Exploring the value of financial services across digital platforms in the construction sector

Exploring the value of financial services across digital platforms in the construction sector

29 May, 2020 •The construction sector – which accounts for 4.5% of GDP in sub-Saharan Africa – forms a critical component of economies, but it faces significant challenges related to shortages of skilled labour, low technology adoption, and payment disputes. Partly supported by digital platforms, digitisation and associated data infrastructure support contractors and companies to make better-informed decisions around sourcing and scheduling labour and materials, managing budgets, enhancing safety and streamlining supply-chain operations. Platforms also create new channels of access for informal workers to participate in the formal economy.

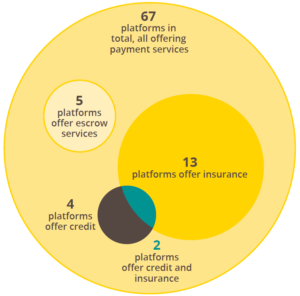

Our latest research explores how digital platforms match different groups of construction industry participants (i.e. contractors, workers, homeowners and suppliers), which financial products are distributed on the platforms, the incentives for offering these products, and how the products can add value to livelihoods in the construction sector. The report presents key findings from a review of 67 digital platforms that are active in the construction space and operating across 176 countries.

We find that digital platforms are well placed to deliver on financial needs within the construction sector, especially with respect to liquidity and risk management. Innovative payment solutions such as digital wallets and escrow services facilitate trust in the market. More than half of the platforms that offer an insurance product offer third-party liability coverage, often protecting workers from liability due to risks related to physical loss or damage that may happen to the property, machinery or work done on the site. Beyond financial services, we find that platforms have been innovative in creating other value-added services for construction workers and suppliers, through damage/satisfaction guarantees and warranties, as well as integrated technologies, which enable users to better manage business operations.

Our analysis of partnership case studies highlights that partnerships between digital platforms and financial service providers result in more value creation for platform participants through fit-for-purpose financial services.

This work forms part of the Risk, Remittances and Integrity programme, a partnership between FSD Africa and Cenfri.

insight2impact (i2ifacility) was funded by Bill and Melinda Gates Foundation in partnership with Mastercard Foundation. The programme was established and driven by Cenfri and Finmark Trust.