MSME resilience in Ghana

MSME resilience in Ghana

15 December, 2021 •In sub-Saharan Africa (SSA), micro, small and medium enterprises (MSMEs) make vital contributions to growth, employment and livelihoods, representing more than 90% of businesses and employing about 60% of workers.

However, the full potential of MSMEs is often not realised as they are highly exposed to risks that threaten their survival, including business interruption, poor access to finance, fire and other perils, as well as larger shocks like pandemics or natural disasters. In Ghana, only 40% of MSMEs survived beyond five years. A focus on enhancing their resilience is vital to unlocking the potential contributions of MSMEs.

COVID-19 constitutes one of the largest systemic shocks to businesses and economic systems in recent history. In 2020, over 90% of MSMEs in SSA experienced significant profit losses due to reduced sales, value chain disruption and indebtedness, among many other risks. In addition, economic players struggled to cope, leaving them ill-equipped to effectively support those impacted by COVID-19. To better understand MSME resilience in light of COVID-19 in SSA, Cenfri and GIZ, in collaboration with the Ghanaian Programme for Sustainable Economic Development (PSED) set out to assess the perceived and experienced risks faced by MSMEs in Ghana and to evaluate the extent to which MSMEs and the Ghanaian ecosystem have remained resilient. The project identified opportunities to build greater resilience among MSMEs and MSME ecosystems. Some of the key findings from the study include:

- COVID-19 had severe impacts on MSMEs, whose risk profiles were exacerbated. Over 80% of MSMEs were negatively impacted by the pandemic, predominantly through the exacerbation of risks that they faced prior to COVID-19. These risks include payment risks (late/ delayed/ no payment), poor access to finance, and business interruption. Interestingly, risks commonly faced in the past were not mentioned (e.g. fire, perils), suggesting that firms’ perceptions of risk changed and that they struggle to accurately assess the risks they experience at any point in time.

- MSMEs were not fully equipped to manage COVID-19 impacts. MSMEs’ poor risk assessment capabilities may explain why many reported not implementing any coping mechanism to respond to risks. Other MSMEs were dependent on using finite business incomes and savings to survive, with little use of typical resilience mechanisms, such as insurance and credit. Moreover, MSMEs were unable to engage with ecosystem support provided, due to poor risk awareness, informality, low digitalisation and low levels of trust in, and awareness of, the support available.

- COVID-19 highlights weaknesses in ecosystem resilience with little emphasis placed on recovery and adaption. Though highly responsive to intervene during the pandemic, ecosystem stakeholders were strained to effectively deliver support and continue operations. Challenges included financial and resource constraints, as well as broader ecosystem level challenges, such as poor coordination. Furthermore, the focus of these players was primarily on delivering short-term interventions, with limited focus on longer term MSME recovery and adaption.

- Weak firm- and ecosystem-resilience hindered adaptation. Although more than 50% of the sampled medium-sized firms report high digitalisation of most processes, most small firms struggled to digitalise their operations. Business repurposing, on the other hand, was low among all firms. This suggests that MSMEs were too preoccupied with managing the impacts of COVID-19, or lacked the necessary skills, to consider new opportunities. Assisting MSMEs to adapt in these ways will be key to enabling their recovery.

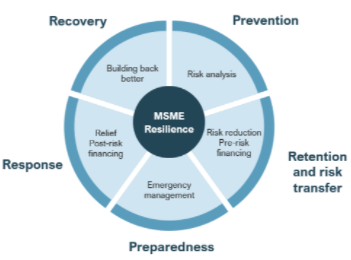

Our findings highlight a need to develop more holistic approaches to promoting MSME resilience. To effectively build the resilience of MSMEs, a dual approach that focuses on the resilience at the micro-level (i.e. among individual firms) and at the macro-level (i.e. ecosystem) is required. Using the MSME Resilience framework (adapted from GIZ ICDRM framework), this report also identifies key opportunities that can assist FSPs, government and development partners to start thinking about resilience more holistically, better prepare for and proactively manage risks, and how they can provide greater value to MSMEs through the provision holistic risk solutions. Five key cross-cutting interventions emerged from this study:

- Strengthen training and risk assessment initiatives for MSMEs to better understand and prepare for risks.

- Support and strengthen the use of technology for early warning and real-time risk management and mitigation.

- Design fit-for-purpose insurance solutions that account for the specific contexts and sectors in which MSMEs operate, their informality and resilience needs.

- Improve coordination between and within ecosystem stakeholders to ensure that approaches towards MSME resilience are coordinated and that players leverage existing knowledge and resources to improve their preparedness and responses to future shocks.

- Support digitalisation and broader aspects of recovery to build back better and ensure that MSMEs can survive in a “new normal” economy amid COVID-19.

If you’re interested in finding out more about this work, please contact Michaella Allen.