FinNeeds toolkit

FinNeeds toolkit

9 March, 2021 •A guide to using the FinNeeds approach to financial inclusion measurement.

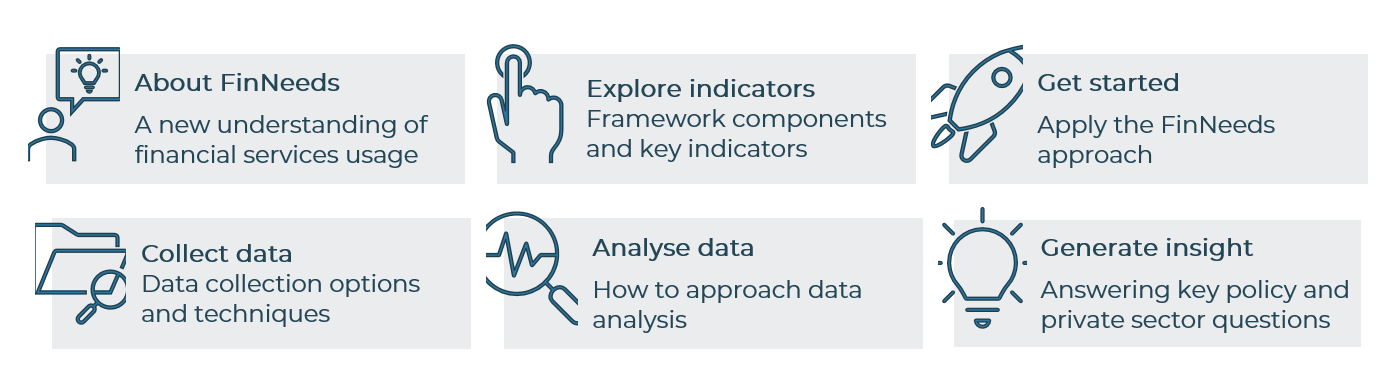

FinNeeds is the name of insight2impact’s (i2i’s) financial needs measurement framework. This framework is based on the fact that people use financial services as a means to an end. To increase the use of financial services and ensure financial inclusion impact, we need to better measure to what “end” customers use financial services – namely financial needs. The FinNeeds approach measures which strategies and financial services people use to meet those needs. This toolkit introduces the elements of the FinNeeds measurement framework, outlines the FinNeeds indicators to track, and discusses the data sources and measurement approaches relevant for each element, as well as how to analyse the data for policy-ready insights.

Who should read this toolkit?

- Policymakers and regulators. The FinNeeds approach identifies gaps between what the formal financial sector offers and how people prefer to meet their financial needs. The focus on consumer needs and usage patterns helps policymakers to identify barriers to usage and to design interventions to improve the use of financial services.

- Financial service providers. By interpreting usage patterns in light of consumer needs and use cases, the FinNeeds framework provides financial service providers with insights to inform their market strategy.

- Development partners. The FinNeeds approach adds further insight to the conversation on customer-centric approaches to financial inclusion

View the toolkit which outlines the FinNeeds indicators to track, and discusses the data sources and measurement approaches relevant, as well as how to analyse the data for policy-ready insights.

The FinNeeds toolkit has been developed under the insight2impact programme in collaboration with the AFI Financial Inclusion Data Working Group (FIDWG).