Then and now: Is Ethiopia at an inflection point after 15 years of insurance underdevelopment?

Then and now: Is Ethiopia at an inflection point after 15 years of insurance underdevelopment?

22 February, 2024 •Very little has changed in the Ethiopian insurance industry over the last fifteen years but there is a potential silver lining: a few fundamental changes are setting the scene for potentially dramatic shifts in the financial and insurance sector.

In 2008, I was excited to make my first trip to Addis Ababa. It was one of the first global projects of the newly established Cenfri (we turned 15 last year and if you are curious about what we have been up to during that time, see here). We were commissioned by the International Labour Organization (ILO) and United Nations Capital Development Fund (UNCDF) to conduct a comprehensive microinsurance diagnostic as a basis for designing recommendations to develop the insurance sector.

Fast–forward 15 years and I was fortunate to be back in Addis for insurance work. This time through donor support from FSD Africa’s Risk, Resilience and Regulatory (R3) Lab to undertake a capacity-development workshop on enabling innovation to support the development of the insurance market. This work with the Ethiopian industry and regulator follows an insurance innovation review Cenfri conducted for the R3 Lab across eight markets: Ethiopia, Nigeria, Ghana, Rwanda, Malawi, Kenya, Zimbabwe and Uganda.

The sobering finding was that very little has changed in the Ethiopian insurance industry over the last fifteen years. There is however a silver lining: a few fundamental changes are setting the scene for potentially dramatic shifts in the financial and insurance sector over the coming years.

Before we consider those fundamental changes, it is interesting to juxtapose the situation in 2008 with the current situation in 2024.

What has changed/improved in the insurance sector?

- Following the microinsurance diagnostic, the Government of Ethiopia took the controversial decision to allow microfinance institutions (MFIs) to underwrite their own credit life insurance. Overnight this transitioned around 1.5m policyholders from the informal to the formal sector. This was a major development given the estimated 300k insurance policyholders at the time. The intention was for this segment to be integrated and regulated under the broader insurance regulation to enable the MFIs as a channel of further value delivery to consumers. However, this sector is still not supervised by the insurance regulator and there are questions about the value offered to clients through insurance products with low claims ratios.

- Overall financial inclusion levels have increased from an upper bound of 11% of adults with some formal financial services estimated in 2007 to 30.5% of adults having a bank account in 2018 [World Bank FI survey June 2021 based on 2018/19 data: pdf].

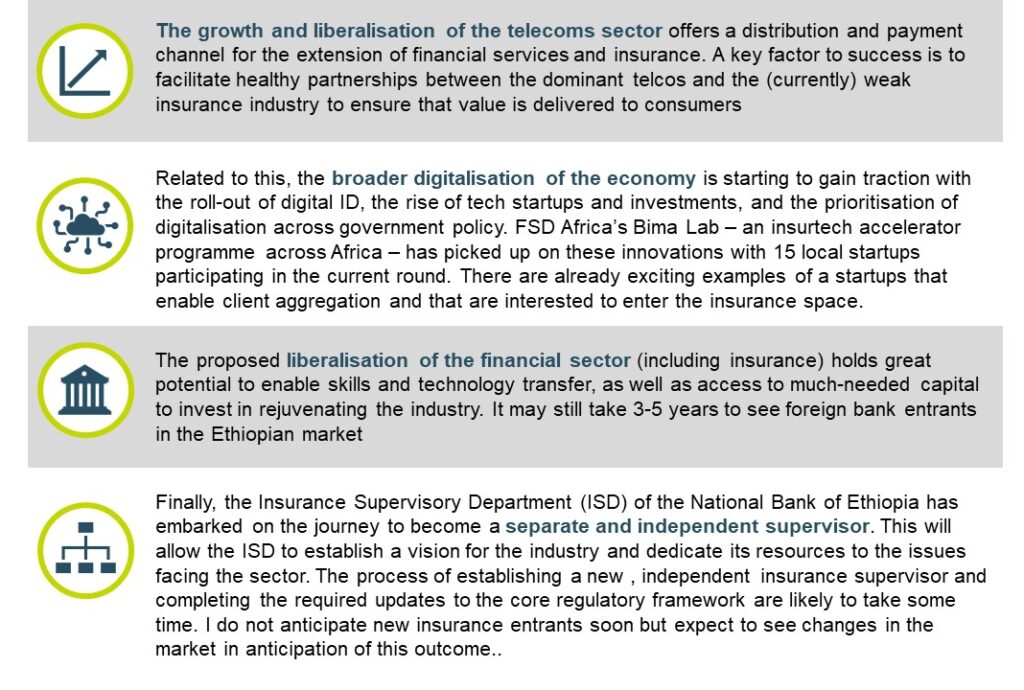

- Mobile penetration has increased dramatically with active connections estimated to cover 54% of adults in 2023 (compared to an estimated 2% of households with either mobile or landline in 2007). In 2020, the NBE allowed non-banks to provide mobile financial services. This triggered the rapid expansion of mobile financial services and was further bolstered with Safaricom’s M-Pesa reaching 2m mobile payments customers within the first two months of launch in August 2023.

- The variety of products has not changed, with few new products being issued.

- There have been repeated agricultural-index experiments, with no apparent progress in sustainability or scale.

- The telecoms market was opened to foreign participants, which saw the entry of Safaricom in August 2023. Indications are that we can expect more rapid expansion and innovation from the telecoms sector going forward. There are indications of early partnerships with insurers, but also challenges to secure insurance partnerships with the now dominant telecoms players.

- In addition to the telecoms sector, the government in 2023 also announced the intention to liberalise the financial sector. It may still take some time before we see the first new entrants/partnerships emerge but the impact on the financial sector should become visible as the industry seeks to adapt to the pending changes.

- The regulator has issued several versions of enabling regulation to facilitate insurance market development (including microinsurance regulation). Take-up of these opportunities remains limited (e.g., there are no registered microinsurers yet) and obstacles remain (e.g. regulatory gaps to enable digital insurance).

What has remained the same/worsened?

- Insurance penetration (ito gross written premiums as percentage of GDP) has, sadly, declined from 0.7% in 2002 to 0.6% in 2022 indicating that the insurance sector is losing ground relative to the rest of the economy.

- Life insurance represented 6% of total premiums in 2007 and remains at 5% in 2023 with fewer than 0.5% of the population estimated to have access to formal life insurance products (note the exclusion in this figure of those covered by credit life insurance through MFIs as these are not regulated under the National Bank of Ethiopia’s Insurance Supervisory Department (NBE ISD).

- The bulk of income-earning opportunities are still in the informal sector. 90% of Ethiopia’s working-age population is informally employed (compared to 94% in 2007) (Cenfri, 2010). This means that they cannot be reached through corporate distribution, plus lack a steady or reliable income source to pay regular insurance premiums.

- Retail product variety remains limited with most still being close copies of products offered by the dominant government insurer.

- The insurance industry has traditionally been fully locally owned with no foreign players allowed (and this is the status quo in early 2024). The government-owned Ethiopian Insurance Corporation (EIC) increased its position as the dominant insurer at 44% of total gross written premiums (2022) compared to 42% in 2007.

- Estimates suggest that Iddir (informal community insurance initiatives) continue to be used by about 80% of the population.

- Digitalisation levels among insurers seemed to have remained limited, with many still struggling to mobilise resources and board support to modernize their MIS systems.

- There is still not a single certified actuary in Ethiopia.

I was astounded to find that so little has happened in the insurance sector. Despite the regulatory and donor efforts to support market development, the market has remained at a virtual standstill. While this may reflect substantial remaining barriers, and was not helped by the impact of the Covid pandemic, the absence of foreign partnerships and entrants has also undermined the ability and incentives to pursue market development.

So, what now? We observe four dynamics, which are likely to result in much faster changes soon:

FSD Africa has been playing an important role in walking the journey with African regulators as they develop action plans for creating a stable and resilient industry within an environment that facilitates innovation. In Ethiopia particularly, this requires that a delicate balance is struck.

With these trends will come disruption from the tech space and, most likely, disruption from foreign entrants. This represents a period of positive flux and, in anticipation of new competition, a mindset change among existing insurers is needed towards the development of a retail market. This will require investment in skills building and partnerships – the fundamentals of market development that have been lacking so far. Cenfri is privileged to support the ISD and FSD Africa on this journey towards a well-functioning Ethiopian insurance market.