The role of different partners for effective MSME insurance

The role of different partners for effective MSME insurance

24 May, 2022 •Insurers can partner with digital platforms, lenders and insurance aggregators to offer better products that matter for MSMEs.

Despite being heavily underfinanced, micro, small and medium enterprises (MSMEs) are critical drivers of economic growth and contribute substantially to employment and innovation. They account for 50% of global employment and 90% of all businesses. MSMEs are exposed to a wide range of risks and often struggle more than larger businesses to cope. This is due to a combination of factors including limited resources, an exposed environment, and a lack of skills and tools to manage risks. Insurance can help MSMEs better manage risks, help them access a greater variety of risk management tools (including loans and savings), and give them the confidence to take more productive, perhaps riskier, investment decisions.

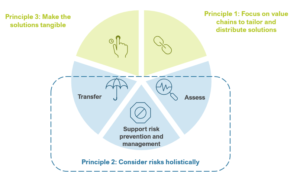

The Microinsurance Network’s MSME Best Practice Group has developed three principles to assist insurers in reaching the largely untapped MSME market, build MSME resilience and contribute to societal outcomes by better understanding MSMEs, considering risks holistically and rethinking their value proposition.

However, few, if any, traditional insurers are able to effectively deliver on all three principles alone. Instead, partnerships, often with unusual and non-traditional organisations, are a critical factor to success. To test these principles, the MSME Best Practice Group identified and consulted with stakeholders on how insurers can better work with innovative partners. This series of notes documents the unique perspectives of digital platforms, lenders and value chain aggregators on the opportunities for insurers.

This paper is the result of the joint efforts of the Microinsurance Network’s Best Practice Group on Insurance for MSMEs. The authors wish to thank the group members for their active participation in numerous discussions during which they generously shared their extensive knowledge on this topic. For additional information, please contact Jeremy Gray.