Governance of digital financial services for sustainable development

Governance of digital financial services for sustainable development

30 July, 2021 •Digital innovation in financial services is happening apace, and regulators are not always able to pre-empt or keep up. Traditionally, financial services are highly regulated. But increasingly, legacy models of regulation and supervision, where a static set of rules is set for industry to comply with, are no longer sufficient. This asks for a broader view of governance that goes beyond just governments: looking at collaborative, principle-based ways of ensuring positive outcomes for consumers and society.

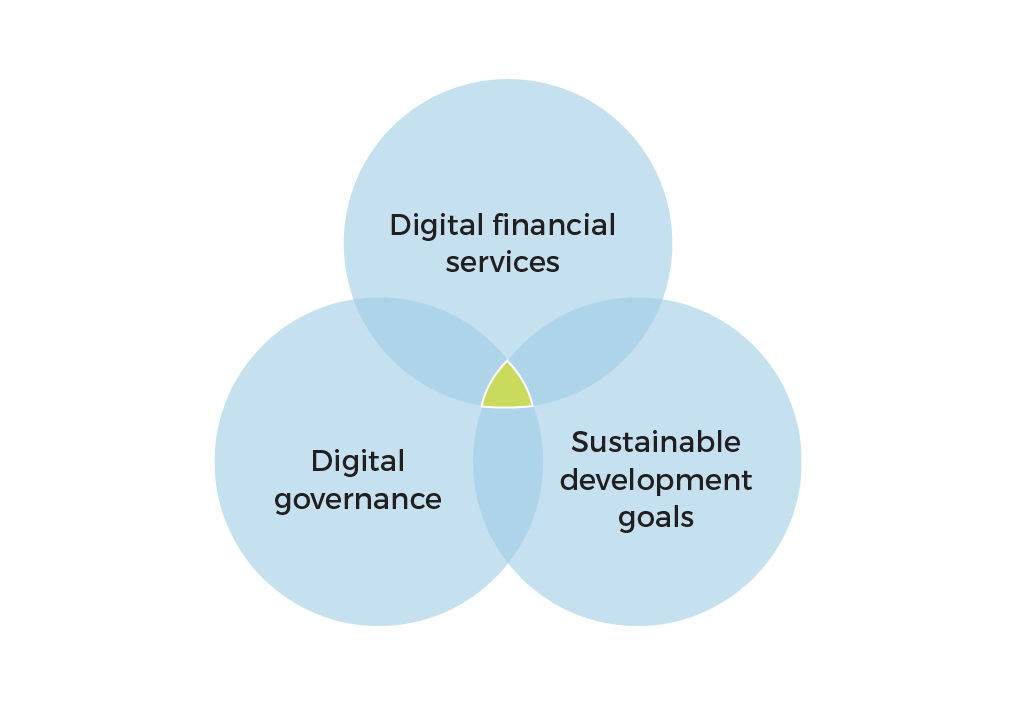

Unpacking what such a broader view means for regulatory models in emerging markets requires building an understanding of the interplay between governance, innovation in digital financial services (DFS) and sustainable development.

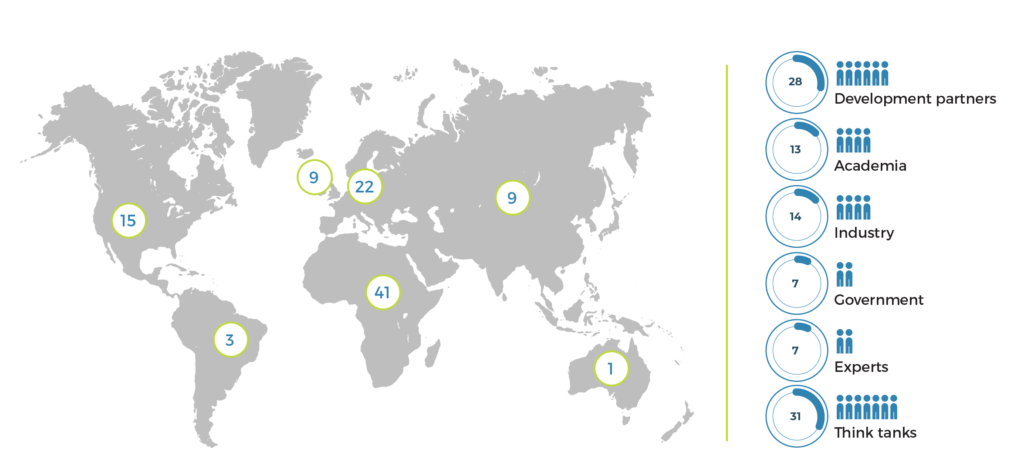

In June and July 2021, Cenfri, with support from GIZ and in collaboration with On Think Tanks, hosted a series of digital dialogues to explore four topics at the intersection of digital governance, DFS and the Sustainable Development Goals (SDGs) across emerging economies:

In our thinking about DFS and digital governance, we also considered the increasing trends towards the role of the private sector in shaping global and local governance, the landscape of data infrastructure and the importance of data sharing.

The central underlying question across the topics was: How do governance models (particularly those in emerging economies) need to be adapted for digital financial services to contribute positively to the SDGs?

It was clear from the ensuing dialogue that the governance questions arising are not about the tech involved per se, but about the underlying context, principles and risks, as well as about questions regarding jurisdiction and who or what sets the tone or decision options for regulators at a local level in an increasingly integrated global marketplace. It’s about asking what the approach to governance should be to dynamically deal with risks, leverage opportunities created by digital innovation, facilitate market development, and take into account the interplay between global and local forces.

This note outlines the cross-cutting considerations, remaining evidence gaps and the corresponding call to action for development partners. If you are interested in discussing digital governance further, please contact david@cenfri.org.