Insurance in the age of COVID-19: The pandemic highlights the need for a new approach

Insurance in the age of COVID-19: The pandemic highlights the need for a new approach

20 April, 2020 •For the last decade, Cenfri and other development partners have focused our approach to insurance development on the welfare implications for individuals and households.

This remains valid – insurance plays a critical role in ensuring that people and households have the ability to mitigate unexpected financial shocks, preserve their assets and take productive risks. But if that is our only focus, we miss an important part of the impact we can have.

As development practitioners, we need to recognise the broader role insurance can play in generating economic opportunities. When insurers build the resilience and productivity of businesses, other sectors in the economy can grow. And when insurers use premiums that they have pooled together to invest capital over longer-term horizons in productive opportunities such as infrastructure development, they create jobs, fuel growth and encourage innovation.

The COVID-19 pandemic has amplified the importance of the insurance sectors’ role in development and in the economic resilience of businesses and individuals. As of April 9, a third of the global population was in lockdown to slow the spread of the virus. Lockdown measures have forced many businesses not operating in essential services to temporarily close their doors. While this has a huge impact on all businesses, it is likely to hit micro-small-and medium-sized enterprises (MSMEs) the hardest. Without adequate reserves, appropriate insurance solutions or easy access to credit, many MSMEs are forced to lay off workers – or worse, shut their doors permanently. This, in turn, has devastating effects on individuals’ welfare and economies at scale.

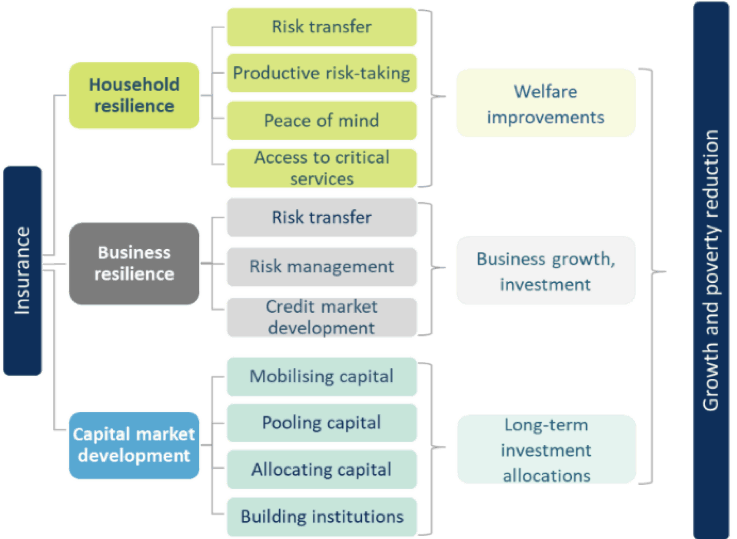

The increasing hardship caused by COVID-19 on individuals, businesses and economies has further highlighted the importance of a sound, stable and developed insurance market, and the role it plays on three distinct fronts, as illustrated by Figure 1 below.

Figure 1: Insurance for growth transmission mechanisms

Source: Adapted from Chamberlain, Coetzee and Camargo (2017)

Building household resilience

It’s easy to understand why retail insurance is a focal point for donors, governments and insurers alike. It is more tangible than discussing the role of insurance in encouraging productive risk-taking for businesses or capital market development. It is also a lot easier to measure the reach and limitations of retail insurance: Although consumer data is not perfect, it paints a clear picture of where the gaps and opportunities lie.

Our research shows that across Ghana, Kenya, Nigeria and Rwanda, only 4.1 million adults (on average just 3% of the adult national population) are estimated to have insurance beyond state-provided health coverage. In each of these markets, there are large untapped opportunities: 50% of adults in these countries should be easy to reach but are not covered by insurance. We define them as being “easy to reach” because they have a bank account, own a mobile phone, are formally employed and earn the equivalent of US $5 a day or more.

Policymakers and regulators have a key role to play in driving innovation in their markets, which would enable insurance providers to reach these customers and strengthen the resilience of their households. They can wield a number of tools to remove barriers to innovation, facilitate innovative business models and address market constraints. For example, they could focus on broadening licence categories to accommodate new functions and partnerships, streamlining supervisory processes for licensing and product approval, or providing proactive market engagement and communication to catalyse innovation.

Building business resilience

Like individuals, businesses also face risks. Whether it be employee work-related injuries, business interruption, lack of access to credit or damage to supplies, these risks affect how businesses invest, plan and respond to shocks.

While MSMEs contribute significantly to employment and innovation, the reality is that many fail or remain stagnant, which negatively impacts the sector’s ability to fulfil its employment and growth potential. Insurance cannot be the sole solution for addressing the obstacles faced by these businesses, but it can play an important role in bolstering their survival rate.

Making this role a reality is challenging, though. Business data – such as information on business’ revenue, risks or constraints – is limited and often difficult to decipher, given the informal nature of MSMEs and their complex insurance needs. It is also difficult and costly to reach the multitude of informal MSMEs in the absence of strong aggregators that connect them. This makes it challenging for insurers to tailor products for these businesses, and prevents the development community from having a nuanced conversation about how to better serve them. Overcoming these barriers deserves much more of our attention.

These challenges also hold for enterprise insurance in the corporate sector. Here, it’s important to recognise the risks as they occur in different economic sectors or value chains. For example, risks faced in the logistics and transport value chain may be very different than those faced in the construction value chain, yet current corporate product offerings tend to be generic and rarely differentiate risks or constraints faced by different sectors or value chains. Addressing these risks requires insurance companies to move beyond reactive risk transfer, by designing products that prompt better risk management and mitigation by businesses.

For insurance to fulfil its potential in building resilience for businesses, the sector needs to explore alternatives to traditional broker distribution models, in which brokers take responsibility for sourcing large corporations and selling them insurance products which best cover the risks they face. Broker distribution models for MSMEs are neither attractive to brokers nor appropriate for MSMEs. However, innovative digital platforms, such as Sendy, present viable alternatives for insurers to serve MSMEs, as they already act as aggregators for MSMEs, and have established trust and communication and payments channels with these businesses. Another way aggregators can support their clients’ insurance needs is through meso-level insurance, in which an aggregator of MSMEs (such as a bank or agribusiness) is the policyholder and distributes pay-outs to its members when the risk event occurs.

For complex business risks, policymakers can reconsider localisation requirements, which typically require local risks to be covered by local insurers. This could enable global insurers and reinsurers to apply specialised skills such as risk modelling to local risks, and build the necessary data for effective risk management. Additionally, policymakers and development partners can help to bridge the data and information gap in the market.

Capital market development

Capital markets play an important role in mobilising private capital to finance domestic development. An underdeveloped capital market will hamper a country’s ability to develop and grow. The insurance sector plays an important role in deepening capital markets through its ability to mobilise, pool and allocate capital into productive opportunities. The role of insurance in capital market development in emerging economies is sometimes seen as secondary to the goal of greater access to insurance among retail customers. But insurers can be important players in providing capital for investment and growth – a role that is even more pertinent in developing countries given the dire need for long-term financing for growth. However, insurers as institutional investors have not yet fully reached their potential in this regard.

In fact, insurers may not yet be capable of mobilising significant amounts of capital in many markets. For example, the combined size of insurance assets across Ghana, Kenya, Nigeria and Rwanda was less than US $10 billion in 2016, which is smaller than the total assets owned by the South African insurance sector alone. However, insurers still have an important role to play in capital market development, as they are among the few domestic private and professional institutional investors in many African countries.

To build the role of the insurance sector in capital market development, policymakers and regulators need to focus on incentivising the long-term savings of individuals to help build insurance sector assets. This can be done by building linkages with the pension market – such as through the insurance annuities market or through insurers’ role as asset managers for pension funds – which mobilises a much larger, long-term investment pool. The development of appropriate investment instruments with an attractive risk-return profile, such as infrastructure funds or real estate investment funds, will enable insurers to diversify their risks and allocate their capital to more than just short-term treasury bills, which insurers currently favour. This, however, is a long-term solution.

How the development community can maximise the impact of the insurance sector

The broader set of roles of the insurance sector, as outlined in this article, are too important to continue to be neglected. Broadening our perspective will require the development community to reimagine the role of insurance in our programming. First, we need to build a deeper understanding of how insurance can support growth, through its role in business resilience and capital market development. Then we need to consider what actions need to be taken by policymakers, regulators, insurers and development partners to ensure that it fulfils this broader role.

In 2018, the Department for International Development, the Centre for Disaster Protection, FSD Africa, Cenfri and the World Bank partnered to take the first step in this process, by conducting insurance for growth diagnostics in Ghana, Kenya, Nigeria and Rwanda. By analysing consumer and business data, taking a close look at regulation, and talking to a range of in-country stakeholders, we came to understand what it will take to unlock insurance for growth in each country. We then synthesised findings to draw cross-cutting conclusions on how to close the risk-protection gap for individuals and enterprises, and facilitate the intermediation role of insurance to support sustainable growth and development. Six imperatives emerged:

- Ensure visible and proactive policy leadership to unlock change: The insurance sector needs policy leadership that translates into a clear mandate for the regulator, as well as effective coordination across government and industry.

- Supervise risk rather than rules to raise standards: Regulators need to move towards risk-based, proportionate supervisory approaches and ensure that their systems encourage technical expertise and the sufficient use of data within insurers.

- Drive innovation to strengthen resilience: Regulators need to create space for responsible innovation and use their channels of engagement with industry to trigger innovation.

- Re-engineer compulsory products to deliver better societal outcomes: Policymakers and regulators need to ensure that compulsory insurance products, such as third-party liability for motor vehicles, are achieving what they are meant to, rather than creating misplaced incentives and cannibalistic competition in the market.

- Unlock risk transfer and management for enterprise development: Policymakers and regulators should work towards an insurance sector that helps large corporations and MSMEs to not only transfer their risks, but also manage them.

- Invest insurance assets for development: Policymakers and regulators need to make sure that the insurance sector is fulfilling its role as an institutional investor and is contributing to productive opportunities.

The insurance sector can help to manage risks and transfer funds to individuals and businesses when unexpected crises like COVID-19 hit, and it can aid in economic recovery by enabling capital to flow into investments and lending practices. But most insurance markets still need to develop further to achieve this potential. This requires policymakers, regulators and the insurance sector to take action on the steps above, as appropriate to their markets. If changes are made now, the sector will be able to more effectively mitigate and respond to the current crisis – and to the inevitable crises of the future.

This article is the first in a larger series, which is an initiative of FSD Africa, Cenfri, the World Bank and the Centre for Disaster Protection. Over the course of the year, these institutions will publish a series of articles to examine each of these imperatives in turn – and how they can be achieved. To access the full series, please visit Cenfri’s website. Contact us at kate@cenfri.org or thomas@fsdafrica.org for more information.

This article was first published on Next Billion as part of the Openi2i series an initiative of Cenfri and Finmark Trust.