The detrimental effects of COVID-19 and lockdown on the livelihoods of female-headed households in Kenya, Nigeria and South Africa

The detrimental effects of COVID-19 and lockdown on the livelihoods of female-headed households in Kenya, Nigeria and South Africa

25 May, 2020 •In our previous article we took a first look at the different ways in which COVID-19 and its associated economic measures impact men and women in Kenya, Nigeria and South Africa. Using the nationally representative survey data from the COVID-19 Tracker, in this article we take a closer look at the main income earners in Kenya, Nigeria and South Africa, and the ways in which COVID-19 has affected the way they make a living – particularly focusing on the different experiences of men and women.

As countries are considering how best to maintain and phase out lockdown measures, it is important to look at the ways in which different segments of the population are affected, to allow for targeted policies and support. The data clearly shows us that women’s livelihoods are, in general, affected more severely by the COVID-19 responses in all three countries. And not only this, but they also earn income in different sectors, which experience different challenges and effects as a result of lockdown measures. In interpreting these insights, please keep in mind that the survey data only accounts for two genders (men and women), and thus doesn’t allow us to provide insights on individuals beyond the gender binary.

Looking behind the main income earners: On average, women support larger households

Overall, household’s main income earners are more likely to be male than female in the three countries. However, households that are reliant on women’s income are on average larger. Men are roughly twice as likely as women to be single or support households of only two people. This means that the impact on female main income earners will have a larger ripple effect than that of men, given that their livelihoods need to cover more individuals. For example, in Kenya, 40% of main income earners are women, supporting 44% of individuals. In Nigeria, 21% of main income earners are women, supporting 23% of individuals.

On average, women experience greater income deterioration

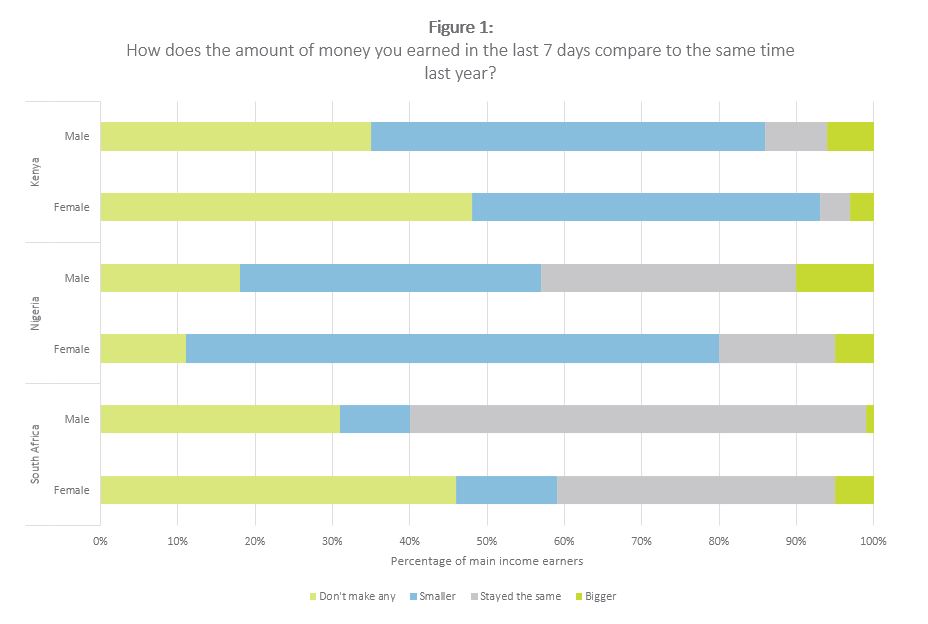

Across our three countries, main income earners largely indicated a decrease or complete loss of income compared to last year. Women are more likely to indicate this negative impact than their male counterparts (see Figure 1). In fact, men are almost twice as likely as women to have their income stay the same as compared to a year ago. Interestingly, men in Kenya (6%) and Nigeria (12%) are more likely to have lost their jobs since 1 March than women (2% and 1% respectively).

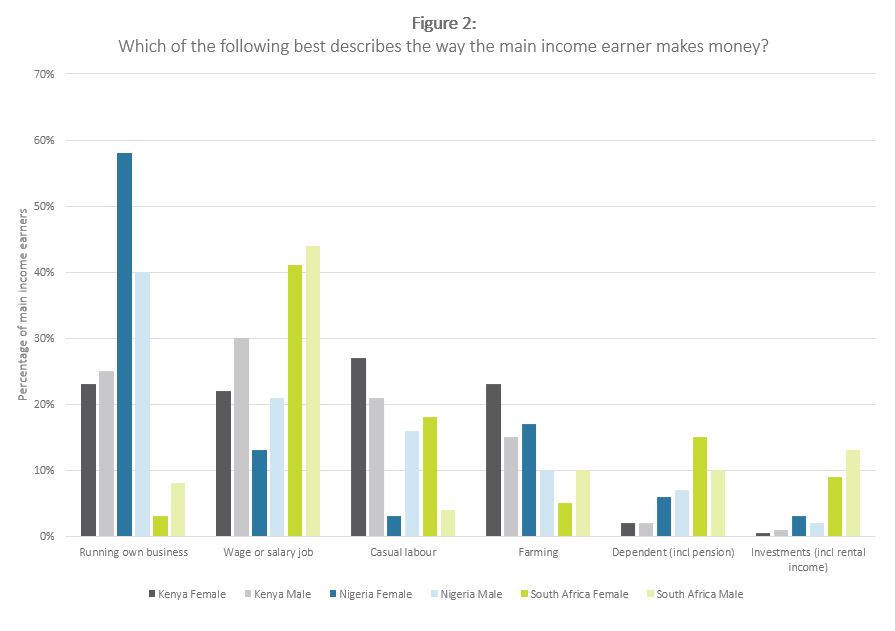

Taking a closer look at the different types of occupation that male and female main income earners engage in, respectively, gives us a clearer indication of what might be causing and influencing these decreases in income. As becomes clear from Figure 2, men are more likely than women to make a living through salaried employment (either formal or informal), which increases their chances of receiving unemployment benefits, or being able to access support provided by an employer (such as through credit).

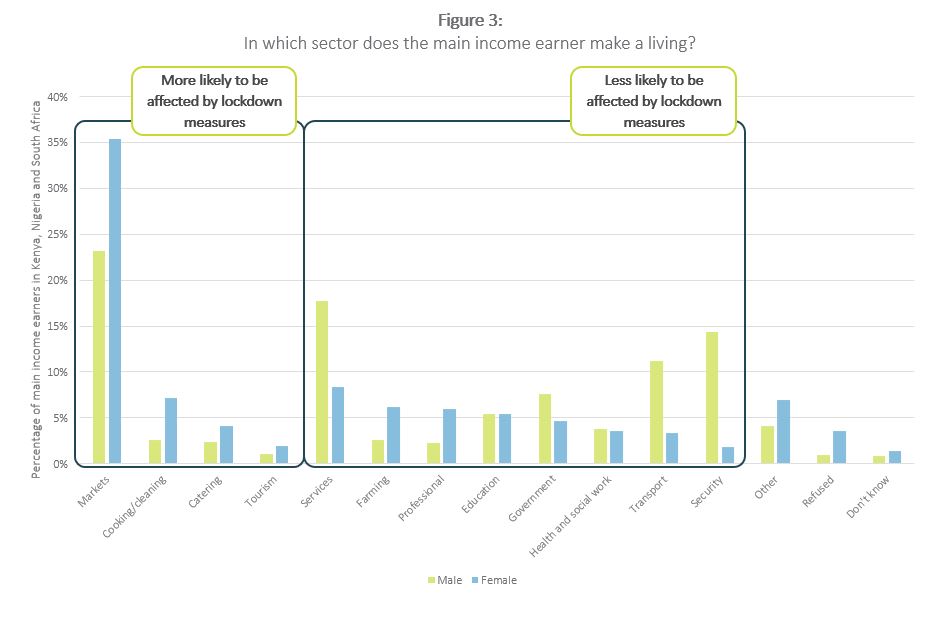

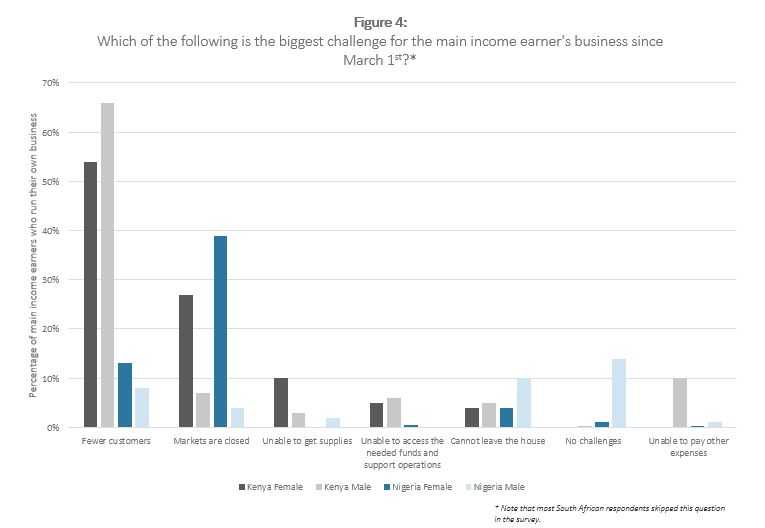

Diving deeper into specific industries shows us how the livelihoods of male and female main income earners might be affected differently by lockdowns (Figure 3 summarises all three countries). The most common industries for main income-earning women, across all three countries, are “markets” or “selling goods”. While this is similarly a source of income for many men, they tend to show a greater spread across industry types. What’s more, around 50% of women make a living in sectors that are more likely to be affected by various lockdown measures – compared to just under 30% of men. While both men and women indicate having fewer customers as a significant challenge to their livelihoods, women are significantly more likely than men to suffer from the fact that markets are closed – effectively putting a stop to their income-generating abilities (see Figure 4).

Taking a closer look at specific income types:

- Business owners seeing a greater deterioration in income: Running their own business is the most common way for women to make a living in Kenya and Nigeria. Women’s businesses are more likely to operate in markets, and their closing is thus a more substantial challenge than for male business owners. With regard to changes in income earned, business owners indicate a greater deterioration than the average. Interestingly, the gender gap in these income changes seems to be smaller for business owners than for the average main income earners.

- Farmers appearing slightly less vulnerable than the average: At 23% in Kenya and 17% in Nigeria, farming is an important way of making a living for women. When considering income changes, agricultural earners are a little less likely than the average to indicate a deterioration (either an absence or decrease of income). While agriculture is typically considered a relatively vulnerable source of income, reliant as it is on weather patterns and seasonal income streams, the current crisis is casting a new light on what we consider vulnerable or secure. With food production being a critical service, even under lockdown, it stands to reason that livelihoods in agriculture are less likely to suffer from business closures.

It seems that external help is currently mostly absent in dealing with these business challenges. The overwhelming majority of main income earners have not received any emergency government support in the last month. Most main income earners have likewise not borrowed any money in the past 14 days – whether male or female.

Takeaways: Shining a light on priority areas for support

Taken together, these insights give us an indication as to the sectors that need to receive prioritised support to ensure women and the households they support are not left behind. The income earned by female main income earners is more likely to deteriorate, and supports on average larger households – indicating greater economic vulnerability for a significant part of the population. This vulnerability warrants specific attention, to ensure our designed responses leave nobody behind.

We have seen that many women are self-employed and are suffering from the fact that their business can’t operate under lockdown: Women are particularly affected by the closure of markets, as compared to men. Where it is not feasible to safely open markets, we may consider how to support women in changing delivery options or develop e-commerce solutions. Digital platforms might be an answer here, but one mustn’t forget the gaps that exist in digital skills and digital access. While e-commerce solutions are on the rise during the pandemic, it is important to support those unfamiliar with such novelties: from setting up telephonic support, mentoring through messaging between peers (through virtual peer groups), or targeted community interventions, we can ensure that women have the means to take advantages of the advances in technology to boost their income.

The following presentations provide more detailed underlying data used in this article.