The rise of African digital platforms

The rise of African digital platforms

16 October, 2018 •Early findings from our African digital platforms and the future of financial services research

An increasingly digital and connected Africa is providing new ways for entrepreneurs and consumers to participate in the economy. To better understand the related opportunities and challenges, the i2i facility has embarked on a journey across eight African markets to explore:

- The landscape of digital platforms

- The individuals who economically benefit from these platforms

- The relationship of these platforms and platform participants to the financial sector

Early findings from Ghana, Kenya, Nigeria, Rwanda, South Africa, Tanzania, Uganda and Zambia show more than 300 unique digital platforms match providers and consumers of goods and services (also known as multi-sided platforms [1]). These platforms operate in diverse economic sectors, including transportation, online shopping, asset sharing and professional services.

What do we know about digital platforms in Africa so far?

Most of the digital platforms in Africa are homegrown. Much of the digital-platform conversation in Africa relates to the activities of foreign platforms (such as Uber and Airbnb). Our study has, however, found that across our focus countries more than 80% of the digital platforms were founded in Africa. The remainder of the platforms primarily originate from North America (7.8%), Europe (6.8%) and Asia (1.4%).

Foreign platforms lead cross-border scaling. We found that 37 platforms operate in more than one African market. Roughly half of these platforms are homegrown platforms, such as Jumia and Twende. Foreign platforms, however, represent nearly 70% of the 24 platforms that operate in three or more of our focus countries.

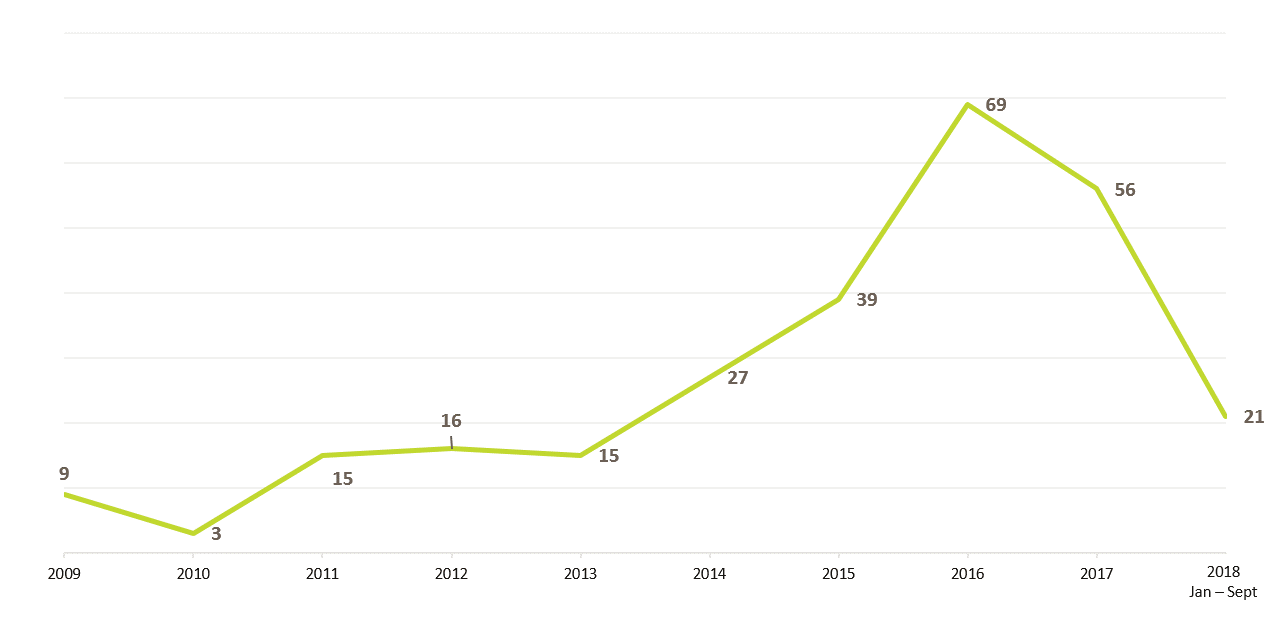

2016 recorded the largest number of new platform launches. The number of new digital platforms launched annually, across our focus countries, increased steadily between 2013 and 2016 (see Figure 1). Platforms launched in 2016 mainly match consumers and providers along e-hailing (e.g. Fone Taxi), online shopping (e.g. Edwom) and freelance activities (e.g. HelpOga)

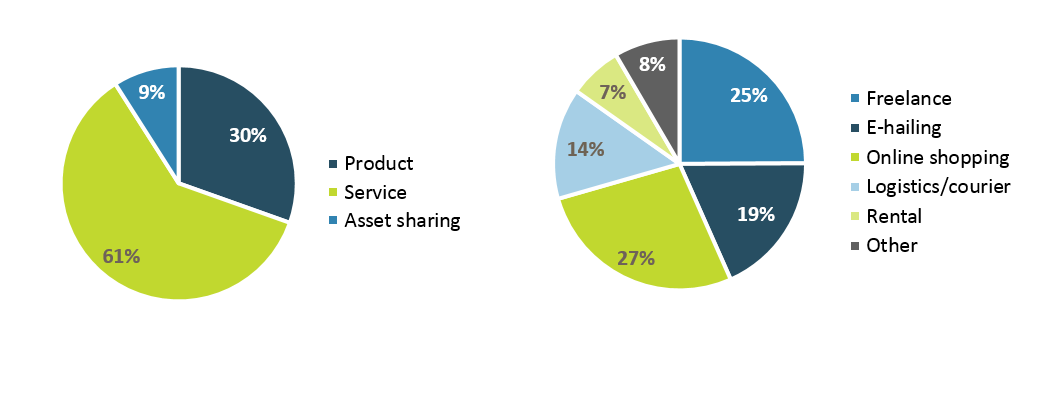

Most platforms match providers and consumers of services. More than 60% of digital platforms match services such as transport (e.g. Safeboda), courier (e.g. USGoBuy), and professional (e.g. Paydesk) and domestic tasks (e.g. Emakatt Kenya). This was followed by platforms that match physical products (30%) and that allow for asset-sharing (9%). Our study further identified that a quarter of platforms operated in the freelance[2] or microwork arena.

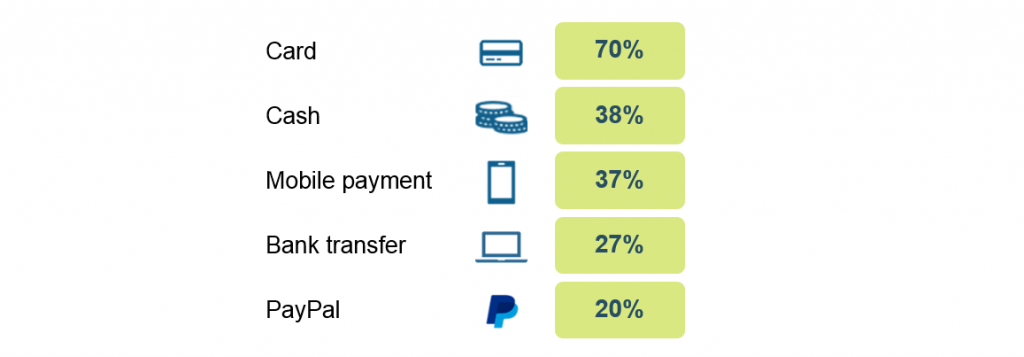

Platforms have adopted multiple payment options. Credit and debit cards are the most common payment options available to consumers: At least 70% of platforms offer a card option for consumer payment (see Figure 3). This was followed by cash and mobile payments. Interviews with platforms providers suggest that cash and digital wallets were primarily introduced to serve customers who do not have, or who prefer not to use, other payment options.

Next steps for African digital platforms and the future of financial services

We have published an interactive online database with key characteristics of the 300-plus digital platforms that we have identified across our focus countries in Africa. Over the coming weeks, we will continue to supplement our initial findings with infographics, interviews with platform providers and survey data on platform users. Our objective is to advance our understanding of:

- Financial services requirements for platform participants. In addition to the payment options available to consumers, we will collect data on the financial services requirements that platforms place on providers of goods and services. This will advance our understanding of the financial needs of these platform participants.

- Relative size of platform participation. We are partnering with Research ICT Africa to quantify the number and key characteristics of individuals in our focus countries who generate income from digital platforms.

- Partnerships between platforms and financial service providers. We also intend to investigate the partnerships between digital platform providers and the financial services sector that are, or have the potential for, making platform economies more inclusive.

Please engage with us on this research initiative via email (comms@cenfri.org or chernay@i2ifacility.org), and follow #AfricanDigitalPlatforms for live updates from our team.

[1] We define a multi-sided platform (MSP) as a virtual space that derives value from facilitating direct interactions between consumers and providers. For example, the platform Uber Eats can be considered a product platform and a service platform, as it connects participants across three sides of the platform: the consumer of food is matched with a restaurant (which supplies a good) and a delivery agent (which supplies a service), i.e. the Uber driver.

[2] Freelance refers to all on-demand services provision (including, but not limited to, digital micro-tasks, remote freelance services and domestic tasks).

[3] We adopted a multi-tagging approach to the classification of digital platforms, i.e. a platform is categorised based on matching activities across all possible sides of the platform, and the classification data in Figure 2 refers to digital platforms launched between 2009 and 2018.

[4] Based on the available data we have collected for 85% of the total unique number of platforms so far

insight2impact (i2ifacility) was funded by Bill and Melinda Gates Foundation in partnership with Mastercard Foundation. The programme was established and driven by Cenfri and Finmark Trust.