livelihoods. Platform workers are under significant financial pressure while they are unable to find work opportunities and fulfil them in place-based sectors of work. There is a clear need for financial support to these workers during this time, as anecdotal evidence suggests that they have limited pools of financial reserves and other support mechanisms available to them. The private sector, including platforms, has undertaken novel approaches to support workers during the crisis but given their early-stage maturity in Africa [4], they lack adequate financial reserves to fully accommodate the loss-of-earnings experienced by workers. One early initiative includes SweepSouth’s COVID-19 Sweepstar Fund that is utilising crowdfunding to provide an income during the lockdown for domestic workers that use their platform. Airbnb has launched their Superhost Relief Fund that provides relief to hosts that have lost a significant share of their earnings due to COVID-19. Uber has also provided two weeks of sick leave for drivers that have either contracted COVID-19 or ordered to self-quarantine.

Looking ahead, digital platforms can play a crucial role in accelerating digitisation in Africa

The looming global recession is likely to increase the number of unemployed across the world and capacity building for workers and small businesses in Africa should be rapidly prioritised. Digital platforms, including social media applications, provide an opportunity for individuals to easily access consumers and new self-employed work opportunities. However, as a growing pool of job-seekers looks to join the platform ecosystem, a range of skills in business management, as well as training on the digital tools, will be required, amongst other skills. According to Hilda Kragha – CEO of Jobberman Nigeria – the youth, in particular, may need a combination of digital and hard skills to become productive in rapidly digitising African economies. Looking ahead, we think the changing nature of platform work activities is likely to shape longer-term policy responses in areas such as digital skills, the portability of platform benefits and social safety nets for workers.

So, do platforms have a role to play in the digitisation of Africa’s economies during the COVID-19 crisis? We and our recent webinar attendees believe so, with 96% of attendees indicating that they agree that platform business models have a role in economies going digital during the current crisis. A recording of the past webinar is available here in case you missed it, and we encourage our readers to join the rest of the webinar series as we continue exploring key issues around Africa’s digital platform ecosystem.

To engage with our team on data access, research collaboration and/or forthcoming project opportunities to fund, contact digitalplatforms@cenfri.org.

The authors would like to acknowledge the contributions of Hennie Bester, Melanie Fairhurst and Hannah Sack in production of this blog, as well as the high-quality insights put forward by our webinar speakers: Annabel Schiff (co-Director, Caribou Digital), Herman Singh (CEO, Futures Advisory) and Hilda Kragha (CEO, Jobberman Nigeria).

[1] A systematic review of eight African countries was conducted in 2019, and the publicly available database of digital platforms can be accessed here.

[2] 55% of platform participants in Research ICT Africa’s survey said platform income was essential for meeting basic needs.

[3] Mark Graham. (2019). Digital Economies at Global Margins.

[4] African platforms are on average five years younger than non-African platforms.

insight2impact (i2ifacility) was funded by Bill and Melinda Gates Foundation in partnership with Mastercard Foundation. The programme was established and driven by Cenfri and Finmark Trust.