Savings groups: Exploring the collective individualism of Kenyan women’s financial lives

Savings groups: Exploring the collective individualism of Kenyan women’s financial lives

31 March, 2020 •As we reflect on International Women’s Month 2020, we look back on the different things we’ve learned about women’s financial needs, and all the things we are yet to learn! Under the banner #EachForEqual, International Women’s Day 2020 drew attention to the importance of collective individualism – recognising that we are all part of the whole and can pull together to contribute to more equal economic empowerment. But beyond being part of the collective, this slogan also reminds us that we are individuals, confirming the responsibility for individual action, and the value in recognising each individual.

As a data-driven organisation, we see the value in collecting more data to enable impactful action, but also see the danger in the average hiding insights on the individual. This is particularly relevant when it comes to sex-disaggregated data on financial needs and financial services usage: Serving female target markets is hampered by the fact that data about women is often pooled into one homogenous group – thus obscuring the variety of sub-segments and their individual realities.

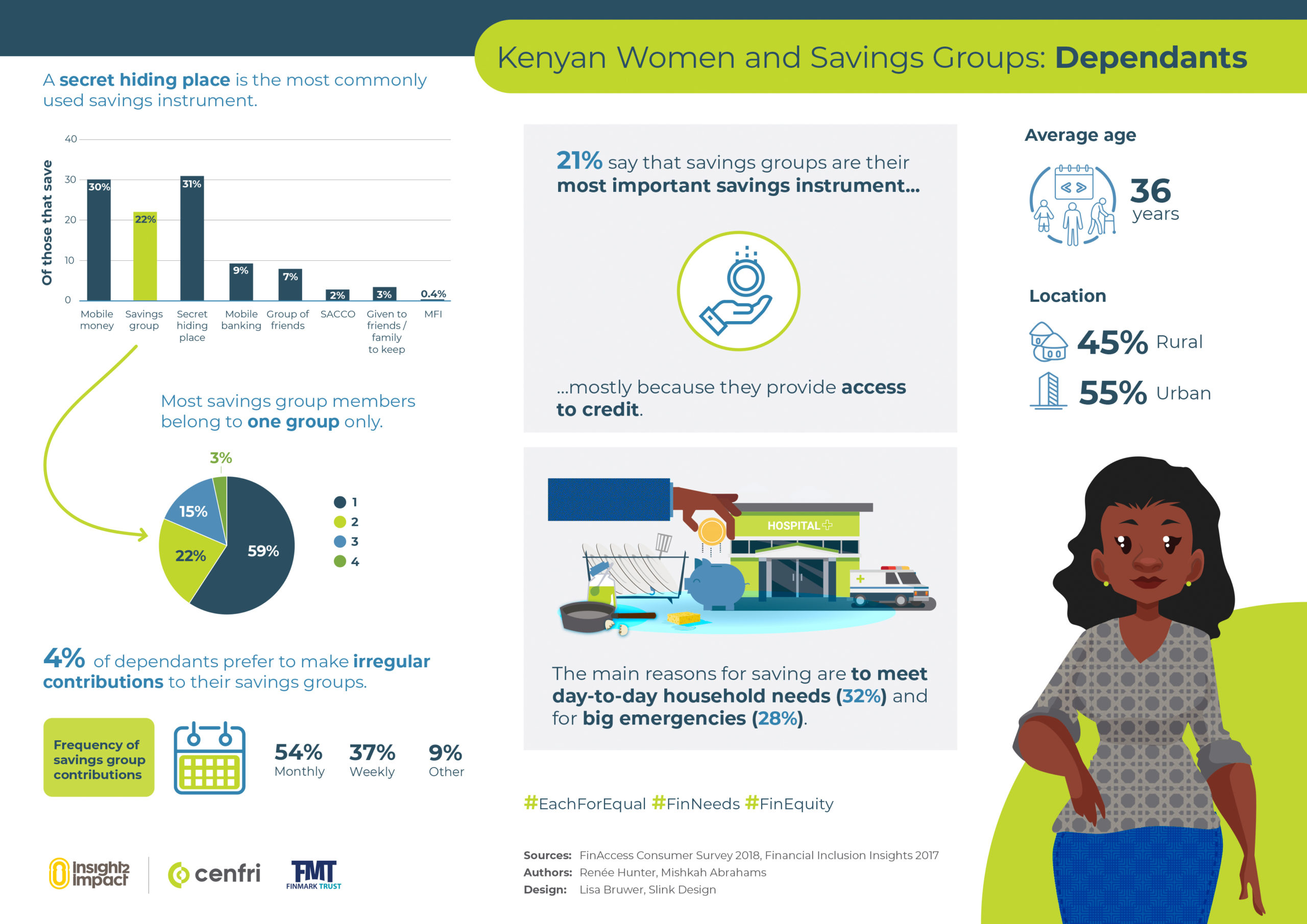

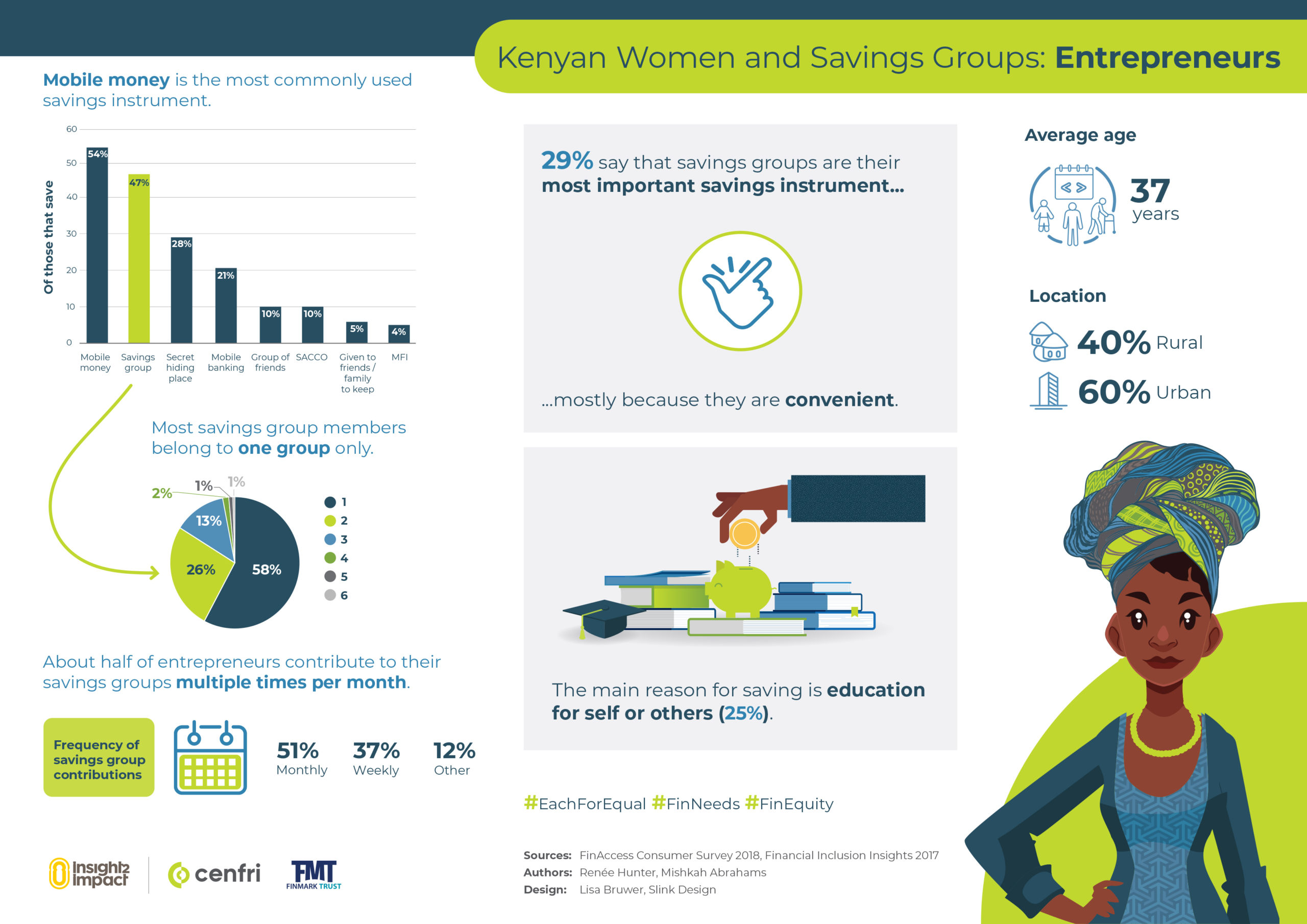

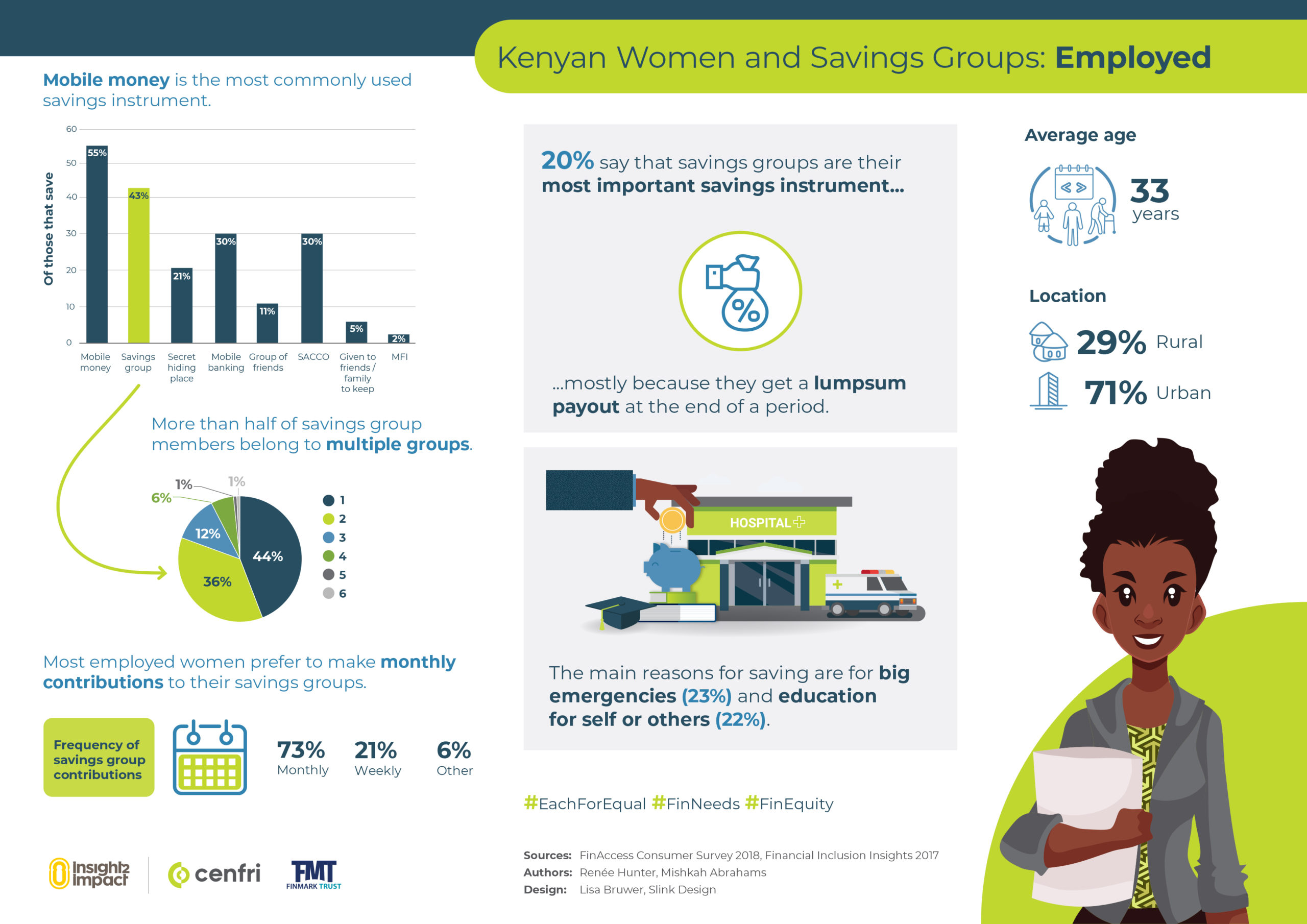

In applying a gendered lens to our work, we are committed to unpacking the collective to give a more nuanced understanding of the various segments. Here we do that through an in-depth view of the different ways that Kenyan women make use of savings groups – a widespread example of collective individualism in many Africans’ financial lives.

Savings groups, also known as chamas, ROSCAs, or merry-go-rounds, are an informal financial tool in which groups of people come together on a regular basis to make contributions to a pot, the total of which is periodically paid out to each group member in turn. Often, such groups fulfil multiple roles in their members’ lives, including social and business support and access to credit, which members can’t access via formal providers. The 2019 FinAccess survey reports that 7.6 million Kenyan adults used informal savings groups, which is more than those using insurance (7 million) or pensions (3 million). Clearly, this is a financial tool of note for the Kenyan population, and even more so for Kenyan women; where 22.5% of Kenyan men use informal groups, this number stands at 37.4% for Kenyan women.

This infographic series delves into four different groups of Kenyan women, segmented by income source, and explores the different ways in which they save, and the role that the collective individualism of savings groups fulfils in their financial lives.

insight2impact (i2ifacility) was funded by Bill and Melinda Gates Foundation in partnership with Mastercard Foundation. The programme was established and driven by Cenfri and Finmark Trust.