Rich enough for a discount?

Rich enough for a discount?

8 July, 2017 •Tax credits and employer subsidies are required to make medical schemes affordable for those earning just above tax threshold.

Pre-funded health financing mechanisms are important tools that can protect people against the financial risks of health events and provide access to private healthcare. Such protection is especially important in the low-income market where the majority of individuals cannot afford to pay large medical bills. Yet in South Africa only 16% of the population are members of medical schemes.

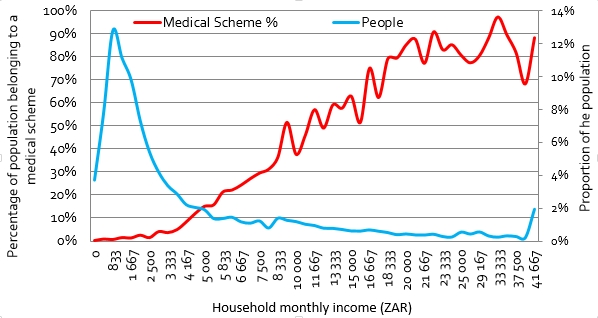

Figure 1 below shows that medical scheme coverage is concentrated in the higher income market.

So, is income the main factor that prevents the bulk of the South African population from accessing pre-funded health financing mechanisms? For the medical scheme market it is the main factor and the lack of affordable medical schemes is a major concern, but it is not as straightforward as you may think and affordability is impacted by a number of factors.

As a general rule of thumb, households are able to spend about 10% of their disposable income on medical coverage. In a report commissioned by FinMark Trust, Insight Actuaries and Consultants considered the affordability of a range of health protection products (including medical schemes) and it was found that medical schemes generally only become affordable when households earn ZAR 6 300 a month or more. At income levels below this, it would be financially unviable for most to belong to a medical scheme.

But why such a specific figure? The answer is simple: this is the monthly income at which an employed person crosses the tax threshold in South Africa. All taxpayers are eligible for a tax credit if they belong to a medical scheme. The benefit of this credit, in turn, reduces the cost of membership and the proportion of their income that they spend on medical schemes. The difference is large enough to be the tipping point for many between joining or not. For example, the cost of membership to a typical low-cost medical scheme (before an employer subsidy or tax credit) for a household that earns ZAR 6 300 per month is ZAR 1 700. But the impact of the tax credit is significant and the monthly tax credit for a family of three is ZAR 670. The credit for the main member alone is ZAR 286 and for each additional dependent there is an additional credit of ZAR 192. No small saving!

However, the credit is only available to a small number of South Africans as the vast majority of South Africans earn below ZAR 6 300 per month. Rather it is the few, wealthier South Africans who benefit from it. Ironically, the tax credit thus means that the wealthy minority that are earning above the tax threshold access medical schemes at lower absolute costs than the poor majority.

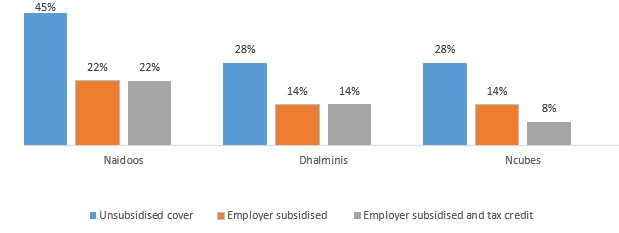

Confused? Let’s consider three different households in South Africa: the Naidoos, the Dlaminis and the Ncubes. The Naidoos earn ZAR 3 500 per month, the Dlaminis earn ZAR 6 200 and the Ncubes earn ZAR 6 300. Figure 2 below maps out the proportion of their income that they would spend on a medical scheme under three different circumstances: if they paid it all by themselves (unsubsidised), if it is partially subsidised by an employer and, lastly, if they are both partially subsidised by their employer and are eligible for a tax credit.

The results indicate that the Ncubes are likely the only family that will be able to afford a medical scheme with the help of an employer subsidy and a tax credit. The Naidoos, who earn ZAR 3 500 per month, would spend 22% of their disposable income on a medical scheme even if it was partially subsidised by the employer, illustrating just how unaffordable medical schemes are for the very low-income. Even though the Dlaminis earn just ZAR 100 less a month than the Ncubes, they are unlikely to afford medical scheme coverage. Therefore, the results show that even the least expensive medical scheme options only become affordable for households working for a formal employer willing to subsidise their medical scheme membership and earning ZAR 6 300 per month or more, and thus qualifying for a tax credit – a tall order indeed.

The tax credit story is only one of the interesting angles highlighted in the comprehensive stock-take of the features and trends in the market for pre-funded health finance options in South Africa contained in the FinMark Trust/Insight Actuaries study. Read the report to learn more about the challenges, players, regulatory context, product features and driving forces of the pre-funded health market in South Africa.

Kate is a researcher in the Client Insights team at the insight2impact (i2i) data facility.

insight2impact (i2ifacility) was funded by Bill and Melinda Gates Foundation in partnership with Mastercard Foundation. The programme was established and driven by Cenfri and Finmark Trust.