The potential of digital platforms as distributors and enablers of insurance in Africa

The potential of digital platforms as distributors and enablers of insurance in Africa

11 December, 2018 •The past decade has seen the emergence of digital platforms. These digital platforms (also known as multi-sided platforms[1]) connect buyers and sellers of goods and services and allow them to seamlessly transact with one another. They are providing new ways for workers, micro, small and medium enterprises (MSMEs), and consumers traditionally operating in the informal economy to participate in the formal economy, and as such are changing the nature of many economic activities.

We think that digital platforms offer innovative solutions to overcome barriers to low insurance penetration in African markets. In the past, those operating in the informal economy have been hard to reach with formal insurance solutions that mitigate risks that they face. Digital platforms have the ability to transform the delivery of traditional insurance products to underserved consumer segments. They have an established client base, reputation and communication channel, and hold unique insights into the financial needs of their users. This means that like mobile network providers (MNOs), digital platforms can serve as a low-cost distribution channel for insurance products.

At the 14th International Microinsurance Conference held in Zambia in November 2018, Cenfri hosted a plenary session that explored the role of digital platforms in inclusive insurance. Panellists included Richard Leftley, the CEO of MicroEnsure, Amolo Ng’weno, East African Director for BFA, and Adrien Lebegue, Business Development Director the Chinese online insurer, Zhong An. The panel was moderated by Cenfri’s founder and Managing Director, Doubell Chamberlain. We highlight major takeaways from the plenary session below.

There are many digital platforms and platform workers in Africa

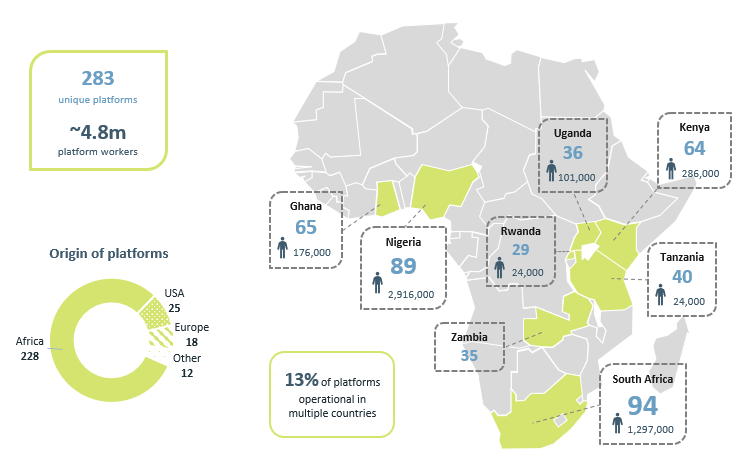

A scan of eight African countries (Ghana, Kenya, Nigeria, Rwanda, South Africa, Tanzania, Uganda, Zambia) conducted by the insight2impact facility shows that there are 283 unique platforms operating in Africa, 81% of which originate from Africa. Within these countries, between one to three percent of adults earned an income from platform work in 2017, which equates to an estimated 4.8 million platform workers across these countries (i2i facility, 2018).

Source: i2i (2018) and Research ICT Africa (2017)

Scale through platforms is possible, but necessary preconditions must be in place.

Zhong An, the first online only digital insurer in China, was established in 2012 by Tencent, Alibaba and Ping An. It later established a subsidiary, Zhong An Technology, which creates and commoditizes advanced technological offerings for insurance companies. Zhong An self-identifies as a technology company doing insurance and over half of their employees are either engineers or technicians.

With the objective of “redefining insurance in the connected world,” Zhong An has become one of the most effective and advanced online insurance companies, having issued over five billion policies in 2017 to more than 432 million policyholders. Zhong An operates across five major ecosystems (lifestyle consumption, travel, health, consumer finance and auto) and has 307 ecosystem partners.

There are several key factors to Zhong An’s success. Firstly, they have strong partners with established reputations. Secondly, their ecosystem partners have hundreds of data points on their consumers, which Zhong An utilises to design products that extend beyond traditional insurance and address consumer needs. Lastly, China’s regulation and existing digital infrastructure enables payments mechanisms and mobile connectivity.

There are many factors that differentiate China from Africa. China has a population of 1.38 billion, whereas Sub Saharan Africa is made up of 48 countries with an average population of 22.1 million per country (World Bank, 2017). Regulatory harmonisation has not happened in Africa. Albeit improving and growing, payments infrastructure and mobile connectivity in Africa dwarf in comparison to China. For instance, 49% of the adult population in China used the internet to buy something online in 2017, compared with 25% in Kenya, 14% in South Africa, 6% in Nigeria, 5% in Rwanda and (Global FinDex, 2017).

Specific enabling factors in China, such as payments infrastructure and mobile connectivity, have aided in the success of business models like that of Zhong An. These factors will likely be necessary preconditions for African insurers and platforms to replicate success in scaling operations.

Platforms have started offering insurance in Africa, but policies are usually embedded and only valid as long as the service or asset is used.

Our preliminary analysis of the 283 unique platforms identified by i2i show that 16 offer an insurance product, and in 12 of these cases, we found that the insurance product was embedded rather than being offered as a voluntary add-on.

Many of the platforms which match consumers to providers of asset-sharing services (rental of cars, homes, etc.) have embedded liability products, which are only valid during the period that the asset is being shared. Rent my ride, a motor-vehicle sharing platform in South Africa has embedded insurance coverage that provides up to 365 000 USD liability cover that is valid while the car is rented out.

Insurance products offered by freelance platforms, which connect employers to freelance workers, are often embedded. Paydesk, a marketplace where publishers, editors and broadcasters find, book and hire professional news-gathering services, offers accidental death and disablement coverage for platform workers during the time they are working for the user. SweepSouth, a platform in South Africa that allows users to book cleaning services within seconds, has recently partnered with Simply (an InsurTech[2]) to provide basic accidental death and disability cover at no cost to SweepSouth’s domestic cleaners.

Kobo360, a logistics and courier platform that connects drivers and owners of trucks with companies who want to transport their goods in Nigeria has an embedded insurance product which covers goods from point of pick-up to point of drop-off. Another logistics on-demand service in Nigeria, ShapShap, gives the user of the platform the choice to insure the good that they are having delivered.

Jumia, one of Africa’s biggest online shopping platforms, is one of the few platforms to offer voluntary insurance products. Jumia partnered with the insurance company AXA Mansard to offer device protection, health and life insurance products in Nigeria. These insurance products are sold as add-on’s and can be simply added to a consumer’s online shopping basket and paid for either online or in cash.

Although many of the current insurance offerings on digital platforms in Africa, are embedded or are only valid during the time that the service or asset is being used, it is still encouraging to see African platforms and insurers working together to mitigate some of the risks that their users face.

There is a clear business case for insurers to partner with digital platforms.

The insurance industry in Africa is built on the traditional style of doing insurance, in which the insurance provider designs the product and sells it to the consumer through brokers and agents. This traditional process of selling insurance products is often inefficient and has become increasingly unsustainable, in our view.

Africa has seen some innovation in distribution with the emergence of Technical Service Providers (TSPs) like MicroEnsure who partner with mobile network operators (MNOs) and insurers to distribute products. However, insurance markets in Africa are still underdeveloped with distribution channels remaining quite traditional and retail products undiversified, thereby inhibiting coverage to low-income consumer segments.

Partnering with digital platforms may be one way that insurers can move beyond traditional insurance models and start to target new segments of the population like microworkers and online merchants. There are clear incentives for insurance providers to partner with digital platforms to offer insurance products as they already have a customer base, a myriad of data on their customers and understand their behaviour. However, for insurance products on platforms to reach scale and provide value to consumers, they need to be designed for the local context of the market and the needs of platform participants.

We are optimistic that digital platforms will not simply be MNOs 2.0.

MNOs are cost-effective distribution channels for insurance that have achieved dramatic scale but with questions on value. We believe digital platforms may have some advantages over MNOs. Insurance distributed through MNOs started as embedded loyalty products, which traditionally addressed the (non-insurance) needs of the MNO as opposed those of the consumer. While mobile insurance has transitioned into paid, opt-in models, products remain geared to the incentives of the MNO. Products distributed through MNOs are generally microinsurance products meant for low-income clients, whereas products distributed through digital platforms have the potential to reach a much wider and diverse group of individuals.

Part of MNOs’ success as distributors of insurance is built on their ability to combine trust with the payments mechanisms of airtime deductions and mobile money. Like MNOs, digital platforms can leverage the trust they have established with their participants to offer insurance. However, unlike MNOs, digital platforms offer a wide variety of payments mechanisms: credit/debit card, mobile payments, digital wallets, bank transfer, PayPal and cash.

We are optimistic about digital platforms because they offer more opportunities to insert risk management and mitigation into a wider set of economic transactions and participants than is possible through MNOs. Unlike MNOs, digital platforms aggregate MSMEs in ways that has not been possible in the past and are making them both visible and part of the digital economy. The incentives of platforms are more likely to be aligned with the platform participants and thus they are more likely ensure that products are designed to meet actual needs and thus value is delivered.

Get in touch with us!

i2i is conducting research on the role of African digital platforms and the future of financial products. For more information, please contact info@cenfri.org.

Cenfri’s RRI programme is conducting thematic research on platforms that offer insurance products or want to offer insurance products and is looking to partner with platforms and insurers who interested in further exploring this concept. For more information, please contact info@cenfri.org.

Join the conversation by following #AfricanDigitalPlatforms

[1] We define a multi-sided platform (MSP) as a virtual space that derives value from facilitating direct interactions between consumers and providers. For example, the platform Uber Eats can be considered a product platform and a service platform, as it connects participants across three sides of the platform: the consumer of food is matched with a restaurant (which supplies a good) and a delivery agent (which supplies a service), i.e. the Uber driver.

[2] InsurTech is “defined as an insurance company, intermediary or insurance value chain segment specialist utilising technology to either compete or provide value-added benefits to the insurance industry” (Sia Partners, 2016).

insight2impact (i2ifacility) was funded by Bill & Melinda Gates Foundation in partnership with Mastercard Foundation. The programme was established and driven by Cenfri and Finmark Trust.