Auto Draft

Auto Draft

16 January, 2025 •Over the past three years, the Global Stocktake (GST) embarked on a consultative journey to assess progress towards the objectives of the Paris Climate Change Agreement. The synthesis of these discussions has yielded 17 critical insights, spotlighting both achievements and hurdles in the implementation of the Agreement. Notably, efforts to mitigate climate change, curb deforestation, and safeguard carbon sinks have emerged as significant areas of focus. Environmental crimes, defined as criminal activities that cause significant harm to the ecosystem, pose a major obstacle to the achievement of these goals. Unfortunately, the sheer scale and lucrativeness of unlicensed resource extraction make it a very difficult industry to stop: illegal logging alone inflicts an estimated annual economic loss of USD 17 billion on African economies.

The illicit timber trade extends its influence beyond environmental degradation, having profound implications on security. The Africa Centre for Strategic Studies (2022) notes that it has exacerbated political instability and conflict in regions such as Liberia, the Central African Republic, DR Congo, and Mozambique by providing financial support to warlords and militant groups.

Although traditionally pursued as separate issues, illegal logging and illicit financial flows are closely linked, highlighting the necessity of integrating financial integrity measures in future approaches toward environmental policy.

The high environmental and economic cost of deforestation

The immediate impact of illegal logging is obvious: pristine wilderness areas are replaced by barren and scarred landscapes. However, the more insidious and enduring consequences of deforestation are less immediately apparent. As Africa’s forests disappear, so do the livelihoods of millions of people who depend on them for income and food – leading to large communities of people being displaced. Responsible companies trading in legal and well-managed timber are not immune either as: illegal logging undercuts prices and stifles competition – leading to an estimated US $10 -15 billion loss per year in revenue.

The destruction of Africa’s forests also represents the loss of one of our most effective tools in the fight against climate change. The Congo Basin is recognised as the largest carbon sink on Earth, absorbing and capturing large amounts of carbon dioxide from our atmosphere and replacing it with vital oxygen.

The link between illicit financial flows and deforestation

One of the most startling consequences of deforestation lies in its nefarious connection to organised crime. The low-risk high-reward nature of illegal resource extraction makes it extremely attractive to money launderers.

Trade-Based Money Laundering, defined by the Financial Action Task Force (FATF) as “the process of disguising the proceeds of crime and moving value through the use of trade transactions in an attempt to legitimise their illicit origins,” is one of the most common ways in which illicit financial flows emanating from the underground timber trade is disguised. Utilising trade-based money laundering tactics, such as manipulating invoices, perpetrators camouflage these funds, thereby eroding efforts towards environmental conservation and bolstering networks of financial crime.

The Financial Action Task Force (FATF) is critical in combating environmental crimes by providing a detailed framework to identify and mitigate associated risks. This framework includes the criminalisation of money laundering for a wide range of offences and promotes preventative compliance measures against money laundering and terrorism financing within the private sector. It also empowers law enforcement agencies with the necessary authority to track and seize crime proceeds. Key FATF recommendations cover risk identification and assessment for environmental crimes, criminalising money laundering, encouraging private sector entities like financial institutions and designated non-financial businesses to adopt preventative measures, and equipping law enforcement with the capability to trace and confiscate proceeds from crimes.

Addressing the challenges nations encounter with the FATF’s technical requirements (40 recommendations) and effectiveness criteria (11 immediate outcomes) is crucial. Enhancing the ability of supervisors and financial institutions to integrate environmental considerations into their risk assessments is a significant step forward.

While the World Bank Risk Assessment model offers the flexibility to undertake such integrations, there has been a lack of practical guidance and technical support for institutions and supervisors on how to implement these measures effectively. Cenfri is dedicated to enhancing this support, aiming to improve stakeholder capacity and promote collaboration across sectors for aligning environmental goals with financial integrity. This initiative is crucial for recognising and addressing illicit financial flows, especially from illegal logging, as not just environmental issues but critical financial integrity challenges with significant climate implications.

The application of standards to key sectors, including financial institutions and Designated Non-Financing Business Professions offers a significant chance to curb the environmental impact of these illicit flows. Effective integration of strategies against illicit financial flows and environmental crimes in risk assessments is vital for progress in this domain.

Key actions to addressing the challenge

The Global Stock Take synthesis report clearly identifies the financial sector’s vital role in combating environmental crimes but emphasizes the need for a better understanding of how illegal financial activities are linked to these crimes. This involves identifying the main participants, finding the weaknesses that allow these activities to continue, and understanding how widespread they are.

Key measures to tackle illegal financial flows and environmental crimes include:

- Generating more evidence to understand the issue better. This involves conducting specific diagnostic studies to map out the entire process of climate risk and environmental crimes, including who is involved and where the money originates from. It also means sharing successful strategies and consolidating best practices from different countries and sectors. Furthermore, there’s a need to keep Anti-Money Laundering and Counter-Financing of Terrorism (AML CFT) strategies up to date with the latest insights on illegal financial flows and environmental crimes.

- Providing targeted support to financial institutions and regulators. This includes helping these entities better understand and manage climate risks and related financing issues, such as incorporating these risks into their overall risk assessments and Suspicious Transactions Reports (STRs). It also involves aiding them in aligning their lending and credit decisions with climate finance goals and improving coordination between those fighting illegal financial flows and environmental crimes. Moreover, strengthening the regulatory framework is crucial to curb these issues.

However, a significant lack of guidance and technical support exists for embedding environmental considerations into the risk assessments of financial institutions and regulatory bodies, an area where Cenfri is determined to continue providing substantial support. A unified policy approach is urgently needed to bridge the gap between viewing environmental crimes solely as conservation issues and recognizing them as significant financial challenges. Effective coordination is essential for leveraging the financial sector’s strength in preserving key ecosystems by stopping the financial and trade loopholes that lead to ongoing deforestation.

The FATF standards and tools provide an essential mechanism for the financial sector to significantly contribute towards protection of our planet’s essential carbon sinks. Tackling illicit financial flows alongside environmental crimes is crucial in developing a unified climate mitigation strategy, not just for Africa, but on a global scale.

Over the past three years, the Global Stocktake (GST) embarked on a consultative journey to assess progress towards the objectives of the Paris Climate Change Agreement. The synthesis of these discussions has yielded 17 critical insights, spotlighting both achievements and hurdles in the implementation of the Agreement. Notably, efforts to mitigate climate change, curb deforestation, and safeguard carbon sinks have emerged as significant areas of focus. Environmental crimes, defined as criminal activities that cause significant harm to the ecosystem, pose a major obstacle to the achievement of these goals. Unfortunately, the sheer scale and lucrativeness of unlicensed resource extraction make it a very difficult industry to stop: illegal logging alone inflicts an estimated annual economic loss of USD 17 billion on African economies.

The illicit timber trade extends its influence beyond environmental degradation, having profound implications on security. The Africa Centre for Strategic Studies (2022) notes that it has exacerbated political instability and conflict in regions such as Liberia, the Central African Republic, DR Congo, and Mozambique by providing financial support to warlords and militant groups.

Although traditionally pursued as separate issues, illegal logging and illicit financial flows are closely linked, highlighting the necessity of integrating financial integrity measures in future approaches toward environmental policy.

The high environmental and economic cost of deforestation

The immediate impact of illegal logging is obvious: pristine wilderness areas are replaced by barren and scarred landscapes. However, the more insidious and enduring consequences of deforestation are less immediately apparent. As Africa’s forests disappear, so do the livelihoods of millions of people who depend on them for income and food – leading to large communities of people being displaced. Responsible companies trading in legal and well-managed timber are not immune either as: illegal logging undercuts prices and stifles competition – leading to an estimated US $10 -15 billion loss per year in revenue.

The destruction of Africa’s forests also represents the loss of one of our most effective tools in the fight against climate change. The Congo Basin is recognised as the largest carbon sink on Earth, absorbing and capturing large amounts of carbon dioxide from our atmosphere and replacing it with vital oxygen.

The link between illicit financial flows and deforestation

One of the most startling consequences of deforestation lies in its nefarious connection to organised crime. The low-risk high-reward nature of illegal resource extraction makes it extremely attractive to money launderers.

Trade-Based Money Laundering, defined by the Financial Action Task Force (FATF) as “the process of disguising the proceeds of crime and moving value through the use of trade transactions in an attempt to legitimise their illicit origins,” is one of the most common ways in which illicit financial flows emanating from the underground timber trade is disguised. Utilising trade-based money laundering tactics, such as manipulating invoices, perpetrators camouflage these funds, thereby eroding efforts towards environmental conservation and bolstering networks of financial crime.

The Financial Action Task Force (FATF) is critical in combating environmental crimes by providing a detailed framework to identify and mitigate associated risks. This framework includes the criminalisation of money laundering for a wide range of offences and promotes preventative compliance measures against money laundering and terrorism financing within the private sector. It also empowers law enforcement agencies with the necessary authority to track and seize crime proceeds. Key FATF recommendations cover risk identification and assessment for environmental crimes, criminalising money laundering, encouraging private sector entities like financial institutions and designated non-financial businesses to adopt preventative measures, and equipping law enforcement with the capability to trace and confiscate proceeds from crimes.

Addressing the challenges nations encounter with the FATF’s technical requirements (40 recommendations) and effectiveness criteria (11 immediate outcomes) is crucial. Enhancing the ability of supervisors and financial institutions to integrate environmental considerations into their risk assessments is a significant step forward.

While the World Bank Risk Assessment model offers the flexibility to undertake such integrations, there has been a lack of practical guidance and technical support for institutions and supervisors on how to implement these measures effectively. Cenfri is dedicated to enhancing this support, aiming to improve stakeholder capacity and promote collaboration across sectors for aligning environmental goals with financial integrity. This initiative is crucial for recognising and addressing illicit financial flows, especially from illegal logging, as not just environmental issues but critical financial integrity challenges with significant climate implications.

The application of standards to key sectors, including financial institutions and Designated Non-Financing Business Professions offers a significant chance to curb the environmental impact of these illicit flows. Effective integration of strategies against illicit financial flows and environmental crimes in risk assessments is vital for progress in this domain.

Key actions to addressing the challenge

The Global Stock Take synthesis report clearly identifies the financial sector’s vital role in combating environmental crimes but emphasizes the need for a better understanding of how illegal financial activities are linked to these crimes. This involves identifying the main participants, finding the weaknesses that allow these activities to continue, and understanding how widespread they are.

Key measures to tackle illegal financial flows and environmental crimes include:

- Generating more evidence to understand the issue better. This involves conducting specific diagnostic studies to map out the entire process of climate risk and environmental crimes, including who is involved and where the money originates from. It also means sharing successful strategies and consolidating best practices from different countries and sectors. Furthermore, there’s a need to keep Anti-Money Laundering and Counter-Financing of Terrorism (AML CFT) strategies up to date with the latest insights on illegal financial flows and environmental crimes.

- Providing targeted support to financial institutions and regulators. This includes helping these entities better understand and manage climate risks and related financing issues, such as incorporating these risks into their overall risk assessments and Suspicious Transactions Reports (STRs). It also involves aiding them in aligning their lending and credit decisions with climate finance goals and improving coordination between those fighting illegal financial flows and environmental crimes. Moreover, strengthening the regulatory framework is crucial to curb these issues.

However, a significant lack of guidance and technical support exists for embedding environmental considerations into the risk assessments of financial institutions and regulatory bodies, an area where Cenfri is determined to continue providing substantial support. A unified policy approach is urgently needed to bridge the gap between viewing environmental crimes solely as conservation issues and recognizing them as significant financial challenges. Effective coordination is essential for leveraging the financial sector’s strength in preserving key ecosystems by stopping the financial and trade loopholes that lead to ongoing deforestation.

The FATF standards and tools provide an essential mechanism for the financial sector to significantly contribute towards protection of our planet’s essential carbon sinks. Tackling illicit financial flows alongside environmental crimes is crucial in developing a unified climate mitigation strategy, not just for Africa, but on a global scale.

Policymakers, regulators and supervisors in emerging markets are under pressure to develop, implement and enforce policy and regulation that conforms to global best practice but is effective locally despite considerable constraints. Cenfri leverages the legal background, policymaking and regulatory experience of key team members and assists via direct regulatory development or policy guidance but more often through technical assistance and skills building.

Much of our work has been in the financial sector across Africa, Asia and Latin America. This includes an impressive “regulating for innovation” portfolio in support of financial sector regulators who are grappling with innovation or market development mandates within regulatory environments that do not effectively accommodate the range of risks presented by new financial service innovations. We also support improved digital and data governance in Africa. Examples range from creating a set of scenarios on the possible digital futures in Africa to developing a data-sharing policy for the Government of Rwanda and researching fit-for-context open finance solutions for Africa.

Inclusive market development requires a balancing act to be struck between innovation and consumer protection. Holistically seen, financial consumer protection requires a broad-based and effective regulatory framework, overseen by capacitated supervisors, that covers prudential protection, competition, fair market conduct and effective and accessible recourse for consumers. The objective is to have a suite of products and features that are suitable to consumers’ needs and realities, that are safe from cybercrime and that protect consumers’ privacy, and to have empowered consumers who exercise an informed choice, understand the information disclosed to them, and have their voice heard in their interaction with financial services providers and agents. Ultimately, we want to see financial services ‘working for’ consumers, a harmonised regulatory framework, an oversight framework that is risk-based and sets aside dedicated capacity for market conduct, and monitoring of consumer outcomes that feed back into policy and market decisions.

How should policymakers and regulators navigate what it takes to build a holistic financial consumer protection framework to strike this balance? This requires an understanding of the framework or principles at stake, as well as the local context realities that will inform the approach for each element of the framework. Our report to develop market conduct guidelines for the SADC region takes stock of international principles and guidance to develop a set of best-practice principles for SADC. Based on extensive member state consultations and desk review, it then formulates basic implementation guidance, as well as longer-term objectives, for each principle. The work was commissioned for the SADC Secretariat under the programme “Improving the Investment and Business Environment in the Southern African Development Community Region (SIBE)”, implemented by the SADC Support Consortium comprising FinMark Trust, GFA Consulting and the Southern Africa Trust. The guidelines were validated in a workshop with member states in May 2022, and formally adopted by the SADC Ministers of Finance and Investment in July 2022.

Can digital platforms transform first mile food logistics in Africa?

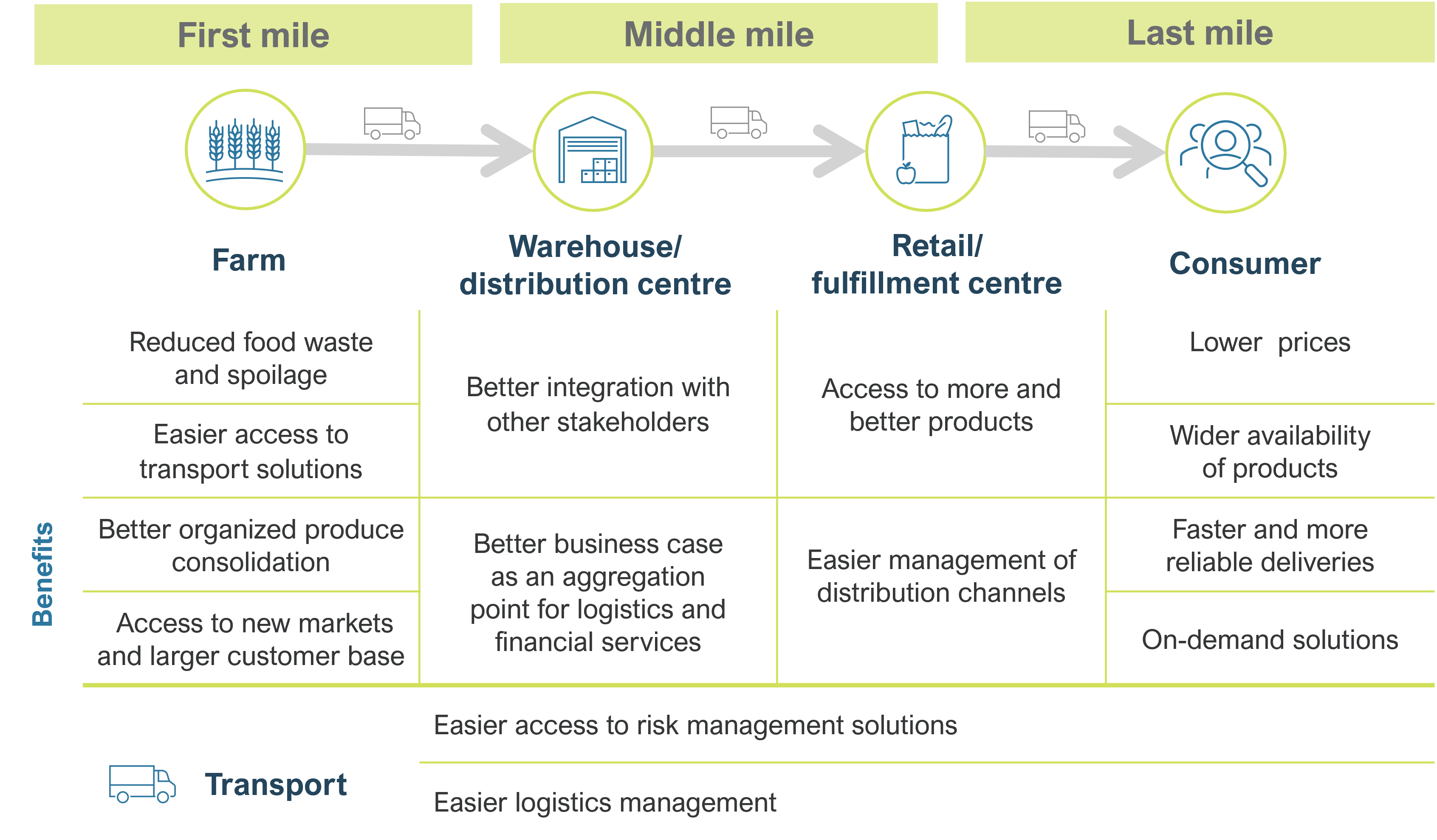

The agricultural sector is responsible for food security and is a major contributor to livelihoods across the globe, but particularly in Africa. The supply chains within the sector are vital to ensuring this contribution but they face severe fragmentation and efficiency challenges. Other industries, including logistics, have been disrupted by digital platforms and we want to explore how logistics platforms could improve the efficiency of food logistics, and by extension agricultural supply chains, in Africa.

The agricultural sector is a key source of livelihoods

In Africa, the agricultural sector employs 54% of the workforce, accounts for more than 32% of the continent’s GDP, and supports the livelihoods of 90% of Africa’s population. Looking ahead, it is predicted that agriculture will be one of the avenues that at least 70% of 220 million young Africans will turn to for income between by 2035. This means that the agriculture sector is a focal sector for improving livelihoods across the continent.

Agricultural supply chains face severe efficiency challenges

There are two key approaches to improving the productivity and global competitiveness of the African agricultural sector:

- Enhance the productivity of farming practices through precision agriculture techniques

- Improve the efficiency and reliability of produce reaching customers

In our research, we are focusing on the second approach.

Transportation and logistics are at the centre of this approach and are a vital element of the food supply chain. Logistics are also crucial to fulfilling consumer demand for deliveries that are accurate, timely and of a high quality, all while limiting food waste.

Some of the challenges that contribute to the poor efficiency of food supply chains are a lack of collaboration and poor communication among supply chain partners, underdeveloped cold chains, and poor road quality. In addition to having bad roads, most smallholder farmers in rural areas have little or no access to electricity to maintain a cold chain. This contributes to about half of the produce from smallholder farms going to waste. All of these challenges are exacerbated by the analogue nature of African food supply chains.

App-based platforms are changing the landscape of logistics

Digital platforms have profoundly transformed the landscape and business case of industries as diverse as hospitality (e.g. Airbnb), software ecosystems (e.g. Google Android), e-commerce (e.g. Alibaba), social media and marketing (e.g. Facebook), and transportation (e.g. Uber). The sweeping changes in these industries are possible because the platforms create digital networks that enhanced coordination, findability, and engagement between actors in the sector and beyond. This collaboration between actors is incredibly difficult in the logistic industry. In this context, the rise of app-based logistics and transport systems can improve efficiency and information flows within and across food supply chains.

Landscape of logistic platforms on the African continent

Similar to other regions, we can observe a rise of digital logistic platforms in Africa – we identified 38 multi-sided digital logistics platforms that operate in Africa and focus on the delivery of goods. The greatest number of these platforms operate in South Africa, Kenya and Nigeria.

There are different models emerging for logistics platforms, with on-demand logistics and parcel delivery being the most common platforms. These platforms usually do not target a specific sector but instead, offer their services across various sectors whereas B2B marketplaces focus either on the retail or the agricultural sector. In the context of first mile food logistics, only a few platforms exist and most platforms connect manufacturers with retailers rather than farmers with other businesses. We only identified three platforms that explicitly target farmers.

App-based platforms can help to overcome some of the key food logistic challenges

There are several features of digital platforms that position them as potential solutions to improve farm-to-table logistics coordination: open and participative infrastructures, simpler scaling mechanisms, and anytime access. Also, the more companies that join a platform, the better the users can leverage each of the companies’ logistics resources to create an integrated chain. And through this chain, previously isolated farmers, aggregation points, warehouses, transportation companies, wholesalers, retailers, and consumers can be actively interconnected. For instance, the B2B e-commerce platform Twiga connects logistic providers, farmers, and retailers through one platform and delivers to 10,000 retailers daily.

This integration could also translate into more efficient aggregation points, better communication between farmers and the rest of the actors in the supply chain, and easier access to transport solutions, thereby supporting a better-functioning supply chain. For farmers, the potential benefits include improved access to on-demand transportation solutions, better organisation of in-farm and between-farms produce aggregation points, increased visibility to consumers that would translate into higher demand for their products, and even access to new markets that they did not have the information or tools to reach before. This reduces the risk of spoilage and food waste at the start of the food supply chain.

Value-added services

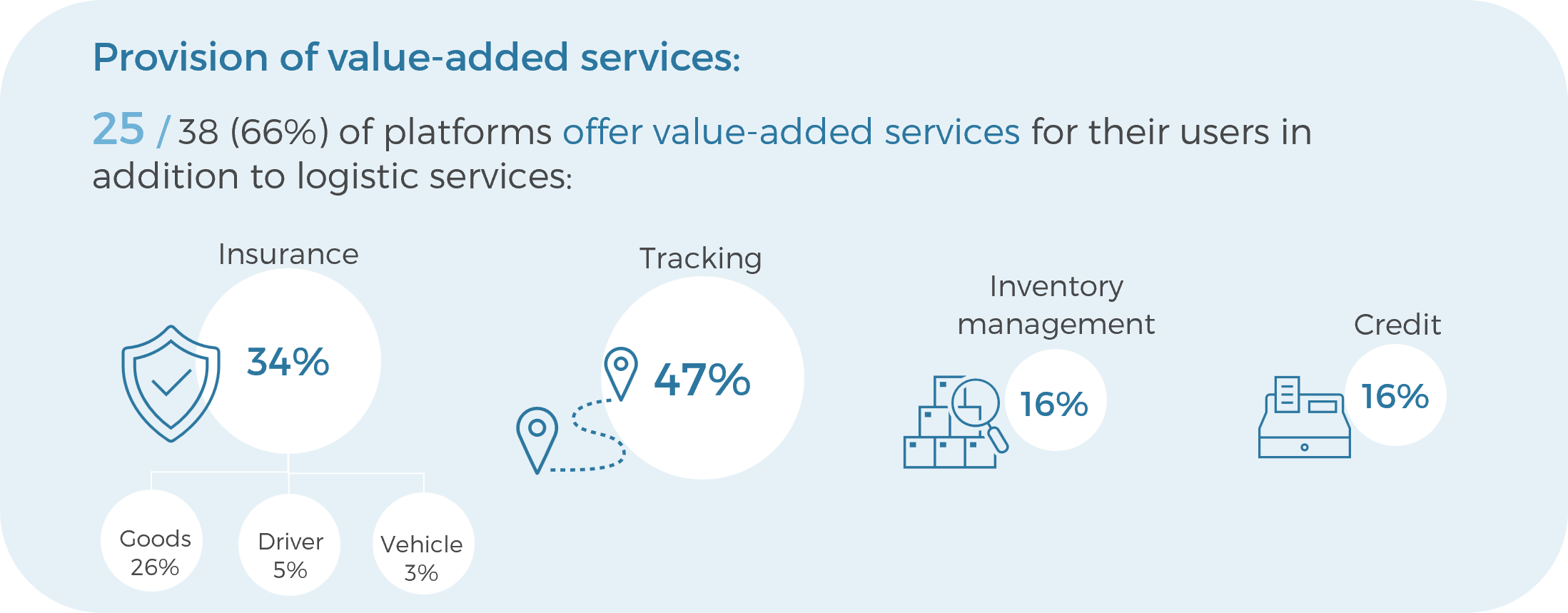

Logistics platforms have the added benefit of offering smallholder farmers access to value-added services they may not otherwise be able to access. Of the 38 logistics platforms we identified operating in Africa, 25 already offer value-added services or products, including insurance, parcel tracking, inventory management and credit. However, the bulk of these value-added services currently focuses on the goods themselves and less on supporting logistic service providers, retail businesses or farmers by increasing their productivity. The Nigerian B2B marketplace TradeDepot is an example of a logistic platform that offers holistic services to its target market by offering an inventory management solution and working capital access to retailers.

The agricultural sector is central to African societies and economies. However, most agricultural value chains are also heavily fragmented and highly inefficient. In principle, digital good logistics platforms can help to address many of these fundamental challenges to the African agricultural sector by connecting farmers to businesses, businesses to businesses, and businesses to customers. There seems to be a clear gap for logistics platforms to coordinate and offer tangible value to the different stakeholders involved along the food supply chain and we already see pockets of this innovation happening throughout supply chains in Africa. In practice, however, on-the-ground challenges like infrastructure, digital adoption and the status quo mean that to unlock this value, platforms will need to do a lot more to integrate farmers into the platforms than simply offer a technologically enabled platform. We will explore some of the critical enablers and emerging solutions in our next article Unlocking the potential of digital platforms to transform food logistics on the African continent.

Loading...

Loading...