Health insurtechs: from incremental digitisation to full digital ecosystems

Health insurtechs: from incremental digitisation to full digital ecosystems

6 May, 2020 •Health – and the welfare implications of illness – has rarely been more front of mind than in light of the ongoing COVID-19 pandemic

As a think tank looking at the role of the financial sector in society, we have been tracking trends in health insurance for a number of years, to help build financial resilience for households in the face of health shocks. For the most part, providing sustainable health insurance to the lower-income market has proven very challenging, with few success stories to note. It is therefore heartening to see that more and more innovators are looking to harness the power of technology to do just that.

While some just make incremental changes to their offerings and channels based on the use of tech and data, we are starting to see some examples of a digital ecosystem being built to form the heart of the offering. By a digital ecosystem, we mean a business model built on tech that leverages data to understand customers so well that they can tailor offerings to their needs. It also allows insurers to reward customers for managing their risks effectively.

Cenfri compiled an Insurtech Tracker to monitor trends in the use of technology in insurance in emerging markets. We took a closer look at our 2019 database update to see what it can tell us about the role of health insurtech in building data ecosystems for better health insurance outcomes.

Four categories

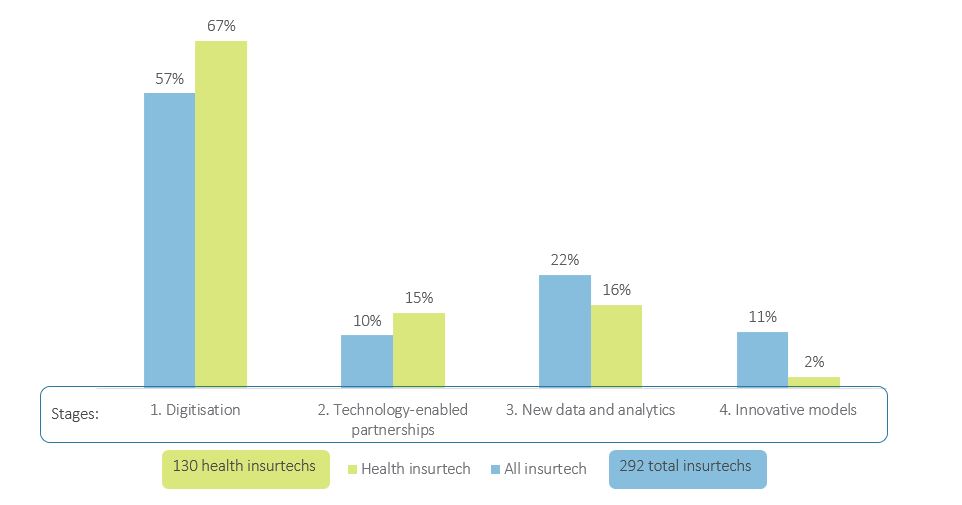

Nearly half of the 292 insurtechs in the database offer health insurance products. As a framework to understand the types of insurtechs, we grouped them by how data and tech-intensive the applications are. We identified four groups of insurtechs:

Digitisation: In the first group, tech is used to digitise existing insurance and health processes for efficiency gains. Thus, tech is an enhancement to the core insurance business model rather than shaping the insurance business in new ways. By applying tech, data is generated on consumers, but the offering is not structured around the mining of such data.

Technology-enabled partnerships: The second group is structured around a partnership between an insurtech and another organisation, often a distribution partner. The partnership forms the heart of the model, and, relies on digital processes like those found in category one.

Source: Insurtech Tracker (2019)

New data and analytics: The third category is characterised mainly by the use of digitally collected data and the use of tech for in-depth analyses thereof to support the core insurance business model.

Innovative models: The fourth group of insurtechs use data and tech to provide insurance in innovative ways that change, rather than enhance, insurance processes.

As we move down the list of insurtech groups we come closer to a digital ecosystem being built: each category makes progressively more use of tech to transform the way that data is harnessed and insurance is designed and delivered.

Let’s take a closer look at each category in turn

As shown in Figure 1, emerging market insurtechs mostly still fall in the first group, and this is even more so for health insurtechs. Health insurtechs need to understand and integrate with the health sector systems, which can add additional complexity and may result in their ‘digital development’ lagging behind other insurtechs. Yet there is much promise as models start to evolve towards a digital ecosystem.

Digitisation

The first and most prevalent insurtech application is where insurers use tech – either in-house or via the use of outsourced technical service providers – to digitise their systems, for example by replacing costly paper-based processes and records with digital platforms. By digitising processes, insurers benefit from immediate economic and efficiency gains. For example, WeeCompany, in Mexico, provides a digital backend platform for health insurers to optimise operational and administrative processes. Other insurtechs focus on digitising customer engagement: GoBear in Asia seeks to make the selection of financial services (including health insurance) easier for customers by offering a product comparison service.

Technology-enabled partnerships

In our initial 2017 study on insurtechs, technology-enabled partnerships accounted for 36% of all the insurtechs in our tracker. They were predominantly partnerships between insurers, technical service providers (the insurtechs) and mobile network operators (MNOs). In the health insurance space, these partnerships include insurtechs like Bima who have expanded the reach of health insurance, reaching 31 million customers in 13 countries around the world. In the 2019 update, we found a decreased focus on technology-enabled partnerships, with only 10% of all insurtechs and 15% of health insurtechs in the database now falling into this category. It was interesting to see a diversification in the partners away from just MNOs:

- A number of health insurers have started to partner with telemedicine providers who provide a particularly relevant value-added service. Telemedicine utilises mobile technology to diagnose and treat patients remotely, which increases access to healthcare services, particularly for patients in hard-to-reach places. Hello Doctor in South Africa and Bradesco Seguros’ Consultation through telemedicine in Brazil offer telemedicine services as value-added service to insurance customers. Telemedicine is also a cost-effective solution in a range of medical fields. Cost-effective access to medical services in emerging markets is particularly relevant as, in addition to annual out of pocket medical expenses estimated at USD539 billion, patients incur costs to visit a doctor such as transport and income loss due to absenteeism from work.

- We are also picking up an emerging trend of insurers partnering with multi-sided platforms that link buyers and sellers. For example, Healthwise in Nigeria provides a range of services including telemedicine, electronic medical records and health insurance sales. If platforms like this gain scale, they could replace MNOs as preferred partners.

New data and analytics

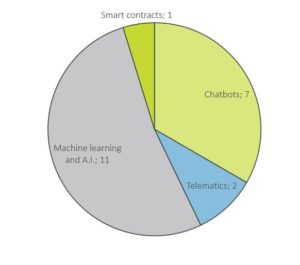

The more interactions happen in digitally-enabled products and systems, the more data is generated that can be analysed to better understand customers. 16% of all the insurtechs in the database are centred on the use of new data and analytics. We identified four different categories of new data and analytics that would classify a model into this category: machine learning and artificial intelligence (AI), chatbots, telematics and smart contracts (see Figure 2):

- Machine learning and AI allow for a better understanding of datasets and trends that evolve over time. For example, Wellthy Therapeautics in India uses AI to modify its behaviour change models to improve diabetics’ health outcomes.

- Chatbots allow software to replace labour intensive communications, such as Inbenta’s multilingual chatbot that facilitates self-service in Brazil.

- Telematics involves the use of wearable devices (like smartwatches) that track a client’s activity. GOQii in India tracks a range of health indicators through their members’ wearable devices as part of a preventative healthcare solution. Based on this information, members receive advice from coaches and doctors on how to meet specific health targets. The aim of this initiative is to demonstrably lower customers’ health risks, which allows them to negotiate cheaper insurance premiums.

- Smart contracts automate contracts, which is particularly relevant for making the payment of claims efficient. Consuelo in Mexico uses blockchain to automate these processes for Saldo.mx.

Source: Insurtech Tracker (2019)

Machine learning and AI is currently the most used tech. In addition to the 11 examples where this is the main defining characteristic of the insurtechs, it’s also present in many of the other examples, as chatbots, telematics and smart contracts often iterate insights from large amounts of data through the use of machine learning or AI.

Innovative models

Only a few models in the database use technology to completely change how insurance is delivered. We identified two such health insurtech models:

- The first is peer-to-peer (P2P) insurance which, as the name indicates, is about people insuring their peers. Platforms help individuals to insure each other by facilitating the pooling of risk of people that customers know or trust. In traditional insurance, the insurer owns the resultant risk pool and can keep any contributions in excess to those required to make claims. By contrast, P2P insurers return excess funds in the risk pool to the participants at the end of the contract period. Thus it is a form of digitally enabled mutual insurance. Most P2P health insurtechs are still in the pilot phase, for example Protectiq who uses blockchain to facilitate cancer insurance in Ghana.

- Demand-based insurance provides cover only when customers need it, covering either a short predefined time or a specific event. For example, Toffee in India offers insurance for specific health risks, such as dengue fever as well as short-term travel insurance. Demand-based insurance products must be very carefully developed as adverse selection bias is likely to be high, especially in healthcare.

Towards a customer-centric digital ecosystem

These categories all support greater use of data to better understand customer needs. The technology applications across the four categories can be used to develop a data-rich understanding of customers. As digital processes and analytics become more prevalent, some organisations are starting to develop data ecosystems using customer data drawn from a range of partners. A prominent example is Discovery’s Vitality programme in South Africa. It uses telematics to track how active clients are (Vitality Health) and how well they drive (Vitality Drive), thus including health and non-life insurance products on their platform. In addition, Discovery rewards customers for reaching and maintaining a certain Vitality status with payments into their retirement annuities. The Vitality programme also has partnerships with supermarkets, pharmacies and petrol stations that reward certain purchases, as well as with airlines, gyms and movie theaters to negotiate discounts for members. All this information enables Discovery and their partners to offer clients products as and when they are relevant to their lives, while gaining behavioural insights about their customers from a wide range of activities. These insights are also utilised to lower their risks by, amongst others, incentivising safer driving and the purchase of healthier food.

The building of a data ecosystem draws together the use of data and tech across all four the other models. So how can we facilitate the development of customer-centric ecosystems? There are a few clear pre-requisites for these digital ecosystems to develop:

- The first and most fundamental is infrastructure. Clearly, the ability for technology to innovate is limited where basic infrastructure requirements such as electricity supply and mobile coverage are limited.

- Secondly, digital ecosystems also require new digital skills from customers for them to actively engage with digital products that are becoming a larger share of the economy.

- The third key enabler of access to the digital economy is digital identity, as poorly considered or implemented policy runs the risk of excluding people from accessing digitally provided products or services.

- Lastly, it is also important to consider how regulators encourage innovation while limiting systemic and consumer protection risks. For example, innovative licensing requirements such as the use of cell captives can facilitate easier market entry for innovative models, as evidenced by a number of South African insurtechs making use of this model.

Insurtech is indeed starting to change the face of health insurance. Whether it will be successful in meeting health insurance use cases for a broad base of customers will depend on the extent to which models evolve across the four categories to form a customer-centric digital ecosystem.

This work forms part of the Risk, Remittances and Integrity programme, a partnership between FSD Africa and Cenfri.