Encouraging the uptake of health insurance through SMS communication

Encouraging the uptake of health insurance through SMS communication

11 April, 2022 •How to seed connections with customers through SMS and DMs

The last two decades have seen extraordinary growth in digital connectivity, particularly due to the growth in mobile technologies. In sub-Saharan Africa (SSA), for example, 93% of the population had mobile cellular subscriptions in 2020, up from 76% in 2015 (World Bank, 2020a; World Bank, 2020b). The rise in new technologies has radically transformed how people seek out and engage with a wide range of services, including health care. A range of mobile health (mHealth) solutions, which are platforms that enable access to healthcare via mobile devices, have emerged and enabled better access to healthcare, particularly in developing markets where many individuals struggle to access and pay for health services (WHO, 2018; Brown, 2021). For example, CarePay is a digital platform available to Kenyans and Nigerians that facilitates access to healthcare and allows participants to send, receive and pay health funds and insurance premiums, and save money to cover healthcare needs.

Information overload

However, the rise in digital technologies and communication means that people often face an information overload. Think about the number of times you receive an SMS from your gym, bank, insurance provider or telemarketer and how many of these you instantly mark as read, move to your spam inbox, delete and just outright ignore. We are faced with thousands of choices and bits of information each day, which can easily lead to people feeling overwhelmed. This decreases individual’s cognitive ability, can lead to poor decision making and even result in feeling tired and irritable (The Decision Lab, n/d). Overcoming attention deficits and message fatigue is thus becoming as important as the messaging itself.

Issues with information overload constrain the extent to which individuals can realise the benefits from new solutions and is particularly challenging in the context of selling insurance digitally. SSA is plagued with low insurance uptake (Schlemmer & Rinehart-smit, 2020; AIO, 2020) due to low levels of trust and limited awareness and understanding of insurance among individuals. These barriers, in combination with information overload, can lead to people overlooking solutions that are sold or accessed through digital channels, which actually would help them manage/overcome some of the key challenges they face and improve their welfare.

Behavioural science-based interventions

Leveraging insights from behavioural science can help healthcare and insurance providers better understand human behaviour and use these insights to better design and deliver services to customers. There are various examples where financial service providers (FSPs) have developed practical and implementable behavioural interventions to either reduce the cost of acquiring new customers, servicing/ retaining current customers or improving the financial behaviour and customer’s use of financial products (e.g. improving loan repayments, savings, etc.)

We wanted to explore how insights from behavioural science could be applied to drive the uptake of an existing health microinsurance product in Kenya. To do so, we partnered with Britam and M-TIBA and used nimble evaluations to test the effectiveness of SMS-interventions on encouraging positive health behaviour and increasing interest in the product. These experiments were run over a period of two months from December 2020 – January 2021 among M-TIBA’s existing customer base of over 250,000 individuals who are regularly saving for health purposes.

Nimble evaluations

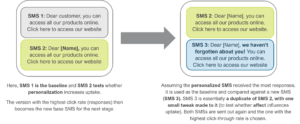

Nimble evaluations are a means of testing multiple hypotheses for behaviour change over time to move towards the most effective behavioural intervention. This involves making small and incremental changes to product features /communication strategies to overcome behavioural barriers and follows a round robin approach to arrive at the most effective intervention design. Using SMS interventions as an example, the diagram explains the process of conducting a nimble evaluation:

Behavioural interventions

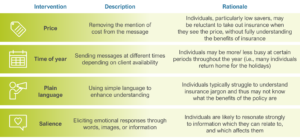

A behavioural intervention is any customer interaction that has been explicitly designed to influence the financial decision (or behaviour) of an existing or potential customer (Smit and Chetty, 2018). We tested four behavioural interventions:

Key insights

Understanding the needs and realities of customers is a key starting point when it comes to designing effective communication strategies. By tweaking the SMSs, we were able to gain some interesting insight into what resonates with customers:

- Firstly, people with lower savings are more likely to respond when price is excluded from the messaging, suggesting that the price may be seen as a barrier to taking out insurance. Thus, FSPs should consider using different messaging for those with high and low savings rates.

- Secondly, it became clear that the time of year has a significant impact on individuals’ willingness to explore insurance options. Response rates were low in December and early January because many individuals are on holiday and travelling during this time. Therefore, it is It is worth considering what events customers are facing during a given time period.

- Lastly, the funeral benefits SMS resonated more with men, while women preferred the original SMS. This might suggest something about who manages large household expenses and the fact that men might feel more of a need to provide for their families. Thus, communication strategies should take gender into account to improve their effectiveness.

However, behavioural tweaks are not appropriate to overcome all barriers. It became clear that product affordability is key, with many customers not taking out the product because they did not have a high enough savings balance to be able to afford the product with just their savings on the platform. Consideration needs to thus be given to how the premium payments can be made more manageable among low savers (i.e. breaking annual premium payments into monthly or weekly payments, as well as aligning premium payments with periods where individuals receive income).

In addition, the overall low response rates across the experiments suggest that SMSs alone may not be the best way to reach lower income consumers. Across Africa, many individuals prefer to engage through physical channels (e.g. agents and brokers accounted for 47% to 62% of policies sold based on premiums across seven SSA markets in 2016 )(EY, 2016). Therefore, it would be useful to consider alternative channels to supplement the SMS communication sent out to customers, such as agents, as well as promoting the product on social media, television and radio.

If you would like to learn more about the interventions we tested, you can read the presentation or contact Jeremy Gray.