New partnership: Findexable and Cenfri

New partnership: Findexable and Cenfri

8 May, 2020 •Findexable and Cenfri are excited to announce the signing of their new partnership agreement. This partnership is designed to contribute to an increasingly thriving fintech ecosystem in emerging markets, with a particular focus on Africa.

The African continent is home to some of the world’s fastest-growing fintech hubs. Its supportive business ecosystems are having an effect: four African cities are in the top 100 fintech hubs globally. There’s still work to be done to improve the prospects for the region’s talented youth and access to the digital economy for all citizens but with Africa being the home of mobile payments and having the ability to leapfrog to nimbler banking infrastructure and technology, the region is ripe for disruption.

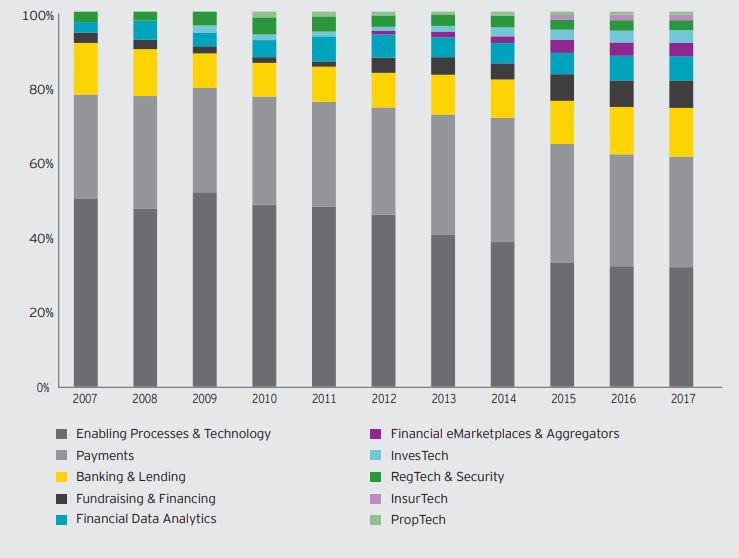

This is a market where fintech is making a difference already, and the potential for impacting society in a real way – notably through enabling financial health – is enormous. Long gone are the days in which mobile money, famously pioneered by Safaricom’s M-Pesa in Kenya in 2007, was the hallmark of local fintech innovation. African fintech has expanded beyond paytech to include digital credit, various insurtech initiatives, digital solutions for savings groups and a growing number of wealthtech solutions, demonstrated by EY who identified a growing diversification of African fintech since 2007 (see image below).

To best support and track this development, it is important to understand the context within which fintech innovations are developed. After all, innovation doesn’t happen in a vacuum, and a host of ecosystem stakeholders come together to generate the necessary enabling environment.

Findexable’s Global Fintech Index (GFI) tracks, on a global scale, both enabling environments and fintech firms themselves. They currently track fintech ecosystems in 21 countries across Africa and the Middle East, including 14 city hubs in Africa. This allows local fintech ecosystems to track their growth, benchmark themselves, and identify leverage points for the development of more inclusive and impactful fintech solutions. The GFI currently ranks Johannesburg, Nairobi and Lagos as the continent’s biggest fintech hubs. Through this new partnership, Cenfri and Findexable will collaborate on mapping and verifying data on African fintech ecosystems, and to support the growth of Africa’s other fintech hubs. Moreover, we will work together to develop thought leadership based on this data.

Denise Gee, Co-Founder of Findexable, comments: “We are thrilled to have Cenfri on board as part of our Global Partnership Network. The contributions of our local partners are vital to ensuring the value and relevance of our Index. We are already looking ahead at the additional insights that this Index might provide – such as the impact of fintech on women’s economic empowerment, and the contribution of fintech solutions to achieving the Sustainable Development Goals globally – and look forward to answering such questions with our thought partners by our side.”

Doubell Chamberlain, Managing Director of Cenfri, comments: “We see great value in making this key ecosystem more visible as it, in turn, has the ability to make individuals, households and small businesses visible who previously weren’t. This industry has great potential to enhance the financial health of African workers, families and businesses. Data-driven insights are key to our work, and we are excited to join this global network that is committed to increasing the data available on the African fintech ecosystem.”

This partnership sees Cenfri building on our existing landscaping efforts, such as our Insurtech Tracker and African Digital Platforms database, as well as our commitments to supporting innovation ecosystems, through our ecosystem mapping efforts and the DataHack4FI.

The initial scope of the partnership includes:

- Collaborating on data collection and validation to map fintech ecosystems in Africa

- Collaborating on key research pieces building on the Global Fintech Index, developing insights into fintech’s contribution to sustainable development

- Co-hosting and supporting industry convenings and learning sessions

- Supporting strategic network growth and facilitation

Contact us for more information on Cenfri’s work in supporting fintech ecosystems.