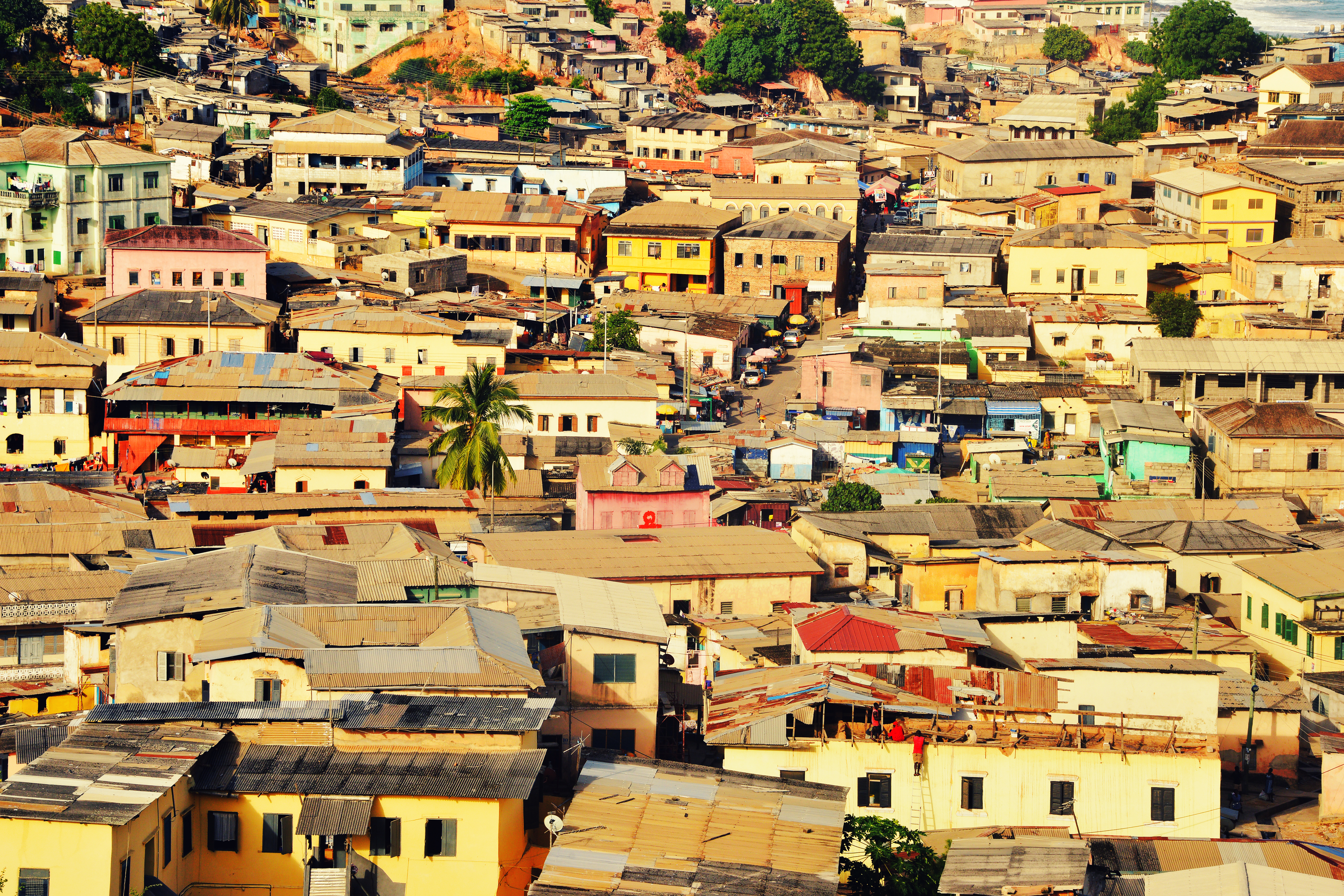

Reaching for the future, searching for a vision for Africa’s digital economy

Digitalisation is disrupting markets and economic structures globally, and even advanced economies do not have a clear view of the new economy and the rules that will govern it. While it is clear that we’re going through a period of disruption and change, it’s not yet clear which of the disrupters will