Africa’s digital platforms and financial services

Africa’s digital platforms and financial services

30 March, 2019 •Exploring Africa’s digital-platform economy and financial services

The digital-platform economy and its potentially disruptive qualities have been a source of excitement and anxiety globally. In the African context, this debate has taken place largely in the absence of information on the size and nature of platform players. This focus note summarises key findings from a systemic review of virtual market places, also known as multi-sided digital platforms, that operate across eight sub-Saharan African countries. The countries were selected from Southern, East and West Africa and comprise Ghana, Kenya, Nigeria, Rwanda, South Africa, Tanzania, Uganda and Zambia. The platforms were identified and key information on these platforms collected between 26 June 2018 and 14 September 2018.

The focus note forms part of a series that seeks to inform the private sector of the opportunities in the platform economy and policymakers of the (potential) contribution of the platform economy to their markets. The note further highlights the interdependent relationships between the platform economy, the financial sector and inclusive economic participation.

The note explores:

- Digital Africa and the platform economy. We present how an increasing digital Africa has supported the emergence of new platforms that connect providers and consumers of goods and services.

- Characteristics of Africa’s digital platforms. We provide an overview of platforms, the nature of their matching activities, region of origin and the economic sectors they contribute to.

- Payment mechanisms for participating in the platform economy. We consider the six payment instruments that platforms rely on to enable transactions and how these vary by geography.

- Financial services offered by digital platforms. We conclude with a discussion about the financial services distributed by digital platforms and the partnerships with financial service providers (FSPs) that make this possible.

- Country-level infographics on the digital platforms landscape for Ghana, Kenya, Nigeria, Rwanda, South Africa, Tanzania, Uganda and Zambia. The full report includes the details and is available for download.

Key findings on Africa’s digital platforms and financial services

The findings indicate that increased technology investment has unlocked opportunities and has supported the emergence of new digital platforms that connect providers and consumers of goods and services. Furthermore, the average rate of participation in the digital platform economies of our eight African focus countries compared well with more digitally advanced developed countries, and it has been identified that Africa is producing digital platforms that can compete globally.

Of the digital platforms identified in our study, 15% offered one or more insurance, digital wallet, savings or credit product. This was telling of future opportunities for FSPs, and it suggests the ability of digital platforms to extend the reach of several categories of financial services to new or underserved individuals and small enterprises.

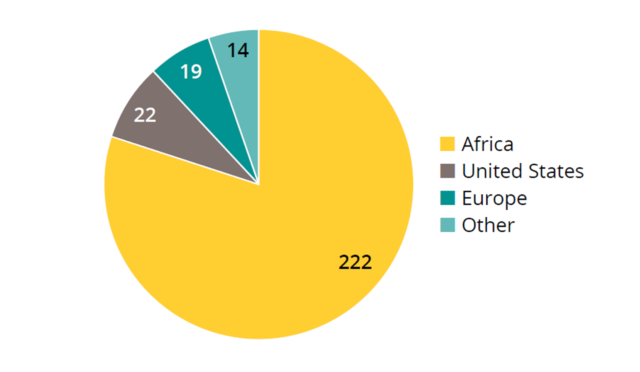

Additionally (as seen above), the research provides more insight into the fact that more than 80% of digital platforms operating in Africa are homegrown – a fact that should get more awareness.

Read the full report below to gain further insight into the interdependent relationships between the platform economy, the financial sector and inclusive economic participation.

insight2impact (established by Cenfri and FinMark Trust) has developed a database of the digital platforms discussed in this research. For more information on the 277 platforms identified in this study, view the database here.

insight2impact (i2ifacility) was funded by Bill & Melinda Gates Foundation in partnership with Mastercard Foundation. The programme was established and driven by Cenfri and Finmark Trust.