Completing the picture in ASEAN

Completing the picture in ASEAN

6 June, 2016 •This blog series seeks to generate a broader discussion on the data that is needed to close the gender gap in financial inclusion in ASEAN.

A previous blog post argued that the headline data available on financial inclusion in the ASEAN region – the percentage of women with access to a formal account – is by itself insufficient to understand if, and how, women derive value from formal financial services.

Due to high levels of participation of women in the informal sector, much of their economic and financial activities remain “invisible” and completely out of sight of formal official statistics. The result is that existing gender data may look good at face value, but does not provide a complete picture of what is going on and may even be misleading. This is exactly the reason behind the latest Gates Foundation initiative to accelerate progress for women and girls. The initiative focuses on using data to make the lives of women and girls visible in order to inform programme design and to hold policymakers accountable.

In this second blog, we use data generated from UNCDF’s Making Access Possible (MAP) programme in Laos, Myanmar and Thailand that captures financial activity in the informal sector to dive deeper into gendered preferences for the different types of financial services.

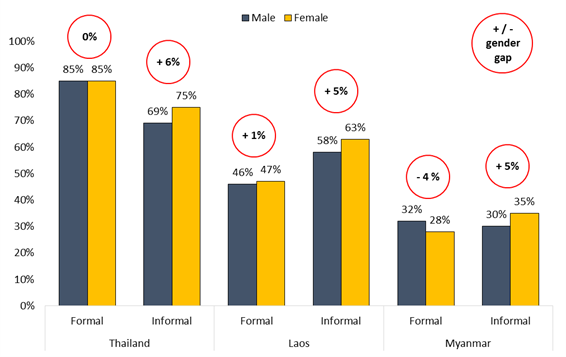

The figure above illustrates the take-up of formal and informal financial services by men and women in the three MAP countries. Formal financial services are those offered by institutions licensed to provide financial services regardless of whether they are supervised and it includes non-bank formal providers such as microfinance institutions, cooperatives, mobile money providers, etc.

Data from the MAP diagnostic in Thailand, Myanmar and Laos revealed a higher take-up of informal financial services by women (the yellow bar) than by men (the blue bar) and almost equal levels of use of formal financial services. While the differences are subtle, further analysis reveals an important story for the financial inclusion gender gap in ASEAN – women use more informal financial services than their male counterparts.

With the exception of separated women in Thailand, nearly all segments (divorced, widowed, older, younger, and non-head of households) of the female adult population across the three countries use informal financial services more than men. This is despite equal take-up of formal financial services.

This finding echoes one of the key lessons learned from the Global Map Insight Series – adults prefer to use informal financial services even when formal options are available. There are a number of reasons for this. Adults value the flexibility and convenience to renegotiate terms when circumstances change or the ability to access emergency credit when needed. They derive social capital from being part of a community group and have relationships with individuals who can provide them with recourse when things go wrong. Lastly, the social relationship increases trust – they know who their money is going to.

The data above shows that these features may be more valuable for women even than for men. For example, the majority of informal financial services used by women are collective or group-based. Is this because they value the social capital that they derive from these groups more than men? Likewise, several research papers illustrate that women in developing countries are often responsible for managing daily and smaller household expenses, while men have more often control over larger expenditures (Johnson 2003; ILO 2014; World Bank Group, Better than Cash Alliance, Nov 2015). Does the immediacy of access to informal mechanisms provide women then with greater control over their household budgets?

UNCDF’s SHIFT programme will use these data insights to mimic some of the valuable features of informal financial services and leverage them into the design of more formalised financial services. The programme also supports financial institutions with data analytics to help explore women’s preferences better so that we can further address the gender finance gap.

UNCDF’s Shaping Inclusive Finance Transformations (SHIFT) programme is a financial market facilitation, technical assistance and funding facility for the ASEAN region. SHIFT aims to facilitate the transition of women’s use of financial services from informal mechanisms to formal, regulated and higher-value services. The programme catalyses innovative partnerships across financial, policy, data and training markets.

This blog originally appeared on the UNCDF SHIFT website as part of a series on gendered data in financial inclusion in ASEAN.