This road will not get you there

This road will not get you there

6 July, 2016 •This week I drove 600km from Cape Town airport to my home and sheep farm in the rural Karoo. Whereas the drive was pleasant and gave me time to reflect on many things, the joy of driving was definitely not the purpose of this journey. Getting home to my family was the goal.

I have realised that much of our difficulties in making headway with financial inclusion links back to this confusion between the road and the destination. Financial services, such as bank accounts or mobile money accounts, are roads not destinations. We travel across them because we want to get somewhere, not because we want to travel, which may be pleasant or painful. In our fervour for financial inclusion, we often deceive ourselves that the roads which we call savings, credit, payments and insurance are the destinations. But the real destinations are the more fundamental needs that people must meet through financial services such as receiving an income, buying groceries, paying for education or health services, buying stock for a business, sending money to my mother, or buying a house. A bank account may or may not connect you to one or more of these destinations.

This deception came home strongly when we recently compared the results from the Consumer FinScope Surveys done in Zimbabwe in 2011 and 2014. FinScope 2014 showed an increase in the number of banked adults from 24% in 2011 to 30%. On the face of it, the financial inclusion score had leapt forward!

Yet, the Findex results, done for the same years, showed an increase in dormant accounts from 4% in 2011 to 25% in 2014. It also showed that by 2014 only 14% of adults with bank accounts were using their accounts more than twice a month. Clearly, most of the 30% of banked adults weren’t frequent travellers.

Yet, FinScope clearly showed that adults were using multiple financial services, just different ones. We then adjusted our analytical lens to try and find out what Zimbabweans were using their financial services for, i.e. which destinations they were trying to reach.

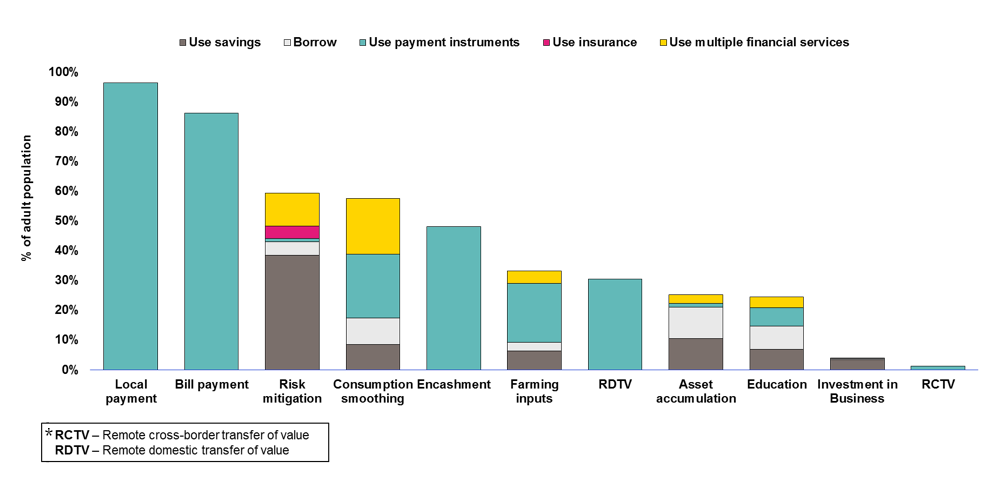

The figure below depicts our first attempt at using this new lens – the needs case lens. It attempts to show, still rather crudely, which financial needs adults try to meet with which types of financial services. It shows that the largest needs are for local payments and bill payments. Local payments include day-to-day purchases for groceries, transport, clothing etc. while bill payments are for paying electricity, water, schooling and other regular expenses. The biggest needs, after these, deal with emergencies, especially medical emergencies, and to meet basic consumption needs.

* Zimbabweans abroad, being a third of the adult population, use RCTV extensively to send money home to friends and family. This was not captured in FinScope which only sampled adults living in the country.

FinScope allows us to take this analytical lens one step further to see which providers meet these needs. For example, due to the unexpected nature of risks faced, the majority of adults reported using informal savings groups to mitigate risks, as it is more cost-effective than formal alternatives. But perhaps the most surprising insight from this new lens was the limited role of banks in meeting any of the needs identified above. This confirmed what we had picked up during consultation with the industry in Zimbabwe: banks had neither the infrastructure nor the services to meet these needs. Which explains why most of the needs that can be met through formal payments have migrated to EcoCash, the new mobile money platform. The other needs continue to be served largely by informal providers. We would have missed this if we had kept looking only through a bank or product lens.

So the sobering lesson for us was this: If our goal is financial inclusion that provides value to customers and meets their real needs, we are looking through the wrong lens. While the lens through which we measure the number of adults with bank accounts may tell us that we are making huge leaps forward, the reality is much different. People are not using bank accounts, but cash and informal products remain the order of the day as they are able to more effectively meet customer needs.

In short, the roads that the financial inclusion community are selling to adults in Zimbabwe, and many other countries, cannot get them to the destinations they want to get to. As a result, they take alternative routes. This will not change until we start focusing on how and why adults use financial services; i.e. the destinations, rather than the roads.

The insight2impact facility is working with the financial inclusion community to identify priority areas to deepen how and what we measure. If you are interested in collaborating or would like to provide input please email, comms@cenfri.org.

insight2impact (i2ifacility) was funded by Bill and Melinda Gates Foundation in partnership with Mastercard Foundation. The programme was established and driven by Cenfri and Finmark Trust.