Understanding insurance distribution and automation in Africa

Understanding insurance distribution and automation in Africa

25 February, 2022 •Limited digitalisation of the insurance sector in Africa constrains uptake. Less than 10% of adults across nine sub-Saharan African countries have private insurance. The low uptake is in part due to high delivery costs and low levels of digitalisation. African insurers, banks and brokers typically rely on manual processes for selling insurance, onboarding and engaging with clients and settling claims. Insurers also tend to have costly and outdated legacy systems, which limit their integration and automation capabilities with distribution partners, who then struggle to originate and administer policies efficiently.

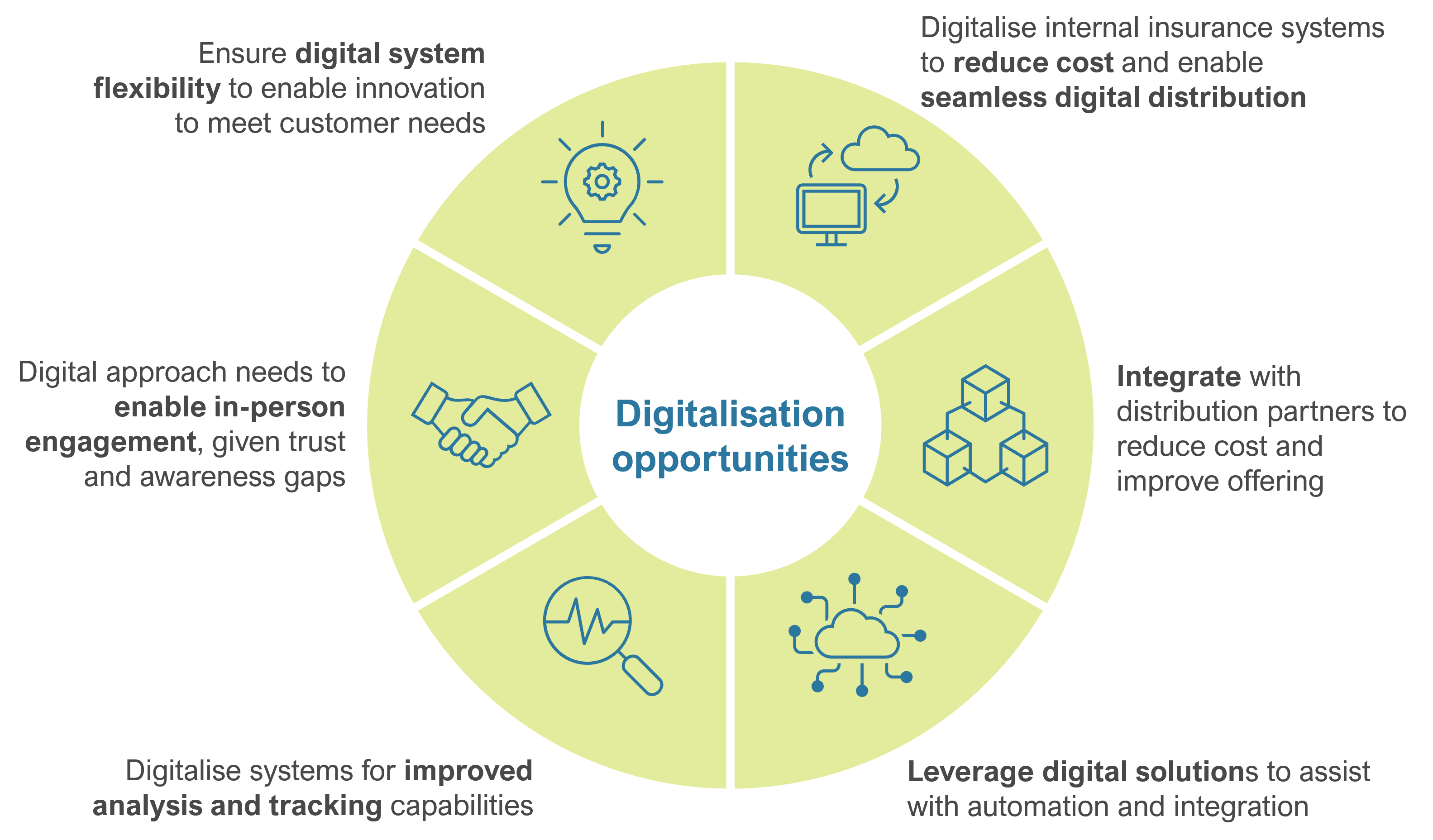

Digitalisation of processes presents opportunities for efficiency gains. COVID-19 strengthened the imperative for insurance markets to digitalise, as the lockdowns and restrictions in movement constrained insurers’ operations and new sales. In addition, distributors face increasing pressure to lower operating costs, increase productivity, automate tasks, and efficiently meet compliance requirements.

Mapping challenges and opportunities. Cenfri, in partnership with Equisoft (a global provider of advanced insurance and investment digital solutions), analysed the challenges and opportunities around the digitalisation of individual life and health insurance distribution through banks and brokers across Africa.

More efficient distribution is a critical success factor for insurance in Africa. The efficiency of insurance distribution processes has a significant impact on product viability for insurers and distribution partners alike, as well as on customers’ user experience. Moreover, improved automation and integration can reduce the costs and capabilities required to maintain systems and innovate, and the overall efficiency gains associated with digitalisation mean that it constitutes a major opportunity for enhanced insurance market development in Africa in the long term.

Insurers and distributors need not walk alone. As technology advances, so do the solutions to help companies digitalise. For insurers and their distribution partners to attempt to digitalise their systems alone would be a costly and difficult process. There are a host of companies that can assist with easing this transition and help insurers and distributors overcome many of the cost, legacy and capacity constraints they face to digitalising their systems.

However, digitalisation is not a silver bullet. While improved digitalisation and integration can help insurers and distributors overcome many of the challenges faced in distributing insurance, the needs and realities of the markets in which they operate need to be considered. Consumers lack trust in, and have a poor understanding of, insurance and often lack the digital skills required to engage through fully remote channels. A digital approach thus needs to be balanced with in-person engagements.

For more information, please contact Mia Thom.